Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Author: Abby Crimmins

Image of the Month

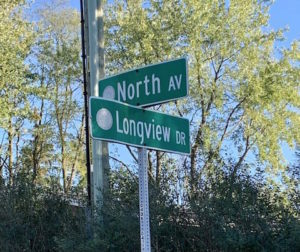

The Intersection of Longview & True North = Destiny. The newest HIG team member, Charles Kafoglis, took this image in Antioch, Illinois. Follow us on Instagram to see more shared images from our team, or tag us in your own.

Image of the Month

It is never too early to start teaching children about taking the long view! Katie Ackerman snapped this photo of her daughter in a perfect pose (Sally, 4) on Dillon Reservoir in Colorado. Follow us on Instagram to see more shared images from our team, or tag us in your own.

Podcast Episode – Gerald Marzorati

What is an encore quest? What’s it have to do with Serena Williams? Matt talks with celebrated author Gerald Marzorati about picking up serious tennis in his 60s and his new book on Serena Williams. Gerry shares his love of the sport, how trying to master the game taught him discipline, and what he observed spending more than a year following Serena Williams. Plus, hear what Gerry says should be Williams’ “Disney movie ending” triumph. Listen below or click here to listen on Apple.