Details Are Part of Our Difference

David Booth on How to Choose an Advisor

20 Years. 20 Lessons. Still Taking the Long View.

Making the Short List: Citywire Highlights Our Research-Driven Approach

The Tax Law Changed. Our Approach Hasn’t.

Category: Planning

SECURE Act 2.0 and What it Means for You

As most of us were celebrating the holiday season, a significant piece of legislation passed that, in one way or another, impacted every person reading this. We’ve tried to boil down the 100+ pages to these highlights:

Required Minimum Distributions: The age at which required minimum distributions (RMDs) begin was pushed back to age 73 for individuals born between 1951-1959 and age 75 for those born after 1960, allowing for additional tax deferrals for many.

529 Plan Changes: Beginning in 2024, some individuals can move money from a 529 plan directly to a Roth IRA. This can be incredibly impactful if you set up a 529 years ago and the beneficiary finished college (or didn’t attend college) without completely exhausting the funds.

Retirement Plan Changes: Beginning in 2025, catch-up contributions will be indexed to inflation, ultimately allowing for more significant retirement vehicle savings. Additionally, matching contributions from employers can now be made to Roth accounts.

Student Loan Debt: Starting in 2024, employers can “match” employee student loan payments by contributing to a retirement account for the employee.

Please get in touch with us if you’d like to discuss any of the above information and see how it may impact your specific situation.

Hill Investment Group is a registered investment adviser. Registration of an Investment Advisor does not imply any level of skill or training. This information is educational and does not intend to make an offer for the sale of any specific securities, investments, or strategies. Investments involve risk and, past performance is not indicative of future performance. Consult with a qualified financial adviser before implementing any investment strategy.

Grateful for Diversification

This year, I’m grateful for Diversification. Diversification is the only free lunch in investing. Let me repeat that. Diversification is the only free lunch in investing. As an investor, it allows you to dramatically reduce the range of possible outcomes in your investment portfolio, thereby making it easier to reach your financial goals. The range of performance of individual US companies this year was extremely wide and volatile. Think of it as a roller coaster with huge and frequent ups and downs. By diversifying, you were able to avoid some possible very negative outcomes. The video below provides a nice visual of the performance of the S&P500 year-to-date and gives an example of how increasing diversification, in this case by adding in small-cap companies, can help smooth the ride.

Video created by Jan Varsava.

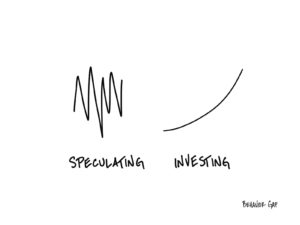

Speculating Versus Investing

Speculating and investing are fundamentally different, and it pays to know why.

Speculating is exciting, full of breathtaking ups and downs. If you chart it over time, it looks like a heartbeat. Probably an elevated one.

Investing, on the other hand, is slow and boring. In the short term, you may have some ups and downs. But if you chart investing over time (over many years of time), it looks like a long slow curve upward.

Speculating is like a Vegas casino. Investing is like watching grass grow.

Know which game you’re playing.