Details Are Part of Our Difference

David Booth on How to Choose an Advisor

20 Years. 20 Lessons. Still Taking the Long View.

Making the Short List: Citywire Highlights Our Research-Driven Approach

The Tax Law Changed. Our Approach Hasn’t.

Category: HIG News

Fixed Income Without Forced Income: Introducing LVIG

Most fixed income does its job quietly. It dampens volatility. It provides liquidity. It helps portfolios stay balanced when markets feel uncertain. But it often comes with a tradeoff that matters more than most investors realize.

Traditional fixed income forces taxable income along the way, even when you would prefer control over when taxes show up, and what type of taxes they are. That loss of control can limit planning flexibility and reduce after-tax compounding over time.

Hill Investment Group and Longview Research Partners have been studying this problem with a simple question in mind.

The answer is a resounding “Yes!” In March, we will launch LVIG, a new fixed income ETF addressing that exact question. LVIG is designed to improve after-tax outcomes by managing not just what investors own, but how returns are delivered. The goal is not to change the role fixed income plays in a portfolio. The goal is to make fixed income work more effectively after taxes by giving advisors and clients more control over the timing and character of returns.

If you were part of last year’s 351 exchange launch of the Longview Advantage Fund (EBI), the philosophy will feel familiar. That effort helped solve a common issue in portfolios, how to diversify concentrated positions without triggering a large tax bill.

LVIG applies the same mindset to a different part of the portfolio, fixed income implementation.

We are hosting a live webinar ahead of LVIG’s launch to explain what’s changing, why we believe it’s an improvement, and how it may fit into client portfolios.

If you’re a Hill Investment Group client or individual interested in taking your fixed income to another level, register here.

If you’re an advisor, please register for one of two upcoming webinars on February 12th (register here) and February 19th (register here) that will dig into how you can deliver a more effective fixed income solution for your clients.

We hope you can join us.

A Real Person, When You Need One

Most of us know the feeling.

You have a question that matters. You call a company. And instead of a person, a menu of prompts, and the hope that someone on the other end will actually care.

We’ve always believed financial advice should feel more human than that.

At Hill Investment Group, our approach to service has been guided by a few simple principles:

- Be fast – Available and respond promptly

- Be friendly — Warm, thoughtful, and welcoming

- Take ownership — If it’s important to you, it’s important to us, and we’ll see it through

As we’ve evolved, we’ve spent a lot of time asking a simple question: How do we grow without losing what makes the experience personal?

One answer is to lean into our people.

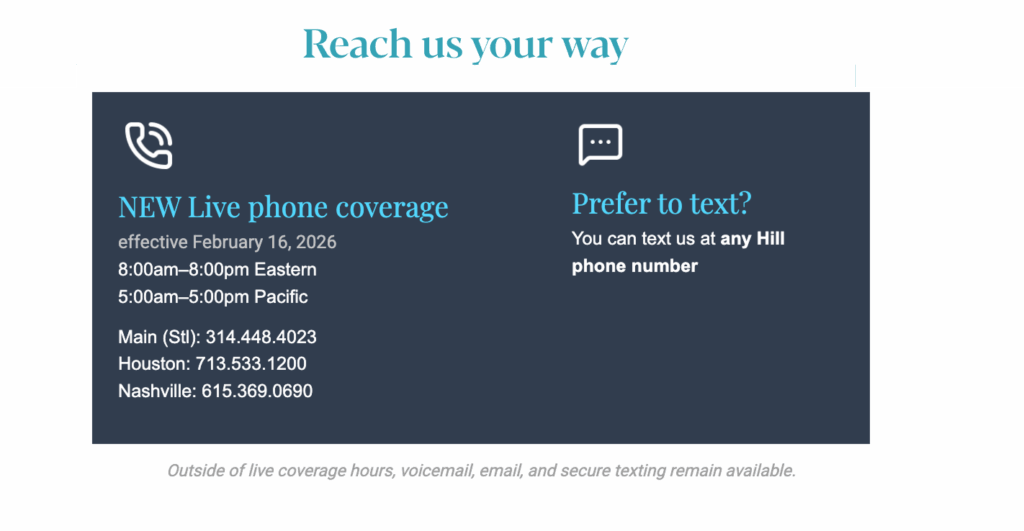

Our team now works coast to coast, and we’re using that to better serve you. Historically, our phones have been answered live from 8:30am to 5:30pm Central Time. Beginning February 16th, we’re expanding live phone coverage so you can reach a real person from 8:00am to 8:00pm Eastern (5:00am to 5:00pm Pacific).

The experience won’t change. No phone trees. No prompts. No outsourcing. Just a knowledgeable member of our team who’s ready to help.

Outside of those hours, our existing voicemail, email, and secure texting options will remain in place.

We don’t view this as a feature or an upgrade. It’s simply part of our responsibility to serve you well. When something is on your mind, you shouldn’t have to wait or wonder if anyone is listening.

Thank you for trusting us with what matters to you. We’re committed to showing up with care, consistency, and a very human voice on the other end of the line.

Holiday Hours, with Coast-to-coast Coverage

As we enter the holiday season, we’re grateful for the trust you place in us. This year also marks an important milestone for Hill—our team now stretches from California to New York, giving us broader coverage and greater availability than at any point in our 20-year history.

Our office will be closed on:

- Dec 24 – 26

- Jan 1- Jan 2

New Year’s Eve (Dec 31): We’ll close early at 1:00 PM.

Even during our closed days, we’re here for anything time-sensitive. You can always reach us at service@hillinvestmentgroup.com or text our main number at (314) 448-4023, and we’ll get right on it.

Wishing you and your family a peaceful, meaningful season.

The Hill Investment Group Team