Details Are Part of Our Difference

David Booth on How to Choose an Advisor

20 Years. 20 Lessons. Still Taking the Long View.

Making the Short List: Citywire Highlights Our Research-Driven Approach

The Tax Law Changed. Our Approach Hasn’t.

Culture & Perspective: Why Culture Matters

The Hill perspective is well known. It is our motto and our compass: Take the Long View. Many of our clients and friends of the firm also know our culture. We strive to be warm, caring, thoughtful, serious about our work, and human enough to enjoy it together.

The Hill perspective is well known. It is our motto and our compass: Take the Long View. Many of our clients and friends of the firm also know our culture. We strive to be warm, caring, thoughtful, serious about our work, and human enough to enjoy it together.

As we grow, an important question stays front and center: how do we continue to deepen both our culture and our perspective at the same time, especially as our team is spread across the country?

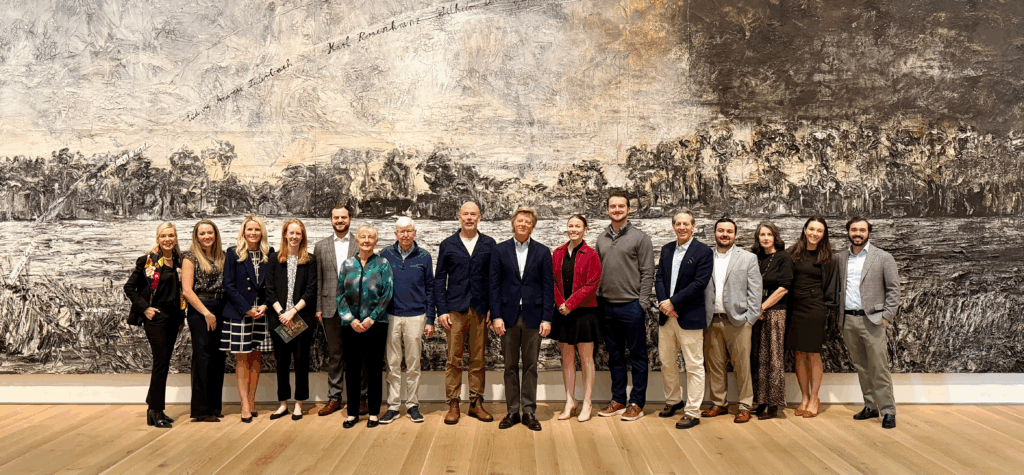

Occasionally, we’re given a rare gift: the chance to be together in one place. Last month, nearly our entire nationwide team happened to be in St. Louis at the same time. Recognizing how uncommon that is, we chose to be intentional with the moment and invest it in something meaningful.

When author, artist, and former financial advisor Carl Richards was in town for our event, we extended the experience by taking the team to a once-in-a-lifetime exhibition by German artist Anselm Kiefer at the Saint Louis Art Museum. The visit was arranged by my wife, Jeana, who serves in a volunteer leadership role at the museum. Notably, Jeana and Rex Sinquefield, co-founder of Dimensional Fund Advisors, were among the significant underwriters supporting the exhibition.

Together, we spent time immersed in the work of one of the most important living contemporary artists. Kiefer, who recently turned 80, is known for confronting history, destruction, and renewal on a monumental scale. His work takes the long view. From loss comes rebirth. From devastation, renewal. The physical scale of his art reinforces the message. Some things simply cannot be understood without stepping back and taking them in fully.

It is hard not to see the parallel.

Life is not smooth. Markets are not either. Both move in cycles that include setbacks, uncertainty, and moments that test conviction. Yet over time, periods of decline have been followed by recovery. Often the most meaningful progress comes from staying engaged rather than stepping away when things feel uncomfortable.

Clients often tell us that one of the most valuable things we do is help them stay on the ride. Not because there are guarantees. There are not. But because perspective matters. When you zoom out and look across decades rather than days, the long-term story of investing has been one of resilience and growth.

That perspective is deeply embedded in our culture. It shapes how we invest, how we advise, and how we support clients through both calm and turbulent moments.

Hill Investment Group is only 20 years old, but we are grounded in values and relationships that allow us to do our work with care, humility, and conviction. When we have moments to come together as a team, we try to use them intentionally to reinforce who we are and how we think.

We’re grateful to share this journey with you, and we look forward to continuing the ride together.

Happy Holidays.

Tis The Season — 2026 Predictions

As we approach year-end, a familiar pattern begins. Financial headlines fill with confident forecasts for the coming year. Market strategists, TV pundits, and well-known investment houses will soon release their precise targets for where the stock market “should” finish in 2026.

These predictions generate attention, but they don’t generate clarity.

When you look back at previous forecast seasons, the lesson is remarkably consistent:

Market predictions, including those from highly respected experts, are usually wrong.

The Track Record No One Promotes

Each year, strategists publish projected returns for the year ahead. Put them side by side and you get a colorful collage of potential “futures” often spanning double-digit differences in expected returns.

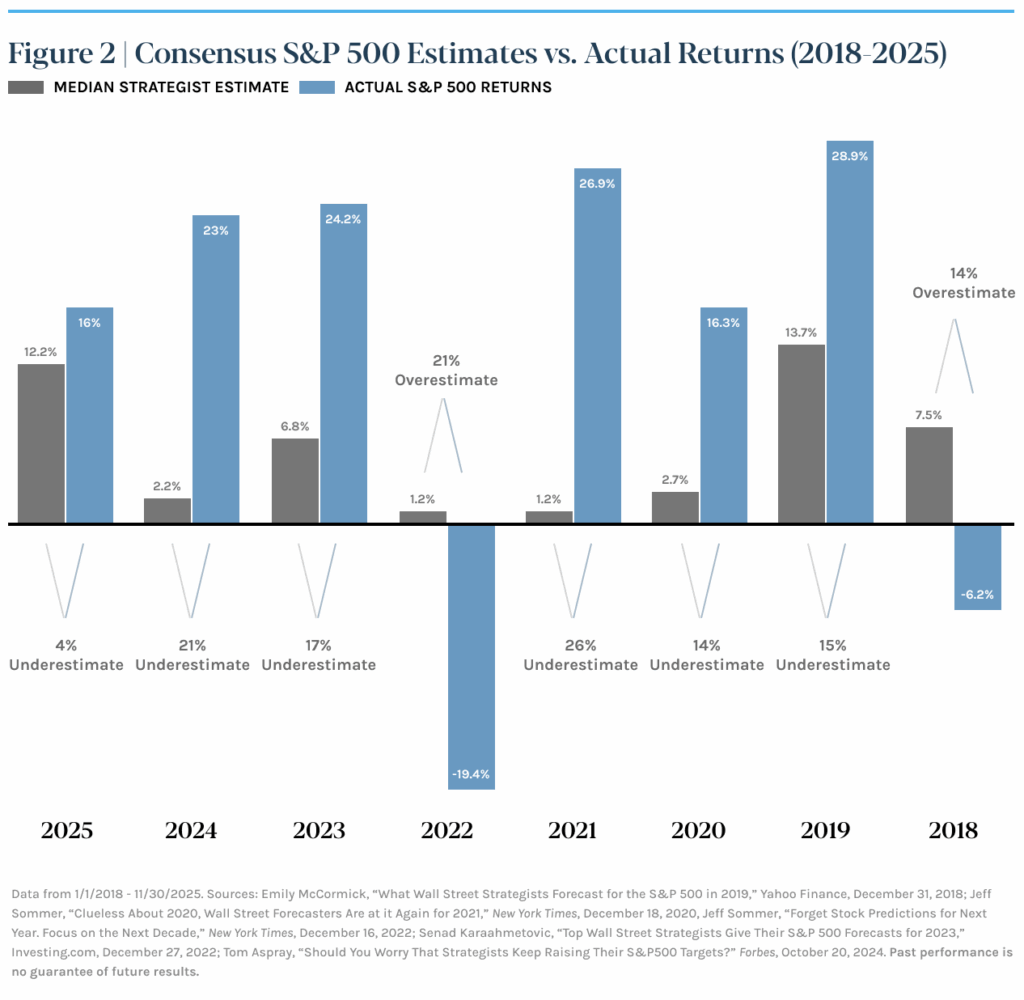

And yet, year after year, the actual market return tends to land well outside the average forecast. Why? Markets don’t cooperate with guesses. The chart below displays the median forecast over the past eight years and the actual market returns. Almost every year the market return differs from the median prediction by 15-20%. Yes. 15-20%. The range of outcomes is almost double the average historical annual return of 10%!

Why Forecasters Miss the Mark

Even the best models can’t anticipate the unpredictable forces that shape markets. Sudden tariff announcements, geopolitical surprises, technological innovations, shifts in interest rates, or global health events can all impact markets in unpredictable ways.

None of these show up in the glossy prediction presentations at the start of the year. Remember, markets move on new information, and new information, by definition, hasn’t been forecast.

What moves stocks is not what experts expect — it’s what they couldn’t expect.

Therefore, investors should focus on what they can control and let markets work for them through the unpredictability.

At Hill Investment Group, this is the core of our philosophy — Take the Long View. Instead of reacting to forecasts, we help clients anchor to what actually drives success:

- broad diversification

- Minimizing expenses and taxes

- disciplined rebalancing

- evidence-based decision-making

- patience through inevitable volatility

These principles have proven far more reliable than trying to anticipate where the S&P 500 will end next December.

Signal vs. Noise: Private Equity

Private equity funds, which buy and sell companies not listed on a stock exchange, are increasingly being marketed to individual investors. The pitches promote democratizing investing by giving the average investor access to exclusive deals, huge target returns, and a chance to “invest like an institution.”

Headline returns for these investments often look enticing, but research shows that those returns rarely reflect the actual economic experience of investors. For individual investors, the gap between perception and reality can be significant.

Tradeoffs to Consider

High Fees – Private Equity Funds often charge 2% fees on all assets plus an additional 20% of all profits. This introduces a significant hurdle that few private equity managers can overcome when compared to public equity investments. The funds we use to access public markets have an average fee of 0.2%. One-tenth the fee andno additional performance fee.

Misleading Returns – Internal rate of return (IRR) is commonly used to report private equity returns. However, IRR’s calculation depends heavily on the timing of cash flows to the investor. Private Equity firms can game these numbers by manipulating cash flows, making IRR return numbers not comparable to the return numbers you see from public markets. For example, the hypothetical return stream below has an IRR of 33% but an actual return on capital closer to 3%.

Investors should focus on the overall growth of their wealth, not return figures grounded in misleading return metrics.

Lack of Access/Liquidity – Private Equity funds typically have high investment minimums, long lockups, and capital call contracts that make it difficult for investors to allocate money to more than a handful of funds. This creates challenges in diversifying investments across the private equity industry, decreasing the likelihood of achieving reliable long-term investment outcomes. The lack of diversification turns investing in this asset class closer to gambling than a reliable long-term investment strategy.

An Evidence-Based Alternative

At Hill, we believe wealth is best built through broadly diversified, transparent, and low-cost portfolios that match your personal risk profile. Public markets offer exposure to the same economic engine as private equity – global economic growth and human innovation – without the high fees and illiquidity.

New research from Dimensional Fund Advisors puts the conclusion succinctly:

“Broadly diversified, transparent, and low-cost public market strategies provide investors with reliable access to global equity and credit risk premia – without the costs and opacity of private funds.”

We agree.

The Bottom Line

Private markets are often marketed as a path to superior returns, but the data tells a different story. Historically, once you adjust for fees, misleading returns, and illiquidity, private equity performance looks a lot like public stock market performance – just with more complexity and buzzwords.

The real question here is not whether private equity occasionally succeeds – it does. It’s whether it offers long-term, risk-adjusted, after-fee advantages over public markets.

The evidence suggests: not really.

Hill Investment Group Partners, LLC (HIG) is an SEC-registered investment adviser. Registration does not imply a certain level of skill or training. The information in this publication is for educational and informational purposes only and does not constitute an offer to sell, or a solicitation of an offer to buy, any specific securities, investments, or investment strategies. Nothing contained herein should be construed as individualized investment, tax, or financial advice. Always consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed.

Investments involve risk, including the possible loss of principal. Past performance is not indicative of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Future returns may differ significantly from past returns due to market and economic conditions, among other factors.

Performance Disclosure (Hypothetical)

Hypothetical or model performance results, when presented, do not represent actual client performance. Hypothetical results do not reflect the impact of material economic or market factors that would have affected an adviser’s decision-making if managing actual assets. Hypothetical results are for illustrative purposes only and should not be interpreted as guarantees of future performance. Actual client results may differ.

Charts

Charts, graphs, formulas, probability visuals, and other illustrations included in this publication are intended to demonstrate concepts and provide context. They are not intended to be used alone to determine which securities to buy or sell, or when to buy or sell them. These illustrations provide limited information and should not be relied upon as the sole basis for any investment decision.