Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Tag: investing

Stop and Ask Yourself…

We wanted to share a poignant excerpt from Jason Zweig’s latest piece for WSJ.

When anyone—in person, online or through an app on your phone—tries to push you into chasing an asset that had double-digit (or triple-digit!) returns last year, try answering this way: “Instead of that, what can you offer me that lost money last year?”

That silences the hype. That opens your mind to the kinds of neglected opportunities that often do best when last year’s market darlings fall from grace. And that keeps you from expecting the coming year to repeat the past year. They seldom do.

To learn more about how we would build your bespoke portfolio, schedule a call now.

Investing Lessons from 2020

The entire world changed in countless ways in 2020. Our investing strategy did not.

Here are 10 lessons from 2020, and for the long view, that remind all of us what didn’t change in a year filled with non-stop uncertainty.

The principles outlined are timeless.

Choose an investment philosophy you can stick with for the long haul

- As Dimensional Executive Chairman and Founder David Booth says, “A philosophy serves as a compass to guide you through turbulent times. When you’ve got a compass, it doesn’t take drastic directional changes to find your way. Small adjustments are all you need to stay on course.”

- While there is no silver bullet, understanding how markets work and trusting market prices are good starting points. By adhering to a well-thought-out investment plan, ideally agreed upon in advance of periods of volatility, investors may be better able to remain calm during periods of short-term uncertainty.

Create an investment plan that aligns with your risk tolerance

- As investors, our risk appetite often changes based on the market environment we are in. In early March when we experienced the fastest bear market in history, some would have slept better at night knowing they had allocated more to bonds or cash. In April, when the market had its best monthly return since 19871, those same investors would have felt better knowing they were allocated more to stocks. The point being, you want to have a plan in place that gives you peace of mind regardless of short-term market swings.

- Over time, capital markets have rewarded investors who have taken a long-term perspective and remained disciplined in the face of short-term noise. By focusing on the aspects within their control (like having an appropriate asset allocation, diversifying their investments, and managing expenses, turnover, and taxes) and sticking to a long-term plan that is in line with their risk tolerance, investors may be better able to look past short-term noise and focus on investing in a systematic way that will help meet long-term goals.

Don’t try and time the market

- The 2020 market downturn offers an example of how the cycle of fear and greed can drive reactive decision making. Back in March, there was widespread agreement that COVID-19 would have a negative impact on the economy, but to what extent? Who would’ve guessed we would’ve experienced the fastest bear market in history in which it took just 16 trading days for the S&P 500 to close down 20% from a peak2, only to be followed by the best 50-day rally in history?3 I would be hard-pressed to find someone who had that in their market timing forecast.

- Trying to time the market based on an article from this morning’s newspaper or a segment from financial television? It’s likely that information is already reflected in prices by the time an investor can react to it. For investors trying to time the market the odds are stacked against you, the good news is, you don’t need to be able to time markets to have a positive investment experience.

Know what’s in your portfolio

- Investors want reliable portfolios with robust risk controls, unfortunately, it often takes a market decline for many to take a closer look at what is actually in their portfolio. In times of market stress, investors rely on the fixed income portion of their allocation to serve as the ballast of their portfolio, helping to provide downside protection. Many investors learned the hard way earlier this year that what they thought were safe fixed income products, were actually stretching for yield, leading to fixed income portfolios that did not hold up during the market downturn.

- We take a transparent, low-risk approach to managing fixed income – in which we are able to pursue higher returns while staying within the guardrails of the portfolio guidelines. Our investing partners perform market-informed credit assessments, providing a more complete picture of an issuer’s credit quality in real-time, helping to ensure that your portfolio behaves in a way that is commensurate with the intended credit risk exposure.

Build flexibility into your investment process – this principle is even more crucial in times of high stress

- For many, the heightened volatility we experienced this past year adversely affected trading processes as traders were forced to demand immediacy, instead of waiting for the best value, when going to the market to trade. We choose partners who approach trading differently. Dimensional’s investment and trading process, for example, is designed to function robustly and account for high volatility, changes in available liquidity, and sharp market movements. While markets were stressed and returns were somewhat unusual, the efficacy of this approach remained true and performed as expected. The approach delivered risk management in a robust fashion, delivered outperformance across many different asset classes, provided daily liquidity to investors in our portfolios throughout the period, and added value to investors.

- What was the impact on clients? In March, Dimensional was able to buy corporate bonds for 50.7 bps cheaper than the trade prior and 21.5 bps cheaper than the trade after. When going to the market to sell bonds and provide liquidity to allow clients to rebalance into equities, we were able to sell corporate bonds for 104bps higher than the trade prior and 116bps higher for the trade after.

Stay disciplined through market highs and lows

- Financial downturns are unpleasant for all market participants. When faced with short-term noise, it is easy to lose sight of the potential long-term benefits of staying invested. While no one has a crystal ball, adopting a long-term perspective can help change how investors view market volatility

Look beyond the headlines

- Read the newspaper to be an informed citizen, not for advice on how to navigate the financial markets. Daily market news and commentary are designed to challenge your investment discipline, and not in a good way. Some messages stir anxiety about the future, while others tempt you to chase the latest investment fad. The result? You buy or sell, and Wall Street gets richer. When headlines unsettle you, consider the source and maintain a long-term perspective – growing wealth has no shortcuts.

Focus on what you can control

- To have a better investment experience, people should focus on the things they can control. It starts with HIG creating an investment plan based on market principles, informed by financial science, and tailored to a client’s specific needs and goals. Along the way, we can help focus on actions that add investment value, such as managing expenses and portfolio turnover while maintaining broad diversification. Equally important, an advisor can provide knowledge and encouragement to help investors stay disciplined through various market conditions.

Size Matters

After 10 years of large companies earning record-breaking returns, any reasonable investor would start to wonder, are small companies even worth hanging on to? We argue yes. Why? Because evidence shows owning small companies pays you more over time and helps your portfolio recover better after a downturn, but only if you have the patience to wait.

Higher expected returns. Evidence shows that small companies have historically outperformed large companies over the long-term. The reason? The market perceives small companies as riskier investments. The extra return you get is the market paying you for taking on that risk. If you think about it, this is intuitive. A simple example: would you lend money to the mom-and-pop diner down the street at the same interest rate as you would to McDonald’s? Of course not. You recognize the additional risk inherent in the smaller, less established diner compared to the more stable, global, fast-food chain.

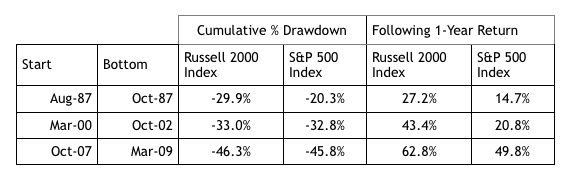

Stronger recovery after a market correction. When the market declines, small companies tend to perform worse than the general market, and investors may start to question if this asset class is one worth hanging on to. The biggest concern we hear is that smaller companies have less capital and cash flow to weather the economic storm thereby making their recovery painfully slow. In reality, small stocks have a tendency to come back stronger and faster after a significant market correction. The data in the table below suggests a healthier small company recovery (Russell 2000) compared to large (S&P 500) over three of the largest market downturns in the last 40 years.

The role of patience. The additional return you get for owning smaller companies can materialize at any time. But we know, especially in times where large has outperformed small for a decade or so, having the patience to wait can feel next to impossible. This is where the role of an advisor is key. It’s only natural after years of underperformance to want to bet on whatever feels like the winning horse. Without having someone to hold our hand any of us, including professionals who know better, have a hard time waiting it out. Our take on all of this: While we see many non-client investors run from small stocks, this as an opportunity for our clients to buy what’s on sale and reap the long-term rewards of remaining disciplined.