Details Are Part of Our Difference

David Booth on How to Choose an Advisor

20 Years. 20 Lessons. Still Taking the Long View.

Making the Short List: Citywire Highlights Our Research-Driven Approach

The Tax Law Changed. Our Approach Hasn’t.

Tag: Matt Zenz

Putting the Odds in Your Favor

With all the noisy commentary, complex investment products, and volatile performance in the financial industry, it can be hard to figure out how to act. How can an investor determine which investing strategies have merit and which have outperformed simply by chance?

For our clients, that’s easy! We do it for you. That’s precisely why we’re here, in the service of our clients.

I recently gave a presentation where I reviewed the investment options out there and explained how some investment strategies put the odds of success in one’s favor while others do not. I related this complex topic to a simple game of betting $1,000,000 on the flip of a coin. Heads or tails? After watching this 30-minute presentation, you will have a much better understanding of our motto, “Take the Long View,” and why we are so passionate about our approach to investing.

For anyone that hasn’t already joined our family, click here to set up a time to meet with us if you find this discussion intriguing.

This presentation is for educational purposes only and represents general information regarding Hill Investment Group’s investment advisory service. It does not intend to make an offer or solicitation for the sale or purchase of any specific securities or to provide specific advice. Past performance is not indicative of future performance; investments involve risk and are not guaranteed. Consult with a qualified financial adviser before implementing any strategy.

Matt Zenz on Recent Market Volatility

We asked Matt Zenz to narrate a 10-minute presentation on recent market volatility. If you’re our client, some of this will be repeat information for you, but it could prove helpful as a refresher.

Feel free to share it with others who could benefit from the long view perspective. It’s easy for investors to be influenced by the noise in the world. This short talk might be just what they need.

Details Are Part of Our Difference

As our clients know, we seek to eke out every last basis point of potential return for you. So, while we balance the ideal combination of factors to achieve the highest odds of excess return, we also seek to minimize all costs, expenses, and taxes which eat into an investor’s net return. There are a couple of ways this plays out:

Evaluating Asset Managers

When evaluating asset managers, we scrutinize their trading practices to implement their strategies cost-effectively. If they don’t have reasonable trading procedures, their trading costs will be higher and, ultimately, lower the return of your investment.

Reducing Trading Fees

Just like our fund managers, we want to make sure that we are trading cost-effectively to be good stewards of your hard-earned capital. The most recent step in this effort was transitioning much of our recommended portfolio from mutual funds to ETFs, mainly to eliminate fees for trading mutual funds.

At Hill Investment Group, we are not satisfied with just better; we are always working towards finding the best solution we can find for you. The change from mutual funds to ETFs is a savings win, but we were eager to take it one step further.

Eliminating Hidden Costs

You may not know that ETFs have their own unique hidden trading costs. Like stocks, ETFs trade with a bid-ask spread. That means that, for example, market makers may buy an ETF at $9.99 and sell it to another investor for $10.01. The market maker earns a nice $0.02 profit/share, and the buyer and seller pay the cost.

We wanted to make this better. So, for ETF trades of over a certain size, rather than trade on the exchange with a limited short-term supply, we deal directly with the banks. We get the banks to compete for our business and bid against each other. This can shrink and nearly eliminate the market maker’s profit. This competition and direct access yield better prices than we could otherwise get on the exchange.

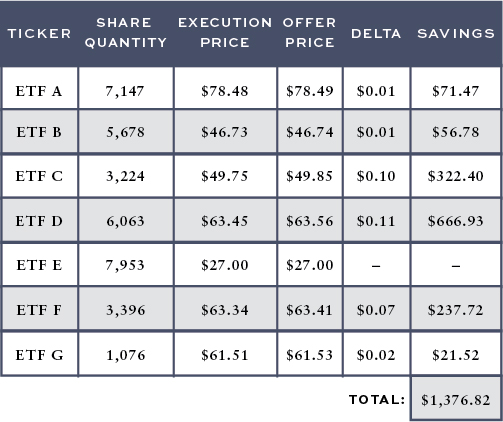

For example, we recently rebalanced one of our clients’ portfolios which resulted in purchases of various ETFs. The table above outlines the ETFs we bought, the price we would have gotten if we went to the market (Offer Price), and the price we executed at (Execution Price).

Conclusion: Details Matter

In just one day, using this trading strategy, we saved this client over $1,300 in trading costs. This one example is just one of many ways we fight for every basis point —the details matter and are part of the HIG difference.

Past results are not indicative of future results, or all client results. There are no implied guarantees or assurances that your target returns or cost savings will be the same as the example shown. Future returns or cost savings may differ significantly from the past due to many different factors. Investments involve risk and the possibility of loss of principal. The values and performance numbers represented in this report do not reflect management fees. The values used in this report were obtained from third-party sources believed to be reliable. Savings numbers were calculated by HIG using the data provided.