Details Are Part of Our Difference

David Booth on How to Choose an Advisor

20 Years. 20 Lessons. Still Taking the Long View.

Making the Short List: Citywire Highlights Our Research-Driven Approach

The Tax Law Changed. Our Approach Hasn’t.

Tag: Dimensional Fund Advisors

Movie Time

I invite you to watch an enlightening movie with me if you’re in STL on October 5th! Originally intended as an event for our firm’s clients, we decided that we wanted to share it with others and are saving a select group of seats for friends of our firm. The 88-minute documentary on the characters who changed modern finance for the better will leave you feeling smarter and more connected to the truth of successful investing. An Academy Award-winning documentarian made the film, and it is appropriately titled Tune Out the Noise. Watch the trailer and sign up here if you’d like to enjoy it with us at the spectacular Saint Louis Art Museum Farrell Auditorium.

*If you’re not in St. Louis, let us know if you’d like information on future screenings in additional cities by emailing us here.

More reasons to attend:

- Co-CEO Dave Butler will be live in attendance for a Q&A following the movie.

- This is the first film to tackle the academic, business, and practical themes connected to modern investing.

- Tune Out the Noise has yet to be publicly available.

- The Art in the film is, in many ways, its own story.

- The score is composed by the award-winning Paul Leonard-Morgan.

- During the “back to school” season, this is an excellent way to fulfill your lifelong learning commitment.

Image of the Month

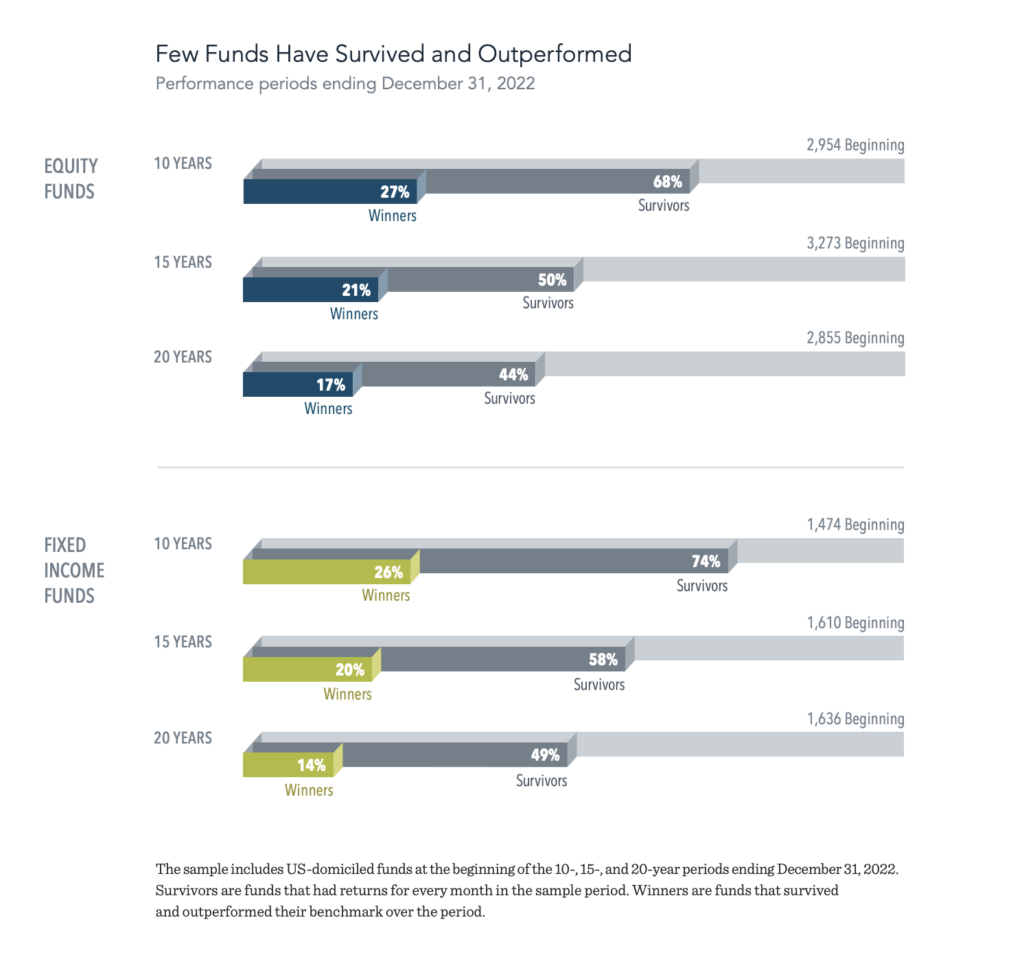

Each year, Dimensional analyzes investment returns from a large sample of US-domiciled funds (over 4,000). This year’s study updates results through 2022 and includes returns from mutual funds and exchange-traded funds (ETFs) domiciled in the US. The evidence shows that a majority of fund managers in the sample failed to deliver benchmark-beating returns after costs. We believe that the results of this research provide a strong case for relying on market prices when making investment decisions.

Does Anyone Remember Inflation?

We’re fortunate inflation has been low, but that doesn’t mean we shouldn’t be prepared for its return. What are important ways we look at offsetting inflation for our clients? Our partners at Dimensional have outlined points on best practices. Read below.

Background:

- On Wednesday, January 13th the Labor Department stated that the consumer price index (CPI) increased by 0.4% in December and 1.4% for 2020, which was the smallest yearly gain since 2015 and was a significant deceleration from 2.3% in 2019.1

- However, given the $900 billion pandemic relief plan approved in December and the expectation for more fiscal stimulus, along with the rollout of the COVID-19 vaccine, some economists are forecasting a rise in inflation for the months ahead. As forecasts have moved higher, so too have market measures of inflation expectations. The 10-year breakeven rate, which is derived from prices of inflation-protected government bonds, recently climbed above 2% for the first time since 2018.2

Ways to mitigate the effects of inflation while still growing wealth:

- Commonly, equities are used as the growth asset within a portfolio and can help protect against purchasing power risk. While inflation has averaged about 4% annually over the past 50 years3, stocks (as measured by the S&P 500 Index) have returned around 11% annually during the same period.4 Therefore, the “real” (inflation-adjusted) growth rate for stocks has been around 7% per year, for the period.

- There are also tools within fixed income to hedge inflation risk including Treasury Inflation Protected Securities (TIPS). TIPS deliver the credit quality of the US Treasury, while hedging against unexpected inflation. As inflation (measured by the CPI) rises, so does the par value of TIPS, while the interest rate remains fixed. This means that if inflation unexpectedly rises, the purchasing power of any principal invested in TIPS should also increase. Dimensional’s Inflation Protected Securities Portfolio (DIPSX) launched in 2006 and has been ranked in the top quartile of its Morningstar category over the last 1-,3-,5-, and 10-years, outperforming its benchmark over each of those time periods.5

- When considering future consumption, investors may prefer a strategy that might provide higher expected returns over TIPS by investing in corporate bonds, while tax-sensitive investors may prefer a strategy that provides exposure to municipal bonds in addition to inflation protection.

Bottom Line: The good news…our clients don’t have to keep track of all these tools. That’s why we’re here for you. We stay on the cutting edge of investing and implement the best-in-class solution in an evidence-based investing world on your behalf. Curious how we can help you hedge inflation risk in your portfolio? Schedule a complimentary call with our advisory team by clicking here.