Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Category: A piece we love

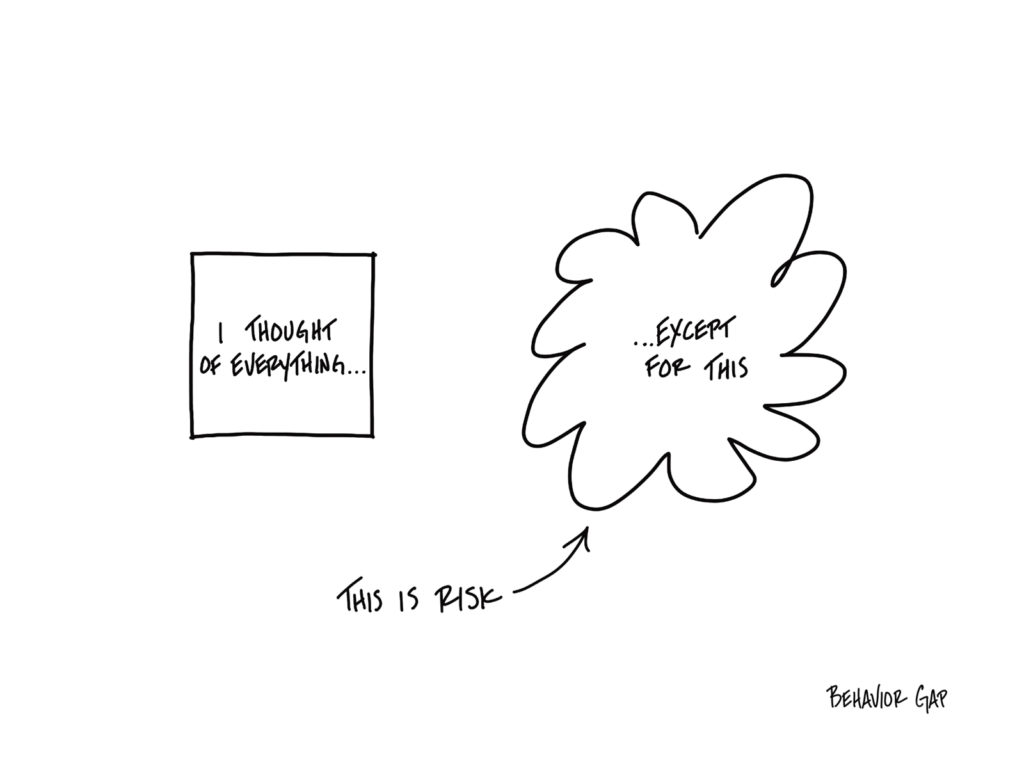

Risk is What’s Left Over

We are really good at managing risk by looking backward and preparing ourselves to handle a situation we’ve already seen. But we’re not very good at managing risk by looking forward and preparing ourselves for something we can’t even imagine.

The problem is, “something we can’t even imagine” is precisely what we need to be prepared for. Because risk is what’s left over after you think you’ve thought of everything.

It’s not the car you see coming that will kill you… it’s the one you don’t.

Bummer, right?

Let me be clear: This doesn’t mean you should cover yourself in bubble wrap and lock yourself in your house.

The point is simply to foster general resilience. You know—like an emergency fund.

And guess what, emergencies will happen. When they do, general resilience provides a margin of safety.

That’s what will protect you from the thing you never saw coming… not trying to predict the future and certainly not bubble wrap.

Volatility & Bananafish. What?

As many investors scratch their heads about the current economy and global market conditions, some may question their long-term investment plan and the relevance of “taking the long view.” Frankly, that’s human nature. That’s our cave-person, fight-or-flight genetics kicking in. Totally expected, as are our current market conditions when put into context. While the following is a slightly longer read than usual, the payoff for reading (and thinking about the contents) are worth it. Enjoy the analogy that ties together: volatility, bananafish, and your portfolio. If you’d like to discuss the article further, simply call the office at 855-414-5500 or schedule time with us via this link.

Click here for the fantastic write-up by our friend Rubin Miller.

Rich vs. Wealthy

One of our favorite podcast guests, author Morgan Housel, wrote a piece about “rich” versus “wealthy.” We had to share the quote below that stands out to us.

I want to be rich, because I like nice stuff. But what I value far more is being wealthy, because I think independence is one of the only ways money can make you happier. The trick is realizing that the only way to maintain independence is if your appetite for stuff – including status – can be satiated. The goalpost has to stop moving; the expectations have to remain in check. Otherwise, money has a tendency to be a liability masquerading as an asset, controlling you more than you use it to live a better life.

For the full piece click here.

And if you can’t get enough of Morgan’s writing here’s more.