Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Author: Matt Zenz

Wisdom of Crowds

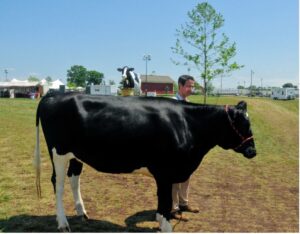

In the heart of a bustling county fair, an extraordinary experiment unfolded, showcasing the incredible power of collective intelligence. A seemingly whimsical challenge emerged: Guess the weight of a cow on display. What initially appeared as a playful game soon transformed into a stunning demonstration of the “wisdom of crowds.”

A diverse group of fairgoers, each with varying degrees of knowledge and intuition, were asked two simple questions: How much does this cow weigh? Do you have any experience with the weight of cows? The goal was to see if anyone in the crowd could guess the correct weight and if experts would be superior to the average individual.

A fascinating phenomenon began to unfold. Although individual estimates ranged wildly, the average of all these guesses astonishingly approached the actual weight of the cow. In the end, the average guess for the non-experts was 1,287 pounds compared to the actual weight of 1,355 pounds. A difference of only 68 pounds. A bigger surprise: the expert’s average guess was less accurate at 1,272 pounds, a difference of 83 pounds.

The genius of this collective average lay in its ability to filter out errors and biases inherent in individual guesses. High estimates countered low ones, and the middle-ground approximations formed a consensus that defied the odds. This experiment showcased the concept of the “wisdom of crowds” that a diverse group’s collective knowledge can outperform the insights of any individual expert.

Translating this concept to the realm of financial markets, where stocks are traded and their prices determined, demonstrates a similar effect. The market comprises countless participants, each with their own insights, analyses, and biases. When these factors converge, the resulting stock prices tend to reflect the most accurate estimate of a company’s value at a given point in time.

This phenomenon finds its backbone in the Efficient Market Hypothesis (EMH), which proposes that stock prices encapsulate all available information. Much like the cow guessing average, EMH posits that the combined insights of countless individuals lead to fair and accurate valuations, making it incredibly challenging to outguess the market consistently. Financial markets react to new information quickly, updating prices to reflect the most up-to-date information and risks fairly. Rather than trying to outguess market prices, causing turnover, high fees, and trading costs, one is better off accepting and using market prices to your advantage. Invest in global capitalism rather than trying to outguess it.

From guessing the weight of a cow to the intricate world of financial markets, the wisdom of crowds continues to shape our understanding of collective intelligence. Just as a diverse group of fairgoers could accurately estimate the cow’s weight, the multitude of participants in financial markets work together to create prices that reflect a collective estimate of a company’s value. The efficient market hypothesis stands as a testament to the power of this concept, reminding us that while individual expertise is valuable, the aggregated insights of many can often lead to more accurate and reliable outcomes. As we navigate the complexities of the modern world, embracing the wisdom of crowds can lead to better decision-making and a higher likelihood of financial success.

Why Diversify Globally?

As an investor, it’s natural to be drawn to invest in your “home” market. The United States is where you live and work. You know the companies, politics, and economic climate. It also doesn’t hurt that the returns of the U.S. market have been fantastic over the last decade. From 2010-2022 the S&P 500 has returned an average of 12% annually.

In comparison, over the same period, the MSCI All Country ex US index, representing global stocks excluding the US, returned an average of 3.5% annually. These figures might lead one to question the need for global diversification. I’m here to convince you that diversification is, in fact, “the only free lunch” in investing.

History has demonstrated the importance of looking beyond recent performance and that any country, even successfully developed ones, can have long periods of sustained underperformance.

For example, let’s start by looking at the United States for the decade directly before the one mentioned above. From 2000-2009, known as “the lost decade,” the S&P500 had an annualized return of -1%, while the MSCI World ex US index had an annualized return of 1.6%. Over this decade, investors lost money by investing in the US stock market and had 27% less money than an investor who invested in global ex-US equities.

Another example is Japan. In 1989, Japan held the title of the world’s largest stock market. With a total market cap of approximately $4 trillion USD, iconic companies like Toyota, Sony, and Honda were global industry leaders. Japan had a diversified economy and was widely regarded as the world’s technology hub. During the 1980s, the Japanese market grew from $0.5 trillion to $4 trillion, with the Nikkei (Japan’s equivalent of the S&P 500) delivering impressive annual returns of 19.5% from 1980 to 1989. At that time, the US stock market’s size was smaller than that of Japan at around $3 trillion.

However, fast forward 35 years, and the picture looks starkly different. Today, the US market is valued at a staggering $40 trillion, while the Japanese market lags behind at approximately $5 trillion USD. Notably, Japan experienced no runaway inflation, wars, political turmoil, social unrest, or famine during this period. Despite its once fast-growing market and technological prominence, the Nikkei grew by less than 1% annually over the next 35 years. This is a powerful reminder that even the most promising markets can encounter prolonged stagnation.

The tale of Japan’s rise and subsequent stagnation highlights the importance of global diversification. While recent US market returns have been remarkable, investors must consider the broader global landscape and the potential risks of concentrating investments solely in one country. By embracing global diversification, investors manage risk, gain exposure to diverse opportunities, and position themselves to capture long-term growth potential. A well-diversified portfolio provides resilience, protects against overexposure to a single market, and helps navigate the uncertainties of the global economy.

This information is educational and does not intend to make an offer for the sale of any specific securities, investments, or strategies. Returns and market information quoted here was pulled from publicly-available, third-party sources believed to be accurate. Investments involve risk and, past performance is not indicative of future performance. Any actual return will be reduced by advisory fees and any other expenses incurred in the management of a client’s account. Consult with a qualified financial adviser before implementing any investment strategy.

Can Artificial Intelligence Help Pick Stocks?

It feels like every conversation lately revolves around the latest discovery in AI and how it’s improving x,y, and z. But how does AI impact our industry as Financial Advisors?

It feels like every conversation lately revolves around the latest discovery in AI and how it’s improving x,y, and z. But how does AI impact our industry as Financial Advisors?

David Booth, Chairperson of Dimensional Funds Advisors, recently wrote an opinion piece on AI and the market for the Financial Times. He states, “Can artificial intelligence help pick stocks? More specifically, can investors use AI to determine the fair price of a stock or a bond? I bet a lot of people right now would say yes, given recent advances that allow for the processing of ever greater amounts of information.

I think my AI is better than all the other ones out there. My AI is the market.”