Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Category: Planning

Hey Hill, how can I…

At Hill Investment Group, we recognize that when a few clients raise the same question, it’s likely that more have similar thoughts. To better serve you, we’re introducing a new segment in our newsletter where we’ll address common questions and how we approach them. To submit questions for future newsletters, email us at info@hillinvestmentgroup.com.

Hey Hill, do I need umbrella liability insurance?

It’s an important question! Many clients feel there’s no shortage of situations or assets that can be insured; however, having adequate risk management is key to protecting your assets and financial health.

So, what is umbrella insurance, and do you really need it?

Most insurance policies, such as home and auto, only pay up to a certain amount for liability coverage. Umbrella insurance can help protect you against claims other policies may not cover entirely. Typically, umbrella policies don’t kick in until all other related policies have been exhausted. For example, if someone gets hurt in your home and you’re sued for medical bills, your umbrella policy would kick in after your home or auto limits are reached.

Further, umbrella policies might have broader liability coverage than your other policies. For example, umbrella policies might cover false arrest, defamation, libel, and slander.

The Texas Department of Insurance provides some examples of claims that could fall under an umbrella policy:

- You cause a severe car accident.

- Your dog bites someone.

- A child is hurt on your property (e.g., in your pool or on your trampoline).

- Someone hurts themselves in your home.

Generally speaking, it is a great idea to have an umbrella insurance policy to cover any additional liability not covered by your existing policies (especially if you have teenagers, as you are responsible for their actions)! For example, auto and home policies typically only cover up to $500,000 in liabilities. If you have a net worth of more than that, you should take advantage of this cost-effective coverage (~$125 annual premium/$1,000,000 of coverage).

To provide additional perspective, we recommend booking a meeting to review your entire risk management portfolio and working with a licensed insurance agent to ensure you are adequately covered at a fair price.

*Hill Investment Group acts to help you secure the appropriate solution but does not sell insurance, nor do we receive compensation from insurance-related firms.

Hill Investment Group is a registered Investment Adviser. Registration of an Investment Advisor does not imply any level of skill or training. This information is educational and does not intend to make an offer for the sale of any specific securities, investments, or strategies. Investments involve risk, and past performance is not indicative of future performance. Return will be reduced by advisory fees and any other expenses incurred in managing a client’s account. Consult with a qualified financial adviser before implementing any investment or financial planning strategy.

Hey Hill, how can I…

At Hill Investment Group, we recognize that when a few clients raise the same question, it’s likely that more have similar thoughts. To better serve you, we’re introducing a new segment in our newsletter where we’ll address common questions and how we approach them. To submit questions for future newsletters, email us at info@hillinvestmentgroup.com

Hey Hill, what should I do about 401k accounts with previous employers?

Congratulations! You just started a new job that provides fulfillment, purpose, and great rewards. In your initial weeks, your new employer offers you a new retirement plan with wonderful investment options and a generous company match.

What can you do to maximize the value of your current retirement plan as a part of your overall portfolio? What about the employer retirement plan you left behind with your previous job?

For your current plan:

- We can incorporate your retirement plan assets into your overall plan and portfolio. This helps us stay in line with your goals and can help with after-tax returns. You can find more details here.

For the plan you left behind with your previous job:

You have four basic options:

- Leave the money in your old employer’s plan. (Usually not a great idea.)

- Transfer the funds into your new employer’s plan.

- Transfer the funds into your existing IRA (traditional and/or Roth).

- Cash-out the plan and pay the taxes and penalties, if applicable.

Here are some key factors that may influence your decision:

- Employer plans have a set menu of investment options and associated fees. While you may be satisfied with those options, a rollover IRA will not limit investment options and generally allows you to invest at a lower cost.

- Many who hold on to old employer plans tend to lose track of them; therefore, they are rarely rebalanced as the market changes nor managed as part of their household portfolio.

- Many plans have pre-tax and Roth components, which may or may not align with a new employer’s plan offerings, but they can be easily rolled over to your traditional and Roth IRAs.

- Cashing out of the plan may involve unnecessary penalties and taxes.

- A unique feature of a 401k is that you can borrow money against it but not from an IRA.

- If you utilize a Backdoor Roth strategy, you may prefer to keep your retirement funds in a 401k to avoid the complications of a non-zero balance IRA account.

In the end, the combination of the above factors leads many to roll over their old plan to their individual IRA. This IRA becomes a hub as they move in and out of employers’ plans throughout their careers. On balance, the ability to choose your low-cost investment options in harmony with your other assets makes the option to roll over into an IRA a sound decision.

Anytime you change jobs, we encourage you to discuss your situation with your Hill advisor. One size doesn’t fit all, and your advisor can help you work through your situation. Book a call with us if you have questions!

Hill Investment Group is a registered investment adviser. Registration of an Investment Advisor does not imply any level of skill or training. This information is educational and does not intend to make an offer for the sale of any specific securities, investments, or strategies. Investments involve risk, and past performance is not indicative of future performance. Return will be reduced by advisory fees and any other expenses incurred in managing a client’s account. Consult with a qualified financial adviser before implementing any investment or financial planning strategy.

The Bumpy Road

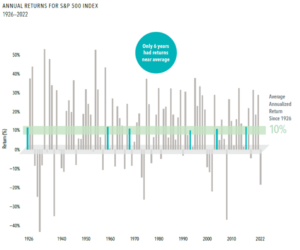

Historically, the US Equity market has returned about 10% annually to investors from 1926 – 2022. Due to this historical rate of return, many investors expect this level of return year over year. However, stock markets are highly volatile. Although the average is 10% per year, it is extremely rare for the market to be up 10% over any given year.

Since 1927, there have only been 6 years where the stock market returned between 8-12%. Thus, even though you should expect the market to give you a 10% return, you should expect the market over any given year to hardly ever give you a 10% return. It is this bumpy road that creates the risk in investing in equities, which is why you are compensated with the 10% annual average return. The key is to take the long view and not look at quarter-to-quarter or year-to-year returns.

People often panic when their expectations don’t match reality. Investors expect a 10% return every year, which will often not materialize. When the market goes down and does not match this 10% expectation, investors tend to panic. Changing your expectations on the range of outcomes of equities while keeping in mind the long-term average can help investors stick to their plan.

Hill Investment Group is a registered investment adviser. Registration of an Investment Advisor does not imply any level of skill or training. This information is educational and does not intend to make an offer for the sale of any specific securities, investments, or strategies. Investments involve risk, and past performance is not indicative of future performance. Return will be reduced by advisory fees and any other expenses incurred in managing a client’s account. Consult with a qualified financial adviser before implementing any investment strategy.

Hill Investment Group may discuss and display charts, graphs, and formulas which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used alone to make investment decisions.