Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Category: Featured

Matt Hall on Your Television

Congratulations to our own Matt Hall, who is featured in Schwab’s new national ad campaign!

As mentioned in a post back in July, Matt was selected to participate in a series of ads highlighting the advantages independent advisors bring to our clients. Here is the first in a series airing over the next few weeks and months.

In the 30-second spot, Matt and the other advisors zero in on a few of the crucial promises independent advisors make when we work with our clients. Schwab is essential in our ecosystem for safeguarding our clients’ securities and is the leading custodian working with independent advisory firms.

The independent model is superior to the other options available to investors because of its fiduciary standard for clients. We work for you, and only you, and avoid the conflicts that exist with big banks and brokerage firms.

Thanks, Matt, for representing Hill and the broader advisor community genuinely looking to serve others now and in the longer view!

The Apple of the Investing Industry

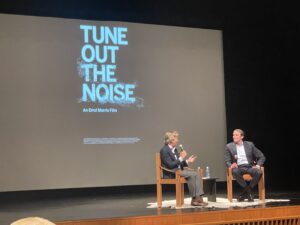

Earlier this month, we had our first-ever movie event. It was a special screening of “Tune Out the Noise,” a documentary by the acclaimed filmmaker Errol Morris. Clients, friends, team members, fellow advisors, and even a few Washington University finance students were in attendance. It was a wonderful evening of education and entertainment.

The Hill team gathered lots of feedback after the movie, but my favorite came through an email stating:

I’m sending a belated thanks for your invitation to the screening of Tune Out The Noise. It’s just another reminder of how you are different from other financial advisors. I describe Hill to my friends as “the Apple of the investing industry.”

The Hill team is inspired by the work highlighted in the film and finds it especially satisfying because the stars are not Hollywood actors but real people, many of whom crossed paths at the University of Chicago in the early 1970s. Their work has changed the financial lives of many, and the compounding benefits go well beyond any blockbuster we’ve ever seen.

After the screening, we discussed the film’s themes and unique approach with our special guest, Dave Butler. Dave is the co-CEO of Dimensional Fund Advisors, which Barron’s ranked as the #1 fund company in the world just last year. Dave is a past podcast guest and a heck of a nice guy. We covered questions like how the movie came to be, what it’s like to be interviewed by Errol Morris, and when the movie will be accessible to the public.

While the answer to the last question is uncertain, we do know that our plan is to share the movie in both Houston and Nashville in the coming months. It’s also worth noting that at the St. Louis screening, we had attendees from as far as Wyoming join us, so whether you’re based in Houston or Nashville shouldn’t stop you from considering one of the next showings if interested.

Stay tuned and keep on “tuning out the noise”!

Best,

Matt

And That’s a Winner!

We want to share some fantastic news and recognition for the Take the Long View with Matt Hall podcast, which, despite being on hiatus since May of 2022, just earned a Signal Gold Award in the “Money & Finance” category. This international award had more than 1,700 entries from 30 countries! Revisit some of the episodes that earned Matt’s podcast its second significant award here.

Want to know the most popular episodes of all:

- Sid and Ann Mashburn: Tastemakers with Heart and Soul

- Morgan Housel: The Psychology of Money

- Danny Meyer: Creating a Better World Through Enlightened Hospitality

- David Kabiller: From “Goldman Slacks” to AQR

For details about the Signal Awards, read more here.