Details Are Part of Our Difference

David Booth on How to Choose an Advisor

20 Years. 20 Lessons. Still Taking the Long View.

Making the Short List: Citywire Highlights Our Research-Driven Approach

The Tax Law Changed. Our Approach Hasn’t.

Tag: take the long view

Image of the Month

We love images that show “the long view”. My daughter, Laura Hill, recently visited Sequoia National Park and took this image of another hiker as he soaked in the view from the top. Interested in having your photo featured in our newsletter? Follow us on Instagram and tag us in your posts to show how you envision the long view!

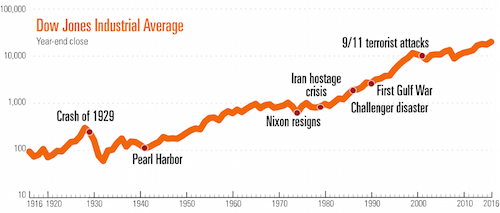

Immitation is Flattery

“Bad news and ill omens can make the market appear riskier than many investors would prefer,” wrote Vanguard in their recently published lessons on their website. “But if you take the long view, things might not seem so bad.” We love that Vanguard, the second-largest mutual fund company on the planet, used our trademarked phrase. Obviously, we agree.

1 Minute Version of TLV

How do we explain Take the Long View? Watch this 1-minute video for the answer.