Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Author: Carl Richards

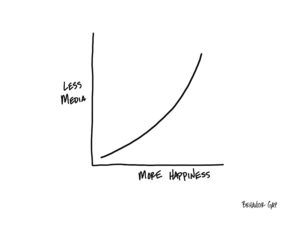

Try a Media Fast

What if, for one whole week, you did a media fast?

You know… like, don’t consume any media at all. No screens, no devices, don’t even pick up a newspaper.

No. Media. Period.

Is one week too long? Then scratch that… make it three days. THREE DAYS. That’s just a long weekend. You can do it, I promise.

Give it a shot. And when you do, pay close attention to your emotional state. How does it make you feel? Happy? Sad? Energized? Exhausted? All of the above? None? Something else? I don’t know how it will make you feel… though I have my suspicions.

When I’ve done media fasts, I find myself feeling calm. Really calm. And to me, that feels good. Really good.

Which makes me wonder… if taking a media fast makes me feel so good, why do I ever go back to it at all?

Warning: You may find yourself asking that same question…

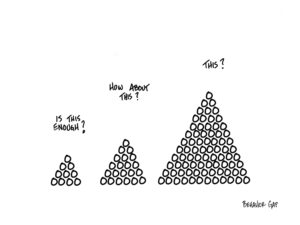

Marginal Utility and Diminishing Return

We don’t know when to stop.

At least, I sure don’t.

Sometimes, on the way home from work, I’ll swing by the grocery store, buy a pint of ice cream, and eat it.

That’s right. The whole thing.

Yes, I know. That’s a LOT of ice cream.

I’ve noticed that a very interesting thing happens when I do this:

Bite 1: Best thing in the world, ever.

Bites 2-10: Really good.

Bites 11-15: Good.

Bites 16-20: Meh.

Bites 21+: OK, now I’m sick.

I learned this lesson the first time I ate a pint of ice cream in a single sitting.

And yet, for some reason, I still occasionally repeat the experiment.

Of course, this phenomenon doesn’t only occur with ice cream. This is a well-documented economic principle called Marginal Utility, and, you guessed it, it applies to money, too.

Beyond a certain point, having more money will not lead to more security, freedom, and happiness.

Because security, freedom, and happiness do not come from more money (at least, not beyond a certain point). They come from knowing when to stop.

Image of the Month