Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Tag: Vanguard

Immitation is Flattery

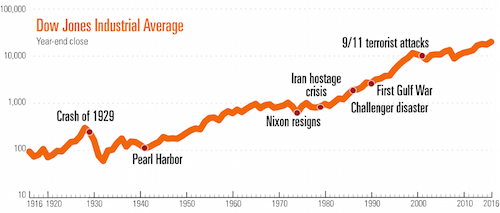

“Bad news and ill omens can make the market appear riskier than many investors would prefer,” wrote Vanguard in their recently published lessons on their website. “But if you take the long view, things might not seem so bad.” We love that Vanguard, the second-largest mutual fund company on the planet, used our trademarked phrase. Obviously, we agree.

Respect to Jack Bogle

Even in the normally staid world of fiduciary investment advice, we have our stars – heroes who inspire us with the brave choices they make to better the lives of investors.

Vanguard founder John C. “Jack” Bogle, who passed away on January 16th at age 89, was among the brightest (and most stubborn) stars of them all. The world lost a giant that day, as evidenced by the instant outpouring of respects paid from around the world.

Bogle refuted the status quo and gave birth to the retail version of index investing in the 1970s. He was energized by the crusade until his dying day. In the video homage below, The Wall Street Journal columnist Jason Zweig observed, “[Bogle’s career] spanned over six decades of change and growth in the industry that he helped to transform.”

To pick a sample from the deluge of sentiments expressed in the media, we especially appreciated a New York Times piece by Ron Lieber and Tara Siegel Bernard, “The Things John Bogle Taught Us: Humility, Ethics and Simplicity.” Many of our other favorite financial voices of reason are represented here, including Behavior Gap’s Carl Richards, and Manisha Thakor, herself a worthy crusader for women and wealth.

We’d say RIP, but Jack Bogle didn’t want people to rest. He roots for us to fight for what’s right, even when it isn’t popular. He was a relentless agitator for good, and his spirit inspires us to keep pushing for better solutions for investors. Every single day.

Still Wondering: Wade or Plunge?

Having been an advisor through boom and bust markets alike, I can attest that some “Frequently Asked Questions” come and go. But for as long as I’ve been around to answer it, here’s one that has never grown old:

“I’ve got a lump sum of cash. Should I invest it all at once, or gradually, over time?”

I covered this question back in 2015, pointing to a 2004 Dimensional Fund Advisors analysis entitled, “To Wade or Plunge.” At the time, I said:

“Although it feels more comfortable to wade given the uncertainty inherent with markets, the evidence shows that, approximately two thirds of the time, you are better off taking the plunge.”

I’d say the same again today. If you’ve got a lump sum of cash you plan to invest in the market, you might as well put all of it to work sooner rather than later.

More recent analysis continues to support this approach. In 2016, Vanguard published a paper and podcast entitled, “Invest now or temporarily hold your cash?” This month, Vanguard’s senior investment strategist Andy Clarke updated his post on the subject, still concluding, “More often than not, it has paid to invest immediately.” He offered data demonstrating that this conclusion holds true across various global markets, and among stocks and bonds alike.

Just as I suggested in 2015, the biggest risk you face when plunging into the market isn’t financial. It’s whether you can ignore the regret you’ll probably feel if you happen to plunge at an inopportune time – i.e., just before the markets take a dive with your hard-earned cash. As long as you don’t act on your regret, it’s natural to feel it. Just remember to Take the Long View® with your actions. The long term trend is up, and the power of global capitalism is at your back.