Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Category: Advanced

Picking up Pennies

At Hill Investment Group, we’re dedicated to putting the odds for the best possible returns in your favor, leaving no basis point behind. Since every client is unique, the method to accomplishing this goal is multifaceted. I have talked to dozens of other prominent investment advisors about how they systematically handle these issues for their clients.

The answer I get 90+% of the time is some combination of, “We are not doing X because… it is too much work, clients don’t know the difference, the benefit is small, etc.”. As your fiduciary, that doesn’t sit well with us. Our obligation is to seek the best solutions we can find for our clients…no matter what.

Therefore, at HIG, we’ll continue to pick up the pennies. Over the coming months, we plan to highlight how we do that and what the impact can be on your wealth over time. We will discuss the following topics, starting with the level of cash we hold in our clients’ portfolios.

- Volume 1 – Keep Cash Balances Low (Better Chance for Higher Returns)

- Volume 2 – Asset Location (Reduces Taxes)

- Volume 3 – Using ETFs (Reduces Taxes)

- Volume 4 – Trading ETFs in Competition (Reduces Trading Costs)

- Volume 5 – Number of Funds and Not Auto-Reinvesting Dividends (Reduces Trading Costs)

- Volume 6 – Tax Lots and Tax Loss Harvesting (Reduces Taxes)

- Volume 7 – Summary (Total Impact)

Most investment advisors and hold between 5-10% of their client’s portfolios in cash for convenience. The “better ones” out there will hold 2-4% cash. Holding a large buffer of cash means the advisor can be a bit lazier in monitoring and trading client portfolios. This buffer comes at a cost. It’s called “cash drag” because, in general, cash doesn’t earn as high a return over time as investing in stocks or bonds. Therefore, for every $1 of cash you hold, there is an opportunity cost… which depending on how much cash you hold, could be massive.

We don’t want our clients to incur that cost, and thus, HIG keeps cash levels well below 1%, ideally around 0.5% (unless the client has recurring withdrawals). Maintaining cash levels below 1% requires diligence and a commitment to active monitoring. It’s easy to keep a significant amount of cash on hand, but it’s far more challenging—and ultimately rewarding—to deploy those funds into investments that generate meaningful returns.

We want the mutual funds and ETFs we invest in to embody the same approach. The average mutual fund holds between 3-5% cash, causing meaningful cash drag to their investors. The funds we recommend generally keep cash in the 0.1-0.3% range. By minimizing cash drag in your accounts and in the funds you hold, your portfolio more closely reflects the asset allocation and the corresponding risk profile you set up with us, that we agree to maintain on their behalf.

The impact of reducing cash drag can be significant. On average, stocks outperform cash by 6% annually. This means that an additional 5% in cash could lead to a 0.3% reduction in returns annually. While it might seem like a small fraction, due to compounding, the deficit can accumulate significantly over time. For every $1,000,000 invested, a 6.0% vs 5.7% return over 30 years represents a difference in wealth of ~$450,000.

At Hill Investment Group, our dedication to maximizing returns sets us apart. Our commitment to picking up every basis point is part of a broader philosophy. We understand that the little things, the pennies, add up to create meaningful gains for our clients. Through careful management and a relentless pursuit of opportunities, we believe these small gains will culminate in a substantial increase in overall returns.

Stay tuned for more insights in the coming months as we continue to share how these small gains add up to significantly impact our clients’ portfolios.

Wisdom of Crowds

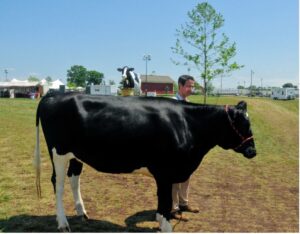

In the heart of a bustling county fair, an extraordinary experiment unfolded, showcasing the incredible power of collective intelligence. A seemingly whimsical challenge emerged: Guess the weight of a cow on display. What initially appeared as a playful game soon transformed into a stunning demonstration of the “wisdom of crowds.”

A diverse group of fairgoers, each with varying degrees of knowledge and intuition, were asked two simple questions: How much does this cow weigh? Do you have any experience with the weight of cows? The goal was to see if anyone in the crowd could guess the correct weight and if experts would be superior to the average individual.

A fascinating phenomenon began to unfold. Although individual estimates ranged wildly, the average of all these guesses astonishingly approached the actual weight of the cow. In the end, the average guess for the non-experts was 1,287 pounds compared to the actual weight of 1,355 pounds. A difference of only 68 pounds. A bigger surprise: the expert’s average guess was less accurate at 1,272 pounds, a difference of 83 pounds.

The genius of this collective average lay in its ability to filter out errors and biases inherent in individual guesses. High estimates countered low ones, and the middle-ground approximations formed a consensus that defied the odds. This experiment showcased the concept of the “wisdom of crowds” that a diverse group’s collective knowledge can outperform the insights of any individual expert.

Translating this concept to the realm of financial markets, where stocks are traded and their prices determined, demonstrates a similar effect. The market comprises countless participants, each with their own insights, analyses, and biases. When these factors converge, the resulting stock prices tend to reflect the most accurate estimate of a company’s value at a given point in time.

This phenomenon finds its backbone in the Efficient Market Hypothesis (EMH), which proposes that stock prices encapsulate all available information. Much like the cow guessing average, EMH posits that the combined insights of countless individuals lead to fair and accurate valuations, making it incredibly challenging to outguess the market consistently. Financial markets react to new information quickly, updating prices to reflect the most up-to-date information and risks fairly. Rather than trying to outguess market prices, causing turnover, high fees, and trading costs, one is better off accepting and using market prices to your advantage. Invest in global capitalism rather than trying to outguess it.

From guessing the weight of a cow to the intricate world of financial markets, the wisdom of crowds continues to shape our understanding of collective intelligence. Just as a diverse group of fairgoers could accurately estimate the cow’s weight, the multitude of participants in financial markets work together to create prices that reflect a collective estimate of a company’s value. The efficient market hypothesis stands as a testament to the power of this concept, reminding us that while individual expertise is valuable, the aggregated insights of many can often lead to more accurate and reliable outcomes. As we navigate the complexities of the modern world, embracing the wisdom of crowds can lead to better decision-making and a higher likelihood of financial success.

2022 Investment Performance

It’s no secret that 2022 was challenging for both the stock and bond markets. Stocks ended the year down 18%*, while bonds were down 13%**. How did we do in 2022? Thanks to our compliance group, all we can say here is that our strategy of investing in low-cost, diversified strategies that tilt toward small, value, more profitable stocks meaningfully outperformed the S&P500 index in 2022.

As much as I would like to pat our firm on the back, you know our refrain: one year is essentially meaningless when it comes to investing. Due to the volatility and randomness of markets, any strategy can outperform or underperform in any given year. Our strategy certainly does not outperform every year and can even underperform several years in a row. To have real confidence in an investment strategy’s reliability, investors must look at how it performs over decades, not just years.

To see how we measure up over the long haul, we go back as far as we can, looking at the investments we recommended each year (and own ourselves) to see how our philosophy has held up over time. Our favorite chart compares the value of a hypothetical $1 invested in the year 2000 to 2022. Some of you may be familiar with Paul Harvey’s famous line regarding “the rest of the story.” Shoot me a note at zenz@hillinvestmentgroup.com for the details and the rest of the returns story. We can share how our recommended equity strategy has performed over time and the magnitude of the benefit of taking the long view.

If you have been a client for a while, you have likely seen the benefit of a long-term, evidence-based strategy show up in your portfolio. If you’re not a client, ask yourself why. Then pick up the phone and call us. You can schedule a call with me anytime here.