Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Author: John Reagan

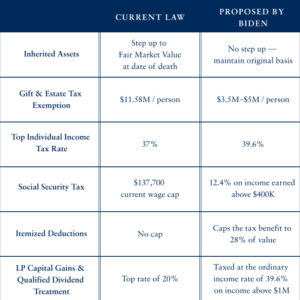

What Joe Biden’s Tax Plan Means for You

With Democratic Presidential candidate Joe Biden recently releasing his proposed tax plan, we thought it would be good to compare what Biden is proposing to our current tax law. Here is a simple side-by-side comparison of some of the major differences. What does this mean for clients of Hill Investment Group? At this point, not much. While Biden’s proposed plan is certainly different from current law, and in some cases significantly different, we are planning for the future, but aren’t making any changes to clients’ plans (at least not yet). As always, if you have specific questions about your specific situation, please call or email us to set up a time to talk.

#1 New Release in Investing Books

The next book about money we plan to read is The Psychology of Money – Timeless lessons on wealth, greed, and happiness. It is scheduled to be released on September 8th and is getting the buzziest reviews we have heard about any finance book in 2020. It’s authored by Morgan Housel, who readers of this email will recognize. Housel uses 19 short stories to explore the way people make financial decisions. “Important decisions are often made at the dinner table, where personal history, your own unique view of the world, ego, pride, marketing, and odd incentives are scrambled together.”

“It’s one of the best and most original finance books in years.”

5 Steps for Dealing With a Scary Market

The New York Times Sketch Guy, Columnist, and Take the Longview podcast guest Carl Richards, is one of the best in the world at connecting money and emotion. His unique ability is boiling down ideas to their essence so that everyone can relate. In a recent piece, he does it again, clearly outlining a 5-step guide to making it through the ups and downs of the financial market. Check it out here.