Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Tag: Fiduciary

Independent Difference Campaign

I’m proud to be a part of the independent advisor community. In the most simplistic definition, independence means that our firm does not fall under a major brokerage firm, bank or trust company. We operate independently and work for you, not a corporation. This is a hugely important distinction because our model allows us to operate objectively.

I was recently invited to be a part of a national ad campaign supporting independent advisors around the country, and I was taped saying lines like:

I am a fiduciary, not just some of the time, but all of the time.

As a fiduciary, I promise to put your interest first. Always.

As a fiduciary, I promise to always act in the best interests of you and your family.

We believe these statements at our core and think every investor deserves to be served by someone who works solely for them, as their fiduciary. Reciting these lines came naturally and we’re honored to help support the broader community of advisors.

Stay tuned for more information on the campaign, who it’s associated with, and when it will air!

Creating a Statement of Financial Purpose

Our good friend (and Matt Hall’s podcast guest) Carl Richards has been discussing a concept that may feel foreign to many people when they think about investing. It’s called a “Statement of Financial Purpose. “

Our good friend (and Matt Hall’s podcast guest) Carl Richards has been discussing a concept that may feel foreign to many people when they think about investing. It’s called a “Statement of Financial Purpose. “

Historically, we’ve talked to clients about goals – we help to set them, work to achieve them, cross them off the list, and move on to the next. A Statement of Financial Purpose is something more profound than just goals. It’s the why behind the goals. This statement is not lengthy; it’s usually a sentence or two and, typically, pretty simple, but it’s not easy.

We have introduced this concept to clients over the last year, and the reception has been very positive. Initially, clients are a bit hesitant when we present the topic, but it has led to some great conversations, and, in certain instances, spouses have uncovered things they didn’t know about the other person! Additionally, we’ve found these conversations especially valuable in guiding the recommendations and decisions we make with our clients.

Please feel free to reach out if you’d like to learn more about creating your Statement of Financial Purpose.

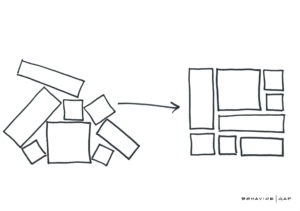

The Big Picture: Integrating all of your Assets at Hill

Integrating Your 401(k) into your Financial Plan

To have the best and most accurate picture of your financial situation, you must look at every asset (and liability). Did you know that you can integrate your 401(k), 403(b), 457, HSA, and variable annuity accounts into your overall plan? And get help managing the investments directly?

We have a new state-of-the-art system that allows for safe and compliant HIG advisor access to all of your accounts – taking the hassle, fiduciary responsibility, and management risk off your plate.

What does this mean for me?

- HIG taking fiduciary responsibility – upon setup, HIG takes on immediate responsibility for managing these assets.

- Combatting volatility with timely trading and rebalancing – ensuring your allocation is in line with your plan, no matter what’s happening in the markets.

- Investing in the right funds for you – full review of the cost and quality of available funds immediately upon setup, repeated quarterly.

- Tax efficiency through asset location – maximizing the value of these vehicles as an important part of your portfolio.

- Cost – the cost for this service is determined according to your regular fee schedule. See more details here.

Why it matters

These accounts shouldn’t be an orphaned part of your financial picture. Let us coach you more effectively and get the peace of mind knowing ALL of your assets are taken care of, no matter what.

Ready to set up your access to this service?

Schedule a call with me here. Setup takes no more than 15 minutes.