Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Tag: Election

The Great Debate – Election Years vs. the Stock Market

Whether your political views are right, left, or somewhere in between, you should check out this video. Election years tend to heighten everyone’s anxiety. This video does a great job of helping us as investors understand what to do.

As changes to tax reform, foreign policy, and social issues loom, it’s totally natural to be tempted to make short-term portfolio changes to profit from the uncertainty, or to minimize losses. But, as we know, markets are extremely efficient at processing new information and adjusting prices based on future expectations, so research would tell us any fears or expectations about the results of the presidential election are already baked in.

So, what’s a savvy investor to do? Our friends at Dimensional Funds skillfully reframe the perspective provided by the regular media.

Going back to 1928, when Herbert Hoover was elected president over Al Smith, the S&P 500 has returned on average 11.3% during election years and 9.9% in the subsequent year. In fact, there have been only three presidents in history that have seen negative returns in the stock market over their presidential tenure: Herbert Hoover during the Wall Street Crash of 1929, Franklin Roosevelt during the Great Depression, and George W. Bush in the 2000s during a time known as the Lost Decade.

Our takeaway? Make sure your investment plan fits your goals and stick with it. No matter what the regular media is saying, the data shows whoever is in the White House is unlikely to negatively impact the long-term value of your nest egg.

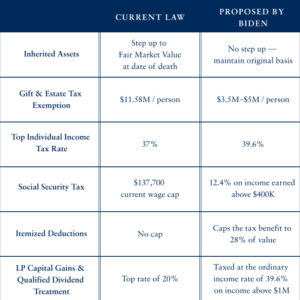

What Joe Biden’s Tax Plan Means for You

With Democratic Presidential candidate Joe Biden recently releasing his proposed tax plan, we thought it would be good to compare what Biden is proposing to our current tax law. Here is a simple side-by-side comparison of some of the major differences. What does this mean for clients of Hill Investment Group? At this point, not much. While Biden’s proposed plan is certainly different from current law, and in some cases significantly different, we are planning for the future, but aren’t making any changes to clients’ plans (at least not yet). As always, if you have specific questions about your specific situation, please call or email us to set up a time to talk.