Details Are Part of Our Difference

David Booth on How to Choose an Advisor

20 Years. 20 Lessons. Still Taking the Long View.

Making the Short List: Citywire Highlights Our Research-Driven Approach

The Tax Law Changed. Our Approach Hasn’t.

Author: Matt Hall

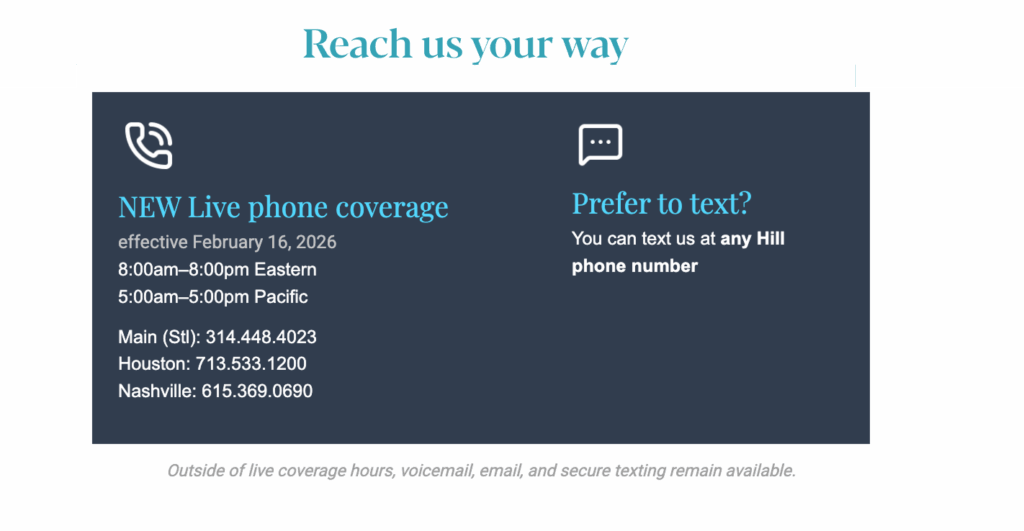

A Real Person, When You Need One

Most of us know the feeling.

You have a question that matters. You call a company. And instead of a person, a menu of prompts, and the hope that someone on the other end will actually care.

We’ve always believed financial advice should feel more human than that.

At Hill Investment Group, our approach to service has been guided by a few simple principles:

- Be fast – Available and respond promptly

- Be friendly — Warm, thoughtful, and welcoming

- Take ownership — If it’s important to you, it’s important to us, and we’ll see it through

As we’ve evolved, we’ve spent a lot of time asking a simple question: How do we grow without losing what makes the experience personal?

One answer is to lean into our people.

Our team now works coast to coast, and we’re using that to better serve you. Historically, our phones have been answered live from 8:30am to 5:30pm Central Time. Beginning February 16th, we’re expanding live phone coverage so you can reach a real person from 8:00am to 8:00pm Eastern (5:00am to 5:00pm Pacific).

The experience won’t change. No phone trees. No prompts. No outsourcing. Just a knowledgeable member of our team who’s ready to help.

Outside of those hours, our existing voicemail, email, and secure texting options will remain in place.

We don’t view this as a feature or an upgrade. It’s simply part of our responsibility to serve you well. When something is on your mind, you shouldn’t have to wait or wonder if anyone is listening.

Thank you for trusting us with what matters to you. We’re committed to showing up with care, consistency, and a very human voice on the other end of the line.

Finishing Strong, Building What’s Next

I’ve been thinking about Christmas a little differently this year.

I’ve been thinking about Christmas a little differently this year.

In some ways, I feel like I’ve already had mine. And I don’t mean the holiday itself. I mean the everyday version. Each day, we get to do work that matters for families we genuinely care about. We help people make better decisions, reduce anxiety, and create order where there was once noise. That’s a gift, and one I don’t take lightly.

This season naturally invites gratitude. Gratitude for trust. For relationships that deepen over time. For the privilege of being invited into important conversations about life, money, and meaning. That sense of gratitude runs through everything you’ll find in this month’s Journal.

It’s also a time of momentum. We’re finishing strong, learning constantly, and quietly building what comes next. I’ll simply say this: the ideas taking shape for 2026 have the potential to be deeply valuable. Not louder. Not flashier. Just more useful, more beneficial, and more aligned with what long-term thinkers actually need. Stay tuned.

As always, thank you for being part of this community. Whether you’re a client, a friend of the firm, or simply curious about how we think, you belong here if you value sound judgment, long-term thinking, and progress over perfection.

I hope you enjoy this month’s Journal, and I wish you clarity and steady momentum in 2026 and beyond.

Take the Long View,

Sketches, Stories, and What Matters Most

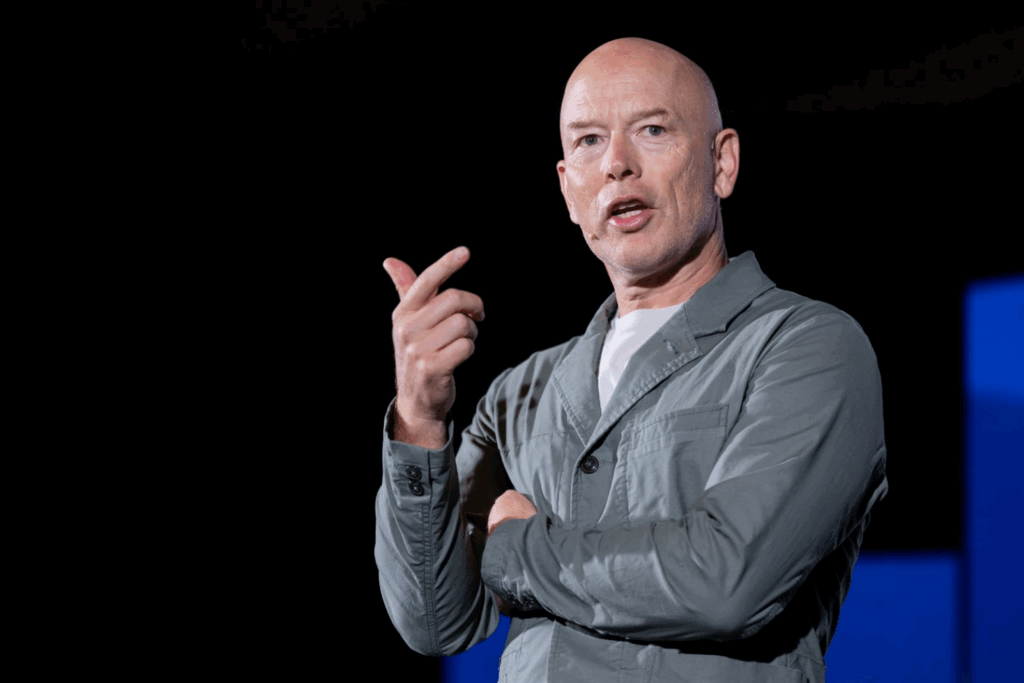

Every once in a while, an event reminds me just how much our work together matters. Our evening with Carl Richards was one of those moments…a room full of people opening up, reflecting, and reconnecting with what’s truly important.

A number of you joined us at the Racquet Club in St. Louis for a conversation that was part money, part meaning, and entirely human. Thank you for being there. And for those who couldn’t join in person, we felt your support from afar.

The energy in the room was palpable. People leaned in, shared openly, and allowed themselves to be moved. Since then, we’ve received thoughtful notes inspired by Carl’s sketches. It’s a reminder that a simple line, drawn with intention, can shift how we see our decisions and ourselves.

In my introduction that evening, I shared a story about meeting a couple on vacation whose wife was “famous to some.” That phrase describes Carl perfectly. He isn’t trying to be famous. He’s trying to be useful. Based on your reactions, he was.

The questions I asked Carl reflect the way we think at Hill Investment Group:

- What’s the story behind the sketches that make the complex simple without being simplistic?

- What feelings sit just below our financial decisions?

- How do we align the values we claim with the choices we make?

Carl reminded us that money is rarely the real topic. It’s a doorway into purpose and clarity.

My biggest takeaway from the evening is this:

At Hill Investment Group, our job is twofold. We help clients make the most of their capital, picking up every penny possible through evidence and disciplined implementation. And we help clients make the most of what matters in their lives through goal setting, accountability, and behavioral coaching.

We’ve been doing this work for 20 years, and we plan to keep doing it for 20 more, for a select group of long-view thinkers.

For those outside St. Louis, we want you to feel part of the experience too.

If you’d like a complimentary copy of Carl’s newest book, just email us and we’ll send one your way.

Here’s to a year ahead defined by gratitude, clearer choices, and deeper alignment between money and what matters most.

Take the Long View,