Founding Hill Investment Group – 2005

This is the latest in a series of posts from Rick. To see prior entries click here.

Once I’d experienced the benefits of an evidence-based investing approach myself, I started thinking about my clients back at the brokerage firm in 1967. How much better off would they have been if these tools were available to me, and in turn, them? With my newfound knowledge on how to truly help people, I decided to take the first step in realizing a dream. I left Anheuser-Busch in 1997, started earning my Certified Financial Planner (CFP) designation, and became a financial advisor at Buckingham Asset Management in St. Louis, Missouri

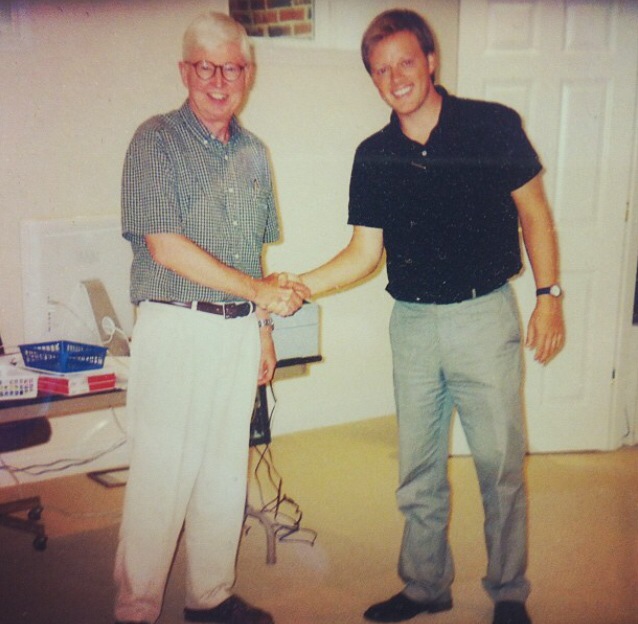

At Buckingham, I met Matt Hall, and after six years working together, we decided to start our own firm. Launching Hill Investment Group in 2005 allowed me to utilize everything I’d learned about both the evidence-based and emotional sides of investing. However, there were still important lessons ahead for me.

Like the best advisors, we always encourage our clients to focus on the long-term, not the market’s daily, weekly, or even yearly movements. Most people think “the long-term” means five or 10 years. However, as we discovered during the early days of Hill Investment Group, even a decade isn’t a significant amount of time in the grand scheme of a long-term investing strategy.

We couldn’t have known that we were launching our firm right in the middle of what’s now known as the “lost decade.” For the 10 years between 2000-2009, the S&P 500 had an annualized negative return of −0.95%*. Yes, the entire first decade of the 21st century netted a negative return as measured by the S&P 500.

The 2007-2008 financial crisis contributed to those poor results. An internationally diversified, evidence-based portfolio with exposure to small and value stocks helped our clients get through that period in great shape compared to investors focused on large-cap, U.S. stocks. What may be more important is what happened next: Between 2010 and 2019, all markets went on a sustained bull run, with the S&P 500 delivering a 13.6%* annualized return.

Talk about a huge swing over two consecutive decades. Even people who thought they were “long-term investors” might have reached the end of the lost decade thinking that their investment strategy wasn’t working and decided to change course. Doing so would have cost them dearly if they didn’t participate in the next decade’s rebound.

Lesson learned: The long-term is the rest of your life.

Sticking with a long-term investing plan requires discipline, including the discipline to weather a decade-long period of underperformance. Some people may focus on one goal or milestone to keep them on track, like wanting to retire at age 65. While that’s not a bad thing, the most successful investors are the ones who recognize that they’re working toward multiple financial goals—including significant expenditures during their working years like college costs and home improvements. To meet all these disparate goals, one must adopt a lifelong commitment to saving and investing through all market conditions. All of this is much easier with a trusted advisor…even better with a trusted team of advisors.

No one can accurately predict all the various things you might want to do with your savings 20, 30, or 40 years from now. Life throws all kinds of surprises our way. Some bad. Some fantastic. When you reach one long-term goal, new ones often magically emerge that become just as important to you. That’s why the real objective of one’s investment strategy should be to reach a point where there are opportunities to do almost anything you want for yourself, your family, and even for others.

I’ve witnessed how rewarding it can be for clients who embrace this approach. They’ve met the goals they set out to achieve for themselves with plenty left over to do some incredible things. Many of them are now supporting their grandchildren’s education or making charitable donations with their excess savings. One client’s wife was diagnosed with Alzheimer’s disease, inspiring him to provide major funding for Alzheimer’s research.

In other words, there will always be reasons to keep saving and investing. As long as you make good decisions based on what you can control, let the markets do what they’re going to do, and avoid meddling with your portfolio, you will likely have a lifetime to enjoy the results.

Improving your own investment experience

It’s easier than ever to start investing. You just need some money and a brokerage account or an app on your phone. The question is: will you be a gambler or an investor. There’s a huge difference.

Becoming a good investor isn’t easy. Many people struggle through experiences like the ones I’ve had myself over the past 50 years and never find a way to move past the stress and anxiety that they feel.

My hope is that these stories help you see how changing your attitude toward investing and the approach you follow can truly improve your quality of life. After all, that’s why people invest in the first place—to make their lives, and the lives of others, better. That’s the most important “return” you can achieve.

If you’ve followed along this far and are not a client already, I have one question:

How can we help you? Click here if you’d like to set up a time to talk.

*Returns data from https://ycharts.com/indicators/sp_500_total_return_annual. Past performance is not indicative of future performance. Principal value and investment return will fluctuate. There are no implied guarantees or assurances that the target returns will be achieved or objectives will be met. Future returns may differ significantly from past returns due to many different factors. Investments involve risk and the possibility of loss of principal. The values used were obtained from sources believed to be reliable.