Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Tag: market predictions

The Futility of Market Predictions: Why Evidence-Based Investing Wins

Why Predictions Fail: Insights from the Experts

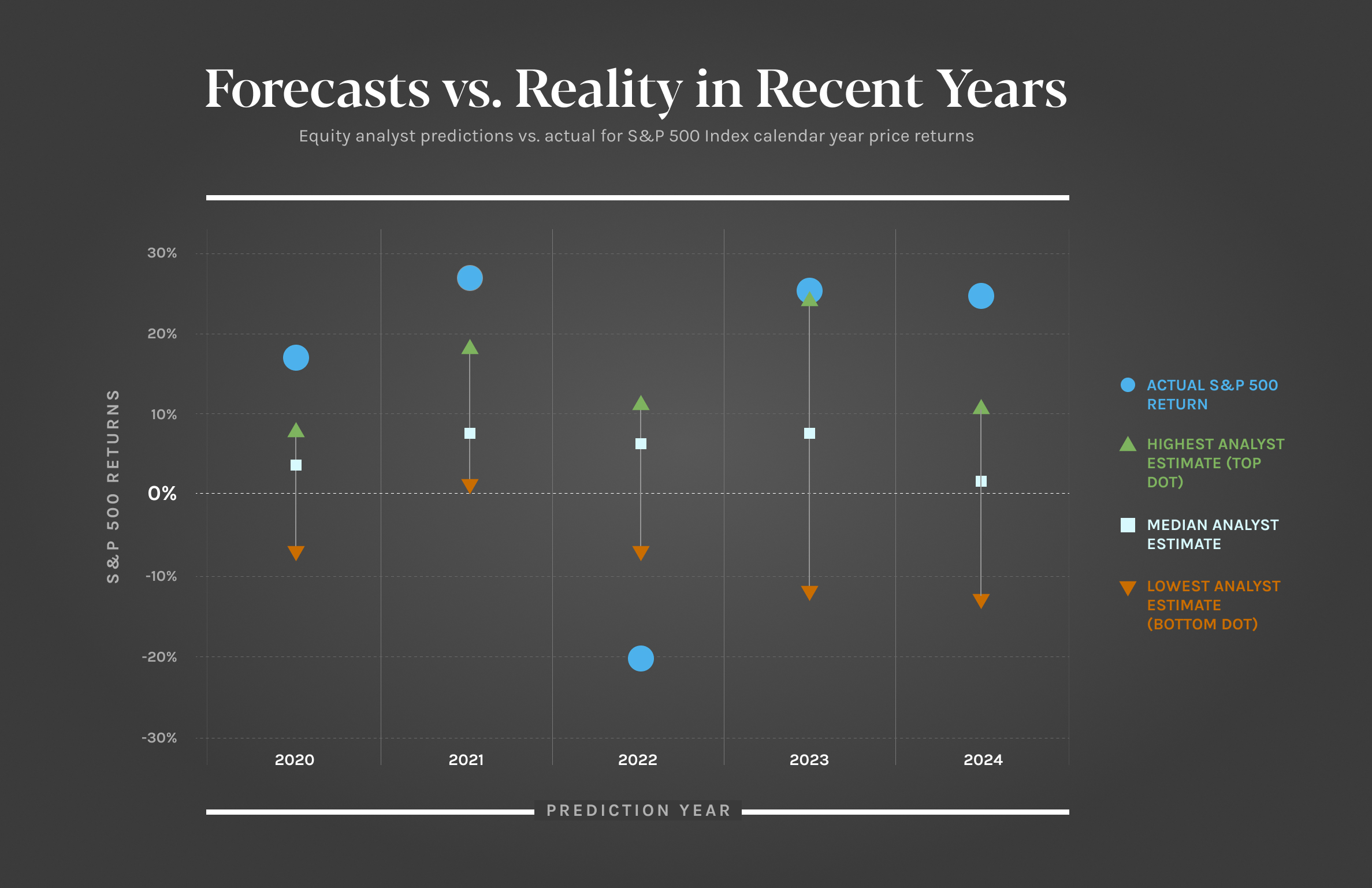

As the new year approaches, financial analysts, equity experts, and market commentators are quick to release their predictions for the year ahead. However, a closer look at their track record reveals a consistent truth: these predictions are almost always wrong. Our analysis of S&P 500 return estimates since 2020 underscores this point—actual annual returns have repeatedly fallen outside the range of the highest, median, and lowest forecasts. Even the most confident experts frequently miss the mark.

The Illusion of Predictability

Equity analysts devote significant time and resources to analyzing economic trends, running complex models, and projecting outcomes. Despite their efforts, their predictions rarely align with reality. Why? Because markets are inherently unpredictable. They are influenced by countless factors—some measurable and others entirely unforeseen. Attempting to predict annual market returns is akin to forecasting next year’s weather: unreliable at best.

Here’s another key insight: while the long-term average return of the S&P 500 is between 8% and 10% annually, the actual return in any given year rarely aligns with this average. Instead, annual returns often deviate significantly, reflecting the market’s inherent volatility.

What Should Investors Focus On?

If accurate market predictions are unattainable, how should investors approach the future? At Hill Investment Group, we take an evidence-based approach. Instead of relying on predictions, we emphasize planning, modeling, and focusing on what we know. Here are our guiding principles:

- Discipline Pays Off: On average, markets increase by approximately 4 basis points (0.04%)* daily. While this incremental growth may seem small, it compounds significantly over time. The key to capturing these gains is staying invested.

- Volatility Equals Opportunity: Market unpredictability isn’t a flaw; it’s an essential feature. The volatility we experience is the price of admission for long-term equity rewards. Rather than fearing market swings, we view them as an integral part of the investment journey.

- Control What You Can: Instead of trying to predict market movements, we focus on what is within our control—creating robust financial plans, building resilient portfolios, and adhering to evidence-based investment strategies.

- Patience Is Crucial: History has shown that markets recover from turbulence and achieve new highs over time. Staying patient and avoiding knee-jerk reactions to short-term fluctuations is essential for long-term success.

The Takeaway

The data is clear: expert predictions are unreliable. This is why we avoid basing our strategies on forecasts and instead focus on enduring principles that withstand market volatility. Here’s what we know:

- While markets are unpredictable, disciplined investors are consistently rewarded over the long term.

- The average return is positive, even though individual annual returns vary widely.

- Long-term success comes from thoughtful planning, patience, and maintaining perspective.

At Hill Investment Group, we embrace the uncertainty of the market and focus on guiding our clients toward their financial goals. By staying committed to an evidence-based philosophy, we help our clients navigate the inevitable ups and downs while positioning them for long-term success.

The next time you hear an expert confidently predict the market’s direction, remember to take it with a grain of salt. Markets may be unpredictable, but with the right strategy and mindset, they remain one of the most powerful tools for building enduring wealth.

*10% on average per year for equity returns divided by 252 trading days per year on average equates to .04%, or 4 basis points, of growth per trading day.

What HIG Predicts in 2022

At the beginning of each year, money managers and financial experts release many predictions around what the forthcoming 12-months will bring from an investing standpoint. But forecasts rarely pan out, particularly in a year as unpredictable as 2021. It is hard, if not impossible, to outguess the market.

So what is the Hill Investment Group take? We expect the US stock market to be up in 2022 between 6-10%. We also predict that the market will most likely not return between 6-10% in 2022.

You probably needed to read that prediction twice, as it seems to contradict itself. Let us explain.

Why do we expect the market to be up between 6-10% in 2022?

That probably seems too simple of a claim given the current market environment. As of the writing of this post, the total US market is at an all-time high; Omicron is spreading rapidly throughout the US, inflation expectations are higher than they have been in decades. Historically, the market has been up, on average, between 6-10% annually. Clearly, with all of these unique circumstances, we can’t expect this year to be like previous years, right?

That is the beauty of the market. Every year is different, and every year the market takes all of these factors into consideration when setting prices. Investors know all of the risks mentioned above, and the current price reflects a fair price for taking on those risks. No matter how you slice the historical data, the market is up about two-thirds of the time, usually between 6-10%. Whether you look at what political party is in office, what inflation expectations are, whether the market had a positive return the previous year, or even if the St. Louis Cardinals made the playoffs…These factors are incorporated into the current price and usually provide investors an expected return roughly between 6-10% over the long term for taking the risk of investing in the equity markets.

Why do we predict that the market most likely will not return between 6-10%?

Although the market, on average over the last roughly 100 years, has returned between 6-10% annually, it rarely returns within that range in any single year. About 1/3rd of the time, the market has had a negative return, about 1/3rd of the time a return between 0-20%, and about 1/3rd of the time a return above 20%. Dating back to 1928, the market has only had a return within two percent of the long-run average four times! Yes…only four times in nearly a century.

This is why we EXPECT the market to return between 6-10% but PREDICT that it most likely will not.

When investing in the stock market, the range of investment returns is much larger than the average return. This is part of what makes investing so hard and why many investors, especially those that choose to do it themselves, get scared and leave the market just when they should likely stay in…or vice versa. It is difficult to see the long-run average when dealing with such volatile swings year to year. However, when you take the long view, embrace our relationship, and think in terms of decades rather than years, you will start to see the benefit and ignore the year-to-year noise and volatility.

Hindsight is 20/20. Foresight Isn’t.

2019 served as a reminder of just how unpredictable the market is. It’s crystal clear to observers that the prediction game is often a losing one for investors. Our friends at Dimensional wrote an insightful piece on the futility of forecasting. We think the story and the data shared here are both worth your attention. (Estimated reading time of 5-7 minutes)