Details Are Part of Our Difference

David Booth on How to Choose an Advisor

20 Years. 20 Lessons. Still Taking the Long View.

Making the Short List: Citywire Highlights Our Research-Driven Approach

The Tax Law Changed. Our Approach Hasn’t.

Tag: Education

2025 Market Highlights

If 2025 reinforced anything, it is how quickly markets can test conviction and how costly it can be to react emotionally or narrowly.

If 2025 reinforced anything, it is how quickly markets can test conviction and how costly it can be to react emotionally or narrowly.

By April 8, the S&P 500 was down 15%, driven largely by Liberation Day and the sudden imposition of global tariffs. Volatility spiked, sentiment deteriorated, and the narrative quickly shifted toward protectionism and questions around US leadership.

Then, just one day later, markets delivered a stark reminder of how unpredictable short-term moves can be.

On April 9, the S&P 500 experienced one of the largest single-day rallies in history, with the S&P 500 rising 9.5% in a single session. Note: That one-day gain is larger than the average annual return of the S&P 500 since it’s existed. Investors who had de-risked or moved to the sidelines in response to the drawdown were not there to participate.

Despite being down double digits just three months into the year, the S&P 500 finished 2025 up nearly 18%, an outcome that few would have predicted during the spring selloff.

But the more important story was not just that markets recovered. It was where the returns came from. Global markets, as measured by the MSCI ACWI index were up 23%.

The Case for Global Diversification

2025 was a powerful reminder that returns rotate, often abruptly, and often away from what has worked most recently.

- US Market (S&P 500): +18%

- International Developed ex US (MSCI World ex US Index): +33%

- International small value (MSCI World ex US Small Value Index): +40%

- Emerging Markets (MSCI Emerging Markets Index): +34%

Investors who reduced international exposure or concentrated further into US equities, often justified by recent outperformance, materially underperformed what markets ultimately delivered.

International small value in particular was one of the strongest performers globally, with the ETF we use, the Avantis International Small Value ETF, returning 50% for 2025!

The Bigger Lesson

Markets do not reward confidence in narratives. They reward discipline. Investing in all types of markets and staying invested in all Markets.

Short term drawdowns are uncomfortable. Large single day rallies are unpredictable. The investors who captured 2025 returns were not those who timed exits or chased recent winners. They were those who stayed invested, stayed diversified, and allowed markets to do what they have historically done over time.

In years like 2025, the value of diversification is not theoretical. It is measurable.

And it is earned by maintaining exposure when doing so feels hardest.

Fees: Opaque vs. Transparent

Clients and those that know us well expect clarity and transparency in all that we do, especially when it comes to fees. In fact, HIG goes overboard to fully communicate all fees and expenses because every last basis point matters.

In contrast, most of Wall Street uses every means possible…including regulations…to disclose as little as possible, especially when it comes to fees.

Jason Zweig of the Wall Street Journal makes a crystal clear statement in a recent article:

“The first question on most investors’ minds is usually: How much can I make on this? Instead, their first question should always be: How much will this cost me?”

We wholeheartedly concur.

Be on the lookout for and learn about the latest pending legislation that would hide fees from investors here.

If you’re interested in more clarity and transparency in your life, set up a time to talk here.

Disclosure:

Hill Investment Group Partners, LLC (HIG) is an SEC-registered investment adviser. Registration does not imply a certain level of skill or training. The information in this publication is for educational and informational purposes only and does not constitute an offer to sell, or a solicitation of an offer to buy, any specific securities, investments, or investment strategies. Nothing contained herein should be construed as individualized investment, tax, or financial advice. Always consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed.

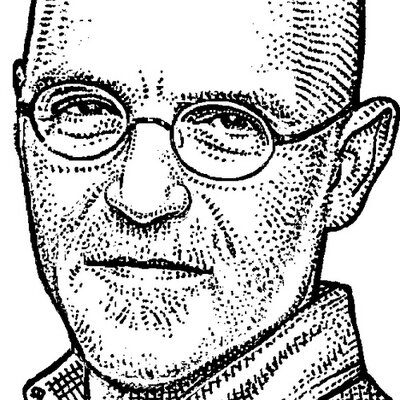

David Booth – In Plain English

Does the following quote sound familiar? Does it sound like a Hill team member? Something from one of these Monthly Journals over the last 20 years? It should, because it’s the foundation of what our clients and we believe about long-term investing success. Not surprisingly, it comes from David Booth, one of the Co-Founders of Dimensional.

– David Booth, LinkedIn, Oct. 14, 2025.

Over the years, I’ve had the privilege of meeting and hearing David speak on several occasions. He is a brilliant man who often sounds like a finance professor getting into the esoteric details of high-level math. You’d expect that of a University of Chicago (Booth School of Business…yes, as in David) Ph.D.

And that’s why I absolutely love this piece. David leaves academia behind and speaks from the heart about his investing experience in plain English that a grade-schooler will understand. Yes. A rare thing. It’s an ode to why all people should consider investing in the market, no matter your age or your net worth. And it’s brilliant.

Enjoy and be inspired to introduce someone you love and care about to the world of investing by starting here.

Of course, the Hill team stands ready to help share the power of long-term, evidence-based investing, too. Set up a time to talk here.

Hill Investment Group Partners, LLC (HIG) is an SEC-registered investment adviser. Registration does not imply a certain level of skill or training. The information in this publication is for educational and informational purposes only and does not constitute an offer to sell, or a solicitation of an offer to buy, any specific securities, investments, or investment strategies. Nothing contained herein should be construed as individualized investment, tax, or financial advice. Always consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed.

Investments involve risk, including the possible loss of principal. Past performance is not indicative of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Future returns may differ significantly from past returns due to market and economic conditions, among other factors.