Details Are Part of Our Difference

David Booth on How to Choose an Advisor

20 Years. 20 Lessons. Still Taking the Long View.

Making the Short List: Citywire Highlights Our Research-Driven Approach

The Tax Law Changed. Our Approach Hasn’t.

Author: Buddy Reisinger

Culture & Perspective: Why Culture Matters

The Hill perspective is well known. It is our motto and our compass: Take the Long View. Many of our clients and friends of the firm also know our culture. We strive to be warm, caring, thoughtful, serious about our work, and human enough to enjoy it together.

The Hill perspective is well known. It is our motto and our compass: Take the Long View. Many of our clients and friends of the firm also know our culture. We strive to be warm, caring, thoughtful, serious about our work, and human enough to enjoy it together.

As we grow, an important question stays front and center: how do we continue to deepen both our culture and our perspective at the same time, especially as our team is spread across the country?

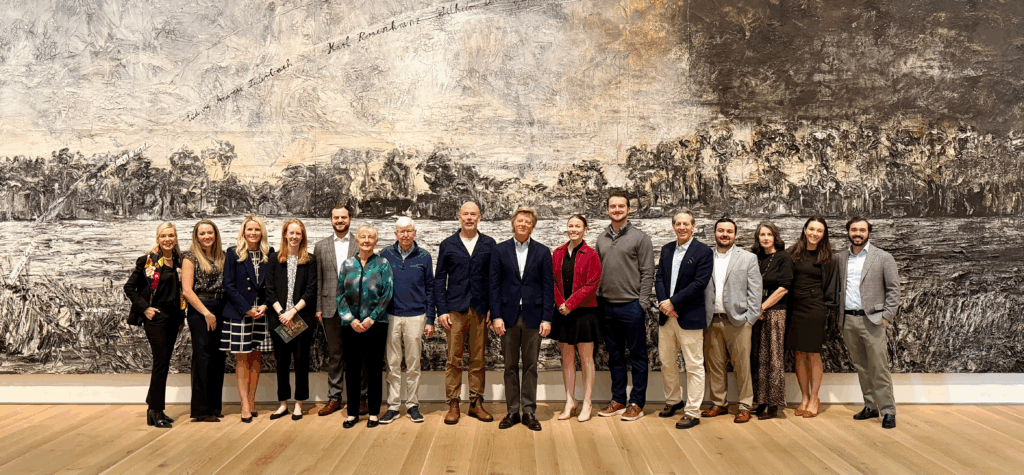

Occasionally, we’re given a rare gift: the chance to be together in one place. Last month, nearly our entire nationwide team happened to be in St. Louis at the same time. Recognizing how uncommon that is, we chose to be intentional with the moment and invest it in something meaningful.

When author, artist, and former financial advisor Carl Richards was in town for our event, we extended the experience by taking the team to a once-in-a-lifetime exhibition by German artist Anselm Kiefer at the Saint Louis Art Museum. The visit was arranged by my wife, Jeana, who serves in a volunteer leadership role at the museum. Notably, Jeana and Rex Sinquefield, co-founder of Dimensional Fund Advisors, were among the significant underwriters supporting the exhibition.

Together, we spent time immersed in the work of one of the most important living contemporary artists. Kiefer, who recently turned 80, is known for confronting history, destruction, and renewal on a monumental scale. His work takes the long view. From loss comes rebirth. From devastation, renewal. The physical scale of his art reinforces the message. Some things simply cannot be understood without stepping back and taking them in fully.

It is hard not to see the parallel.

Life is not smooth. Markets are not either. Both move in cycles that include setbacks, uncertainty, and moments that test conviction. Yet over time, periods of decline have been followed by recovery. Often the most meaningful progress comes from staying engaged rather than stepping away when things feel uncomfortable.

Clients often tell us that one of the most valuable things we do is help them stay on the ride. Not because there are guarantees. There are not. But because perspective matters. When you zoom out and look across decades rather than days, the long-term story of investing has been one of resilience and growth.

That perspective is deeply embedded in our culture. It shapes how we invest, how we advise, and how we support clients through both calm and turbulent moments.

Hill Investment Group is only 20 years old, but we are grounded in values and relationships that allow us to do our work with care, humility, and conviction. When we have moments to come together as a team, we try to use them intentionally to reinforce who we are and how we think.

We’re grateful to share this journey with you, and we look forward to continuing the ride together.

Happy Holidays.

David Booth – In Plain English

Does the following quote sound familiar? Does it sound like a Hill team member? Something from one of these Monthly Journals over the last 20 years? It should, because it’s the foundation of what our clients and we believe about long-term investing success. Not surprisingly, it comes from David Booth, one of the Co-Founders of Dimensional.

– David Booth, LinkedIn, Oct. 14, 2025.

Over the years, I’ve had the privilege of meeting and hearing David speak on several occasions. He is a brilliant man who often sounds like a finance professor getting into the esoteric details of high-level math. You’d expect that of a University of Chicago (Booth School of Business…yes, as in David) Ph.D.

And that’s why I absolutely love this piece. David leaves academia behind and speaks from the heart about his investing experience in plain English that a grade-schooler will understand. Yes. A rare thing. It’s an ode to why all people should consider investing in the market, no matter your age or your net worth. And it’s brilliant.

Enjoy and be inspired to introduce someone you love and care about to the world of investing by starting here.

Of course, the Hill team stands ready to help share the power of long-term, evidence-based investing, too. Set up a time to talk here.

Hill Investment Group Partners, LLC (HIG) is an SEC-registered investment adviser. Registration does not imply a certain level of skill or training. The information in this publication is for educational and informational purposes only and does not constitute an offer to sell, or a solicitation of an offer to buy, any specific securities, investments, or investment strategies. Nothing contained herein should be construed as individualized investment, tax, or financial advice. Always consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed.

Investments involve risk, including the possible loss of principal. Past performance is not indicative of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Future returns may differ significantly from past returns due to market and economic conditions, among other factors.

The Power of a Family Mission Statement

Our clients know we support them and their families in meaningful ways. This includes articulating long-term investment plans, helping refine estate strategies, and thinking creatively about charitable giving.

While mission statements are common in businesses and nonprofits, they’re far less common in family life. Yet as families become more complex, people live longer, and communication becomes more open, many are taking the long view and creating multi-generational plans that reflect not just what they want to happen with their wealth, but why. A family mission statement can bring clarity, connection, and shared purpose, often helping to avoid conflict now and in the future.

A recent Wall Street Journal article shares examples and great stories about how a family mission statement may make sense for your family. In the words of James Harold Webb, a serial entrepreneur quoted in the article and the patriarch of a 16-person blended family,

“Life is a gift that cannot be wasted. Family is the essence of that life and, as a family, we will work hard. We will play hard. We will live in the pursuit of knowledge. We will love our family unconditionally. We will give more than we take to ensure a better world.”

With the holidays approaching and families gathering, it’s a natural time to raise the topic. If this sounds appealing to you, and you’d like our help in preparing for that discussion or have us involved with future discussions, we’d love to help. Please reach out to me at buddy@hillinvestmentgroup.com or directly to your advisor.

Celebrate and make the most of this time together!

Disclosure:

Hill Investment Group Partners, LLC (HIG) is an SEC-registered investment adviser. Registration does not imply a certain level of skill or training. The information in this publication is for educational and informational purposes only and does not constitute an offer to sell, or a solicitation of an offer to buy, any specific securities, investments, or investment strategies. Nothing contained herein should be construed as individualized investment, tax, or financial advice. Always consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed.

Investments involve risk, including the possible loss of principal. Past performance is not indicative of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Future returns may differ significantly from past returns due to market and economic conditions, among other factors.