Details Are Part of Our Difference

David Booth on How to Choose an Advisor

20 Years. 20 Lessons. Still Taking the Long View.

Making the Short List: Citywire Highlights Our Research-Driven Approach

The Tax Law Changed. Our Approach Hasn’t.

Author: Matt Hall

Movie Time

I invite you to watch an enlightening movie with me if you’re in STL on October 5th! Originally intended as an event for our firm’s clients, we decided that we wanted to share it with others and are saving a select group of seats for friends of our firm. The 88-minute documentary on the characters who changed modern finance for the better will leave you feeling smarter and more connected to the truth of successful investing. An Academy Award-winning documentarian made the film, and it is appropriately titled Tune Out the Noise. Watch the trailer and sign up here if you’d like to enjoy it with us at the spectacular Saint Louis Art Museum Farrell Auditorium.

*If you’re not in St. Louis, let us know if you’d like information on future screenings in additional cities by emailing us here.

More reasons to attend:

- Co-CEO Dave Butler will be live in attendance for a Q&A following the movie.

- This is the first film to tackle the academic, business, and practical themes connected to modern investing.

- Tune Out the Noise has yet to be publicly available.

- The Art in the film is, in many ways, its own story.

- The score is composed by the award-winning Paul Leonard-Morgan.

- During the “back to school” season, this is an excellent way to fulfill your lifelong learning commitment.

Independent Difference Campaign

I’m proud to be a part of the independent advisor community. In the most simplistic definition, independence means that our firm does not fall under a major brokerage firm, bank or trust company. We operate independently and work for you, not a corporation. This is a hugely important distinction because our model allows us to operate objectively.

I was recently invited to be a part of a national ad campaign supporting independent advisors around the country, and I was taped saying lines like:

I am a fiduciary, not just some of the time, but all of the time.

As a fiduciary, I promise to put your interest first. Always.

As a fiduciary, I promise to always act in the best interests of you and your family.

We believe these statements at our core and think every investor deserves to be served by someone who works solely for them, as their fiduciary. Reciting these lines came naturally and we’re honored to help support the broader community of advisors.

Stay tuned for more information on the campaign, who it’s associated with, and when it will air!

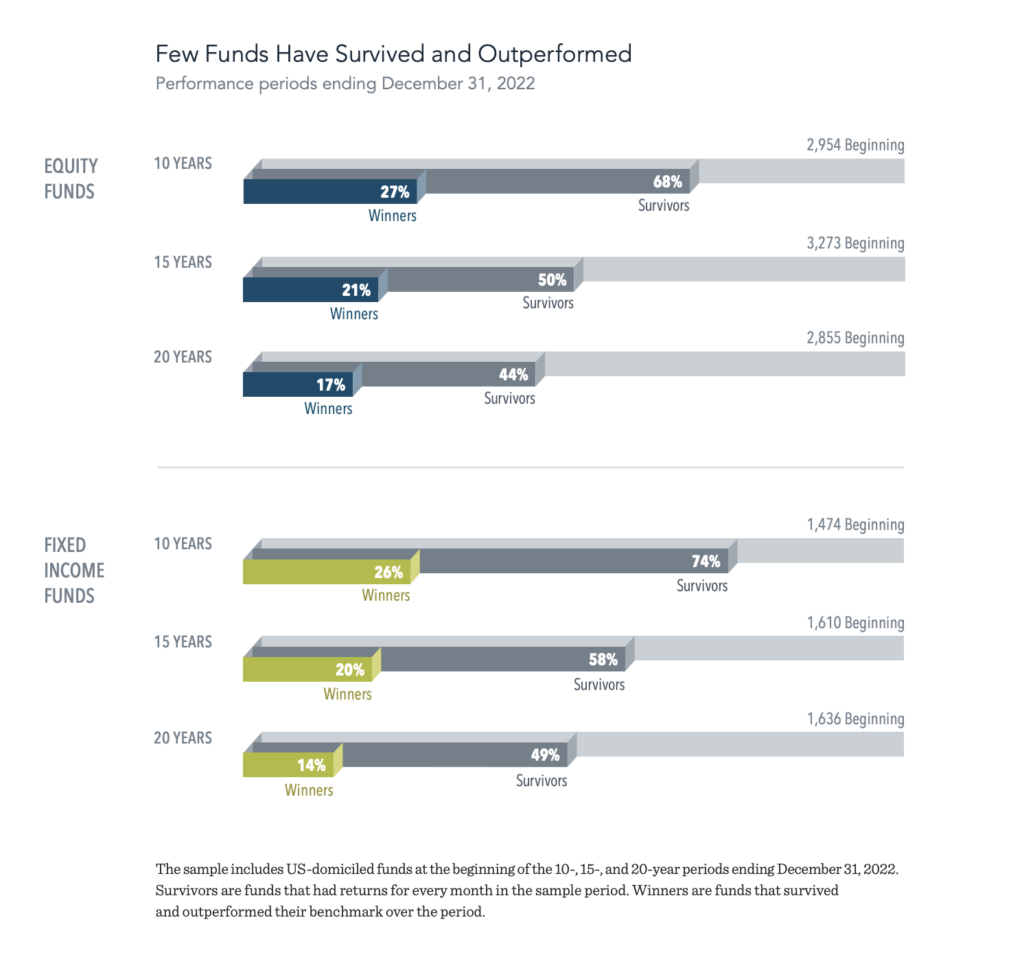

Image of the Month

Each year, Dimensional analyzes investment returns from a large sample of US-domiciled funds (over 4,000). This year’s study updates results through 2022 and includes returns from mutual funds and exchange-traded funds (ETFs) domiciled in the US. The evidence shows that a majority of fund managers in the sample failed to deliver benchmark-beating returns after costs. We believe that the results of this research provide a strong case for relying on market prices when making investment decisions.