Details Are Part of Our Difference

David Booth on How to Choose an Advisor

20 Years. 20 Lessons. Still Taking the Long View.

Making the Short List: Citywire Highlights Our Research-Driven Approach

The Tax Law Changed. Our Approach Hasn’t.

Author: Hill Investment Group

Podcast Episode – Jason Gay of The Wall Street Journal

Name a writer who consistently makes you laugh. Hard to do? Listen to this episode to hear from one of Matt Hall’s favorite writers, Jason Gay. Jason is the sports columnist for the WSJ. To us, Jason is so much more than a sportswriter – remarkable for skillfully being humorous, candid, and poignant, often at the same time. Click here to listen to the episode on Apple.

Always Harvesting

“Typically, harvests happen seasonally. Strawberries ripen in the spring, corn is eye-high by the Fourth of July, those grapes get stomped in the fall, and chestnuts roast on winter fires.

Tax-loss harvesting is different. Those familiar with the strategy mistakenly assume that losses are best harvested at year-end when taxes are top of mind. In reality, tax-loss harvests can happen whenever market conditions and your best interests warrant it.”

From a 2016 post we did on tax-loss harvesting.

Unlike many advisors and do-it-yourself investors, we are on the lookout for tax-loss harvesting opportunities throughout the year. Many people (if they harvest at all) only harvest losses once per year, usually at the last minute in late December. Not us, not you if you’re a Hill Investment Group client. Remember the market decline in March 2020? If your advisor waited until December to harvest your losses, they were likely wiped away. 2020 is a perfect example of why, at HIG, we are opportunistic when it comes to harvest time.

The big question folks have debated is how much all this work is worth? How do we quantify the benefit to you? The Wall Street Journal caught our attention with Derek Horstmeyer’s report claiming the value to be more than 1%. The estimates go even higher if your tax rate is at the top end. If their estimates are somewhere in the ballpark, harvesting looks like a sound strategy year-round with the potential to show you some real money.

You can read about the study here.

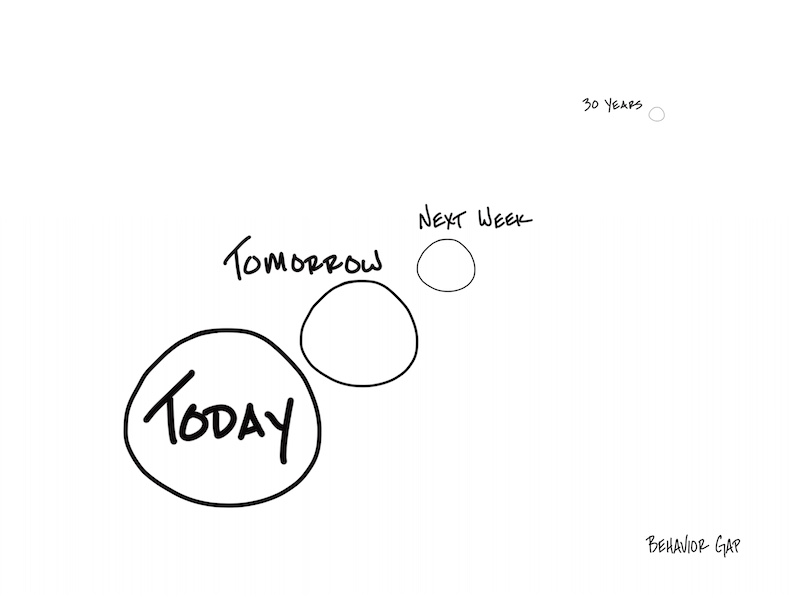

Can You Imagine Your Future Self?

One of the big problems with setting goals is that we’re really bad at imagining our future selves. Remember what you imagined you’d be as an adult when you were a kid? I’m guessing there are some gaps between that dream and your current reality.

In the same way, there will be gaps between your current reality and your future self. And that’s partially because when we talk about goals, we’re often talking about long time frames. Consider retirement, for example. That could be upwards of 20 or 30 years from now. You can’t even imagine yourself at that age, let alone plan for it. That’s your parents, not you!

When we start talking about our distant future self, it’s easy to rationalize the decision to not do anything. Something 30 years down the road sounds an awful lot like something that can be started tomorrow.

In fact, our future self can often feel like some other annoying person constantly stealing heaps of fun from our current self. You may feel like you’re still 30, but if you just celebrated (or mourned) turning 60, it’s time to get real. Our future self will be here faster than we think. So how do we vividly connect with our future self to make better decisions today? Listen to the latest episode of TLV and consider writing a letter to your future self here.