More Long View, More Long Term Success

Tune Out the Noise. Stay the Course.

We’re more plugged in than ever. The average person now spends nearly four hours on their smartphone daily, and over half of Americans get their news from social media. That’s a lot of headlines, and most of them short, urgent, and emotionally charged.

While access to information has never been greater, trying to beat the market by reacting to it is one of the surest ways to undermine your financial progress.

This constant stream of information can rattle even disciplined investors. Markets dip on geopolitical tensions. Another AI company announces a breakthrough. Interest rates nudge higher. The instinct is to react, shift allocations, “de-risk,” or step out of the market altogether.

But history shows that these short-term decisions often hurt long-term results.

Explore the Research

Independent research backs this up. Morningstar’s Mind the Gap study, most recently updated in 2023, compares the returns of investment funds to the returns earned by the investors in those funds. The results reveal a persistent gap: investors tend to underperform their own investments by 1.0% to 1.7% annually. Why? Because they often buy high, sell low, and attempt to time the market, frequently in response to short-term news.*

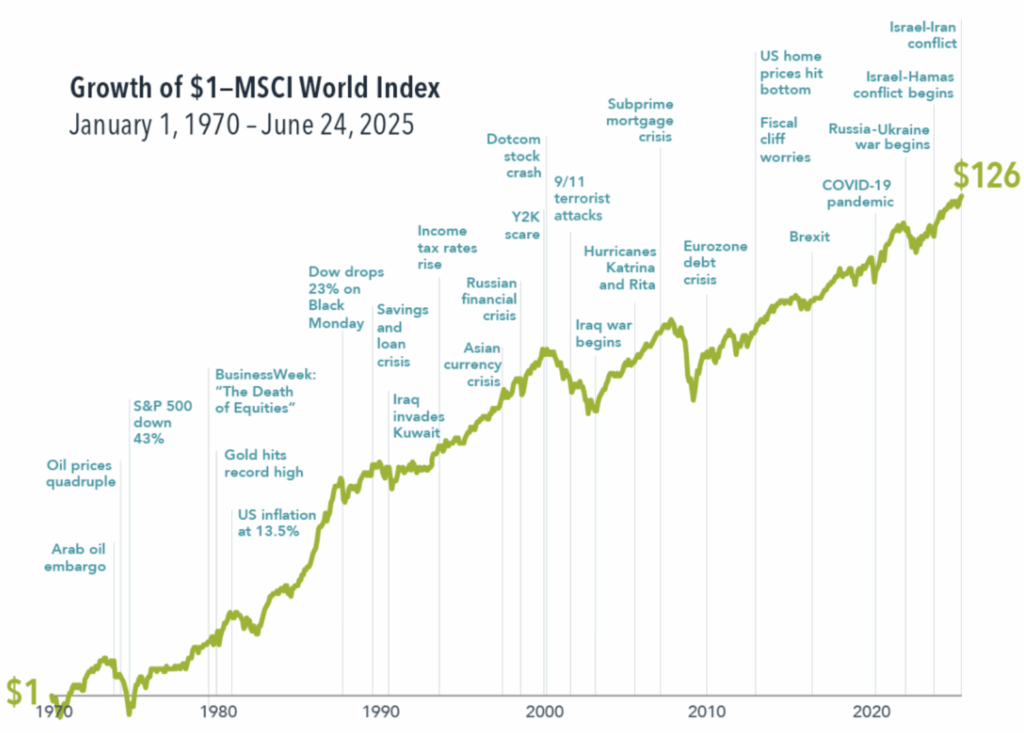

Consider this hypothetical example: Over the last 50 years (1974–2023), while markets faced double-digit inflation, multiple financial crises, and a global pandemic, long-term investors who stayed disciplined were rewarded. A $1 investment in the MSCI World Index would have grown to approximately $126.** Now imagine an investor who underperformed that index by just 1% annually; they would have ended up with a portfolio roughly 40% smaller.

What We Focus On

At Hill Investment Group, we work to tune out short-term noise, not because we’re ignoring reality, but because we believe markets are constantly processing new information. The headlines you’re reading? The market read them about five seconds ago. By the time most investors can react, they’re already behind.

Taking the Long View means focusing on what can actually be controlled: strategic asset allocation, disciplined rebalancing, thoughtful tax management, and investor behavior. That’s where meaningful long-term impact happens.

When headlines get loud, remember this: staying invested is not a passive decision. It’s an active commitment to your plan. That’s what we help our clients do every day.

That’s The Long View.

* Morningstar (2023): Mind the Gap Study – U.S. Edition

** Dimensional Fund Advisors (2025): Geopolitical Jitters