Details Are Part of Our Difference

David Booth on How to Choose an Advisor

20 Years. 20 Lessons. Still Taking the Long View.

Making the Short List: Citywire Highlights Our Research-Driven Approach

The Tax Law Changed. Our Approach Hasn’t.

Tag: client service

Holiday Hours and Coast-to-Coast Support

As we enter the holiday season, we’re grateful for the trust you place in us each year. This year also marks an important milestone for Hill: our team now stretches from California to New York, giving us broader coverage and greater availability than at any point in our 20-year history.

Holiday Hours

Our office will be closed on:

- Nov 27–28

- Dec 24–26

- Jan 1

New Year’s Eve (Dec 31): We’ll close early at 1:00 PM.

Even when our office is closed, we’re here for anything time-sensitive. You can always reach us at service@hillinvestmentgroup.com or text our main number at (314) 448-4023, and we’ll get right on it.

Wishing you and your family a peaceful, meaningful season!

Welcome, Grace!

We’re thrilled to welcome Grace Kreifels to our team as a Lead Advisor! With a strong foundation in evidence-based investing, Grace brings invaluable experience from her eight years at Dimensional and prior tenure at Vanguard. As a Certified Financial Planner (CFP®), her expertise and dedication to her craft will be a tremendous asset to our national client base. We look forward to seeing her make a lasting impact on our clients’ lives.

Beyond her professional strengths, Grace and her husband, Zach, recently welcomed their first child, a son named Riley—and parenthood has already been an incredible adventure for them. True to the spirit of many of our clients, Grace has a passion for the outdoors and enjoys hiking, backpacking, surfing, biking, skiing, and camping (they even took Riley on his first camping trip at just three months old!). As the daughter of a Delta pilot, Grace’s love for travel started young and has taken her to more than 30 countries, immersing her in diverse cultures and experiences.

Please join us in giving a warm welcome to Grace!

New Feature: “Hey Hill, how can I…”

Addressing Common Client Questions

At Hill Investment Group, we recognize that when a few clients raise the same question, it’s likely that many more have similar thoughts. To better serve you, we’re introducing a new segment in our newsletter where we’ll address common questions and how we approach them. The goal is to address what’s top of mind for our clients. To submit questions for future newsletters, email us at info@hillinvestmentgroup.com

This month, we’ll debut our first frequently asked question:

“Hey Hill, how can I secure a high rate of return for my cash savings?”

Understanding Cash Savings:

Every investor has to hold on to some amount of cash. We all have daily bills and expenses, something big we’re saving for, or just want something set aside for emergencies. This is money you want to keep safe. As you’ve likely noticed, cash sitting in your bank account earns very little and it may feel like you’re missing out on potential earnings. The great news? You have options at your fingertips, that we can help you take advantage of.

Why does this matter? Ensuring cash is managed effectively is one of the best ways we can help you “pick up the pennies” of extra return around the edges of your portfolio.

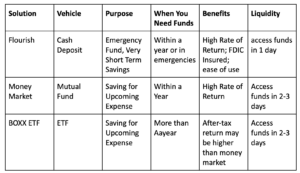

For earning a return on cash, we recommend three options, tailored to your specific situation:

- Money Market Funds

Money market funds invest in highly liquid, short-term debt instruments like US Treasury bills. These funds offer high liquidity and very low risk, making them a secure option. Investors in money market funds can expect a positive return, currently around 5%, matching the returns on short-term US government debt. We recommend money market funds for cash you plan to use within the next year. We can manage this investment for you, ensuring your cash earns the highest return with minimal risk.

- BOXX ETF

BOXX is an ETF providing money market-like returns but in an ETF format. This means returns are reflected in the increasing price of the ETF rather than as income. Since capital gains are taxed at a lower rate than income, holding BOXX for over a year could significantly enhance your after-tax return.

We recommend BOXX for cash that you plan to hold for more than a year. We can manage this investment and monitor the holding period to maximize your after-tax return.

- Flourish – New Service Announcement!

We are excited to introduce Flourish, a new service for Hill Investment Group clients. Flourish removes the hassle of hunting for the highest savings account rate by partnering with over a dozen FDIC-member program banks to ensure you always receive the highest savings rate. Flourish links to your personal checking or business account and offers money market-like returns and up to $10 million in FDIC insurance. This all comes with no fees or minimums and a clean, user-friendly interface.

We recommend Flourish as your high-yield savings account solution for cash held in personal accounts. We can help you set up Flourish to talk to your personal accounts hassle-free so you know you are getting the most out of your cash at all times.

We’ll be rolling out this service over the coming months, but if you are curious to dive deeper – Check out this 5-minute video. If you’re eager to start using Flourish now, email us, and we’ll send you an invite so you can start benefiting immediately.

We’re here to ensure your cash works as hard as you do. Let us help you maximize your returns with minimal risk.

Summary

This information is educational and does not intend to make an offer for the sale of any specific securities, investments, or strategies. Investments involve risk and, past performance is not indicative of future performance. Return will be reduced by advisory fees and any other expenses incurred in the management of a client’s account. Consult with a qualified financial adviser before implementing any investment strategy.