Details Are Part of Our Difference

David Booth on How to Choose an Advisor

20 Years. 20 Lessons. Still Taking the Long View.

Making the Short List: Citywire Highlights Our Research-Driven Approach

The Tax Law Changed. Our Approach Hasn’t.

Author: Hill Investment Group

Get the Whole Family Involved

One question we hear often is, how do I teach my kids about money?

We’ve shared our conversation with Marilyn Wechter about subtle ways to set our kids up for success with money and talked about how not to be a snowplow parent, but what about the nuts-and-bolts? How can we teach our kids the basics of saving, the power of compound interest, and how capital markets work? In other words, how do we make finance fun?

Recently, John and I had a crash course in teaching a trio of teenagers. We thought we’d share some valuable takeaways you can incorporate into your own “money talk” with your kids.

The meeting’s highlight was “Roll with the Market”, a dice game that aimed to replicate the stock market. We also introduced them to our version of Finance 101: budgeting, savings, goals, credit cards, and Rick Hill’s favorite Rule of 72.

In “Roll with the Market”, the kids decided if their money was “in” or “out” through 10 rounds of dice rolls. The game gave the kids a taste of what it’s like to be invested in the stock market, simulating a rising or falling market’s emotional effects and changes to their investments. To our surprise and satisfaction, the three kids stayed in the market all 10 rounds, never once deciding to sit out (equivalent to going to all cash). Even at this young age, they were able to intuitively understand and take the long view!

Here are a couple of tips for keeping children engaged as they learn:

- Use cold hard cash – Once we threw some cash on the table and got them involved in helping manage it, they were hooked.

- Gameify the essential topics – Making the lesson a game reframed their idea of money from obscure to practical and made it fun! They were also able to practice and absorb the lessons without just listening to us drone on.

- Make it relevant – We believe the real power of wealth lies in creating freedom and options to lead the life you choose. By asking a couple of pointed questions, we were able to help them understand that money can power their dreams, even now. The key was showing them money matters today – not just in the future. Each member of the family was totally engaged, asking great questions, participating in thoughtful conversation.

If the idea expressed here sounds good to you, let us take “the money talk” off your hands. Contact us about scheduling a family meeting. You never know what small spark will set off your child’s long-term success with money.

The Great Debate – Election Years vs. the Stock Market

Whether your political views are right, left, or somewhere in between, you should check out this video. Election years tend to heighten everyone’s anxiety. This video does a great job of helping us as investors understand what to do.

As changes to tax reform, foreign policy, and social issues loom, it’s totally natural to be tempted to make short-term portfolio changes to profit from the uncertainty, or to minimize losses. But, as we know, markets are extremely efficient at processing new information and adjusting prices based on future expectations, so research would tell us any fears or expectations about the results of the presidential election are already baked in.

So, what’s a savvy investor to do? Our friends at Dimensional Funds skillfully reframe the perspective provided by the regular media.

Going back to 1928, when Herbert Hoover was elected president over Al Smith, the S&P 500 has returned on average 11.3% during election years and 9.9% in the subsequent year. In fact, there have been only three presidents in history that have seen negative returns in the stock market over their presidential tenure: Herbert Hoover during the Wall Street Crash of 1929, Franklin Roosevelt during the Great Depression, and George W. Bush in the 2000s during a time known as the Lost Decade.

Our takeaway? Make sure your investment plan fits your goals and stick with it. No matter what the regular media is saying, the data shows whoever is in the White House is unlikely to negatively impact the long-term value of your nest egg.

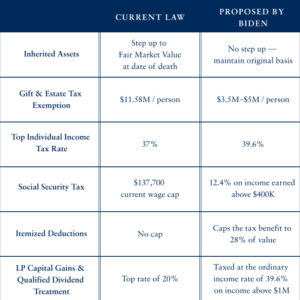

What Joe Biden’s Tax Plan Means for You

With Democratic Presidential candidate Joe Biden recently releasing his proposed tax plan, we thought it would be good to compare what Biden is proposing to our current tax law. Here is a simple side-by-side comparison of some of the major differences. What does this mean for clients of Hill Investment Group? At this point, not much. While Biden’s proposed plan is certainly different from current law, and in some cases significantly different, we are planning for the future, but aren’t making any changes to clients’ plans (at least not yet). As always, if you have specific questions about your specific situation, please call or email us to set up a time to talk.