Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Author: Matt Hall

Highlighting the Value of Independent Advice: Our NYT Feature in a Charles Schwab Campaign

I’m excited to share some recent news: Besides the television ads we’ve mentioned, I’ve had the privilege of being featured in a recent New York Times advertising campaign by Charles Schwab, celebrating the work of independent financial advisors. The campaign highlights the unique value we bring to our clients by considering their entire lives when managing their financial futures.

When people see the ad, they often ask, “How did you get selected for this?” It’s a good question, and the answer is simple: Schwab invited me to participate. We’re not paid to be in this ad, and we don’t pay anything to be featured. We chose to be involved because we believe wholeheartedly in the power of independent advice.

My quote in the ad says, “Your dreams deserve more personal attention,” and that’s not just a tagline—it’s core to the philosophy that drives us at Hill Investment Group. Unlike the traditional brokerage firms or wirehouses that are often more focused on sales targets, independent advisors are free to prioritize what truly matters: you and your goals. We’re not just managing portfolios; we’re connecting your investments to your big picture, your dreams, and your life.

We’re honored to be part of this campaign because it gives us an opportunity to share the story of independent advice with a broader audience. It’s a story about how personalized, unbiased guidance can make a real difference in people’s lives and how being independent allows us to align our interests with those of our clients.

Being featured in the campaign is not just about recognition; it’s about raising awareness of the benefits of working with independent advisors. It’s about championing a model that puts clients first, free from the conflicts of interest that can come with sales-driven environments. At Hill Investment Group, we’re proud to be part of this community and to show what’s possible when your dreams truly receive the personal attention they deserve.

If you have any questions about what it means to be an independent advisor or how we connect your portfolio to your life, don’t hesitate to reach out. We’re here to help you dream bigger, plan smarter, and live fully.

The True Value of Advice: Beyond the Numbers

At Hill Investment Group, we believe in helping our clients take the long view when it comes to their financial well-being. But what does that mean in practice? It’s about more than just numbers; it’s about finding strategies that improve your financial outcomes and give you peace of mind.

Quantifying the Impact of Financial Advice

Several research studies have attempted to quantify the value of good financial advice. Vanguard estimates the impact at up to 3% per year, calling it “Advisor’s Alpha.” Morningstar refers to it as “Gamma,” measuring it at 1.59% per year for retirees. While the terminology may differ, the consensus is clear: thoughtful, evidence-based financial advice can significantly enhance your financial outcomes over time.

At Hill Investment Group, we believe this value goes beyond just dollars and percentages. It’s about guiding you through market fluctuations, life changes, and financial decisions with a steady hand, always focusing on the big picture.

The Behavioral Factor: Turning Plans into Action

One of the most overlooked benefits of working with a financial advisor is ensuring that the plan actually gets implemented. Most people know they should save more, spend wisely, and avoid emotional investing decisions, but turning intention into action is another matter entirely. This is where Hill Investment Group comes in—providing the support, coaching, and accountability needed to take the long view and stay the course.

The “Compared to What” Problem

Measuring the value of financial advice isn’t straightforward. It’s one thing to compare two specific strategies and determine which is better. It’s another to assess how much value a financial planner adds in the abstract, especially when we can’t know how someone would have behaved without the advice.

For example, a strategy that maximizes wealth might not be best if it leaves you feeling anxious about potential losses. What truly matters is how well a strategy aligns with your goals and risk tolerance. A financial plan that looks perfect on paper might not be ideal if it keeps you up at night. At Hill Investment Group, we focus on strategies that not only work on spreadsheets but also fit seamlessly into your life.

More Than Just Portfolio Management

Financial advice goes beyond portfolio management. It touches on various areas like tax planning, insurance, estate planning, and retirement strategies. And while some benefits, like tax savings from effective asset location, are easier to quantify, others, like peace of mind from knowing your financial house is in order, are invaluable.

The Bottom Line

At Hill Investment Group, we believe that the true value of financial planning is not just in the strategies recommended but in their execution and alignment with your personal goals. It’s not just about achieving higher returns or paying less in taxes—it’s about living a life where your finances support your well-being and aspirations. That’s the essence of taking the long view.

August Newsletter Intro

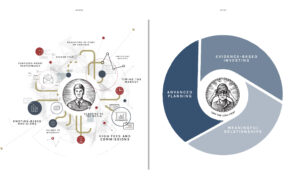

At Hill Investment Group, we’ve always believed that financial success is more than just numbers on a spreadsheet—it’s about creating a life of order, focus, and peace of mind. Years ago, we commissioned a graphic that powerfully encapsulates this transformation. On the left, you see a person overwhelmed by chaotic systems, piles of disorganized papers, and a lack of clear direction—a visual metaphor for the financial stress that many people endure every day. On the right, that same person is calm, collected, and confident, having achieved clarity, order, and control over their financial life. Peace of mind. At last.

This transformation is at the heart of what we do every day for our clients. We help them move from financial chaos to financial freedom by focusing on what we call the 4 C’s, the cornerstones of our advice:

- Competence: Our expertise in evidence-based investing, financial planning, holistic asset allocation, investment selection and monitoring, and risk management ensures that every decision is informed and every strategy is sound.

- Coaching: We guide our clients to set realistic expectations, manage emotions and biases, and stick to their long-term goals, providing objective feedback and a trusted second opinion.

- Convenience: We save our clients time with personalized service, coordinated efforts with trusted professionals, and secure technology that integrates every aspect of their financial life.

- Continuity: Our approach is designed to support clients through life’s transitions, ensuring that their plans are adaptable and their legacy is preserved across generations.

At Hill Investment Group, we believe in helping you take the long view—transforming the complexities of your financial life into something simple, clear, and manageable. We strive to replace stress with confidence, uncertainty with clarity, and disorder with harmony.

This before-and-after image isn’t just a reflection of what we do—it’s a reminder of the peace of mind that comes with working with a firm that’s committed to your financial well-being, both now and in the future.