Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Tag: Evidence-Based Investing

The Bumpy Road

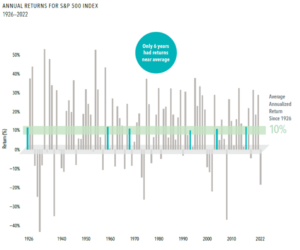

Historically, the US Equity market has returned about 10% annually to investors from 1926 – 2022. Due to this historical rate of return, many investors expect this level of return year over year. However, stock markets are highly volatile. Although the average is 10% per year, it is extremely rare for the market to be up 10% over any given year.

Since 1927, there have only been 6 years where the stock market returned between 8-12%. Thus, even though you should expect the market to give you a 10% return, you should expect the market over any given year to hardly ever give you a 10% return. It is this bumpy road that creates the risk in investing in equities, which is why you are compensated with the 10% annual average return. The key is to take the long view and not look at quarter-to-quarter or year-to-year returns.

People often panic when their expectations don’t match reality. Investors expect a 10% return every year, which will often not materialize. When the market goes down and does not match this 10% expectation, investors tend to panic. Changing your expectations on the range of outcomes of equities while keeping in mind the long-term average can help investors stick to their plan.

Hill Investment Group is a registered investment adviser. Registration of an Investment Advisor does not imply any level of skill or training. This information is educational and does not intend to make an offer for the sale of any specific securities, investments, or strategies. Investments involve risk, and past performance is not indicative of future performance. Return will be reduced by advisory fees and any other expenses incurred in managing a client’s account. Consult with a qualified financial adviser before implementing any investment strategy.

Hill Investment Group may discuss and display charts, graphs, and formulas which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used alone to make investment decisions.

Image of the Month

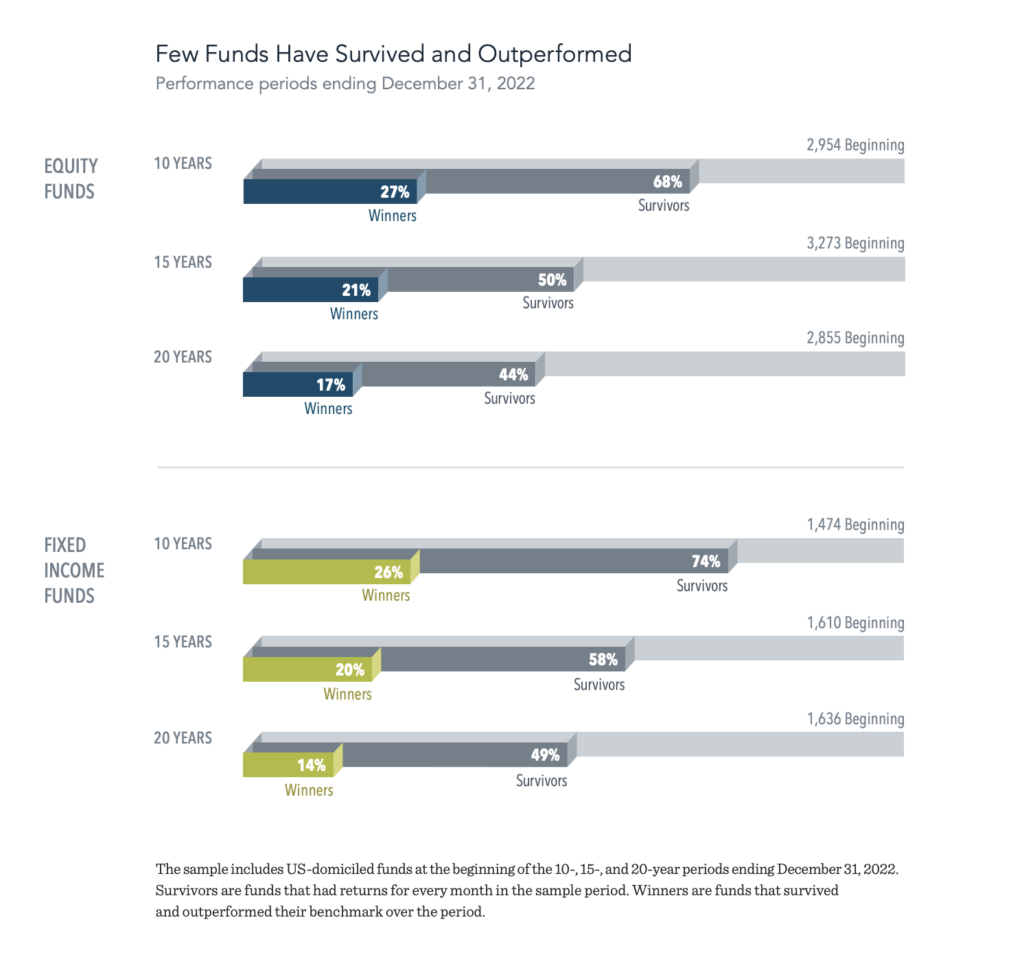

Each year, Dimensional analyzes investment returns from a large sample of US-domiciled funds (over 4,000). This year’s study updates results through 2022 and includes returns from mutual funds and exchange-traded funds (ETFs) domiciled in the US. The evidence shows that a majority of fund managers in the sample failed to deliver benchmark-beating returns after costs. We believe that the results of this research provide a strong case for relying on market prices when making investment decisions.

The One Minute Audio Clip You Need to Hear

Howard Marks is a very successful writer, speaker, thinker, and money manager. He is Co-Chair of Oaktree; you can read his impressive bio here.

We think you need to hear this clip because it is one of the better examples of all time, in our humble opinion, illustrating why taking the long view is likely the winning approach.

There is no need to swing for the fences to be a successful investor. It’s actually the opposite.

Enjoy this classic clip from Howard Marks’ interview with Barry Ritholtz on Bloomberg’s Masters In Business from 2019.

*If you want the full interview, you can find it here.