Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Author: Matt Luzecky

The Great Debate – Election Years vs. the Stock Market

Whether your political views are right, left, or somewhere in between, you should check out this video. Election years tend to heighten everyone’s anxiety. This video does a great job of helping us as investors understand what to do.

As changes to tax reform, foreign policy, and social issues loom, it’s totally natural to be tempted to make short-term portfolio changes to profit from the uncertainty, or to minimize losses. But, as we know, markets are extremely efficient at processing new information and adjusting prices based on future expectations, so research would tell us any fears or expectations about the results of the presidential election are already baked in.

So, what’s a savvy investor to do? Our friends at Dimensional Funds skillfully reframe the perspective provided by the regular media.

Going back to 1928, when Herbert Hoover was elected president over Al Smith, the S&P 500 has returned on average 11.3% during election years and 9.9% in the subsequent year. In fact, there have been only three presidents in history that have seen negative returns in the stock market over their presidential tenure: Herbert Hoover during the Wall Street Crash of 1929, Franklin Roosevelt during the Great Depression, and George W. Bush in the 2000s during a time known as the Lost Decade.

Our takeaway? Make sure your investment plan fits your goals and stick with it. No matter what the regular media is saying, the data shows whoever is in the White House is unlikely to negatively impact the long-term value of your nest egg.

Better Inflation Protector – Gold or Stocks?

“Gold is stupid. But selling stocks to buy gold is beyond stupid; it’s historically insane.”

While we would be hard-pressed to call anyone stupid, we do share in the general sentiments of author and speaker, Nick Murray: that the recent gold rush may be over-extended and not the most logical move for investors playing the long game.

Let us share some context to help explain.

Fiscal and monetary policies that were enacted this year as a result of the COVID-19 pandemic have sparked a growing concern with how these large amounts of debt will ultimately be repaid. A rise in tax rates is certainly possible, but a more prominent fear we hear among investors is an uptick in inflationary pressure. This is leaving many to seek a safe haven beyond the traditional stock market.

This year alone gold has seen an increase of 30%, but as recency bias would show us, many seem to have forgotten the dismal performance of the 80s and 90s. During this 20-year stretch gold had returned -2.8% per year while inflation rose at a steady 4%. Not much of an inflation hedge especially when compared to the S&P 500 Index that returned almost 18% per year over the same period. When we look at even longer periods of time we find that by participating in the stock market an investor would have earned almost 3 times as much as gold.* How’s that for an inflation hedge?

Maybe Nick’s words are a little harsh for some, but you can see why we’re not ready to abandon our philosophy for the hot investment du jour.

*From January 1970 – June 2020

Size Matters

After 10 years of large companies earning record-breaking returns, any reasonable investor would start to wonder, are small companies even worth hanging on to? We argue yes. Why? Because evidence shows owning small companies pays you more over time and helps your portfolio recover better after a downturn, but only if you have the patience to wait.

Higher expected returns. Evidence shows that small companies have historically outperformed large companies over the long-term. The reason? The market perceives small companies as riskier investments. The extra return you get is the market paying you for taking on that risk. If you think about it, this is intuitive. A simple example: would you lend money to the mom-and-pop diner down the street at the same interest rate as you would to McDonald’s? Of course not. You recognize the additional risk inherent in the smaller, less established diner compared to the more stable, global, fast-food chain.

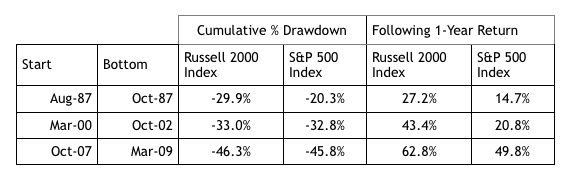

Stronger recovery after a market correction. When the market declines, small companies tend to perform worse than the general market, and investors may start to question if this asset class is one worth hanging on to. The biggest concern we hear is that smaller companies have less capital and cash flow to weather the economic storm thereby making their recovery painfully slow. In reality, small stocks have a tendency to come back stronger and faster after a significant market correction. The data in the table below suggests a healthier small company recovery (Russell 2000) compared to large (S&P 500) over three of the largest market downturns in the last 40 years.

The role of patience. The additional return you get for owning smaller companies can materialize at any time. But we know, especially in times where large has outperformed small for a decade or so, having the patience to wait can feel next to impossible. This is where the role of an advisor is key. It’s only natural after years of underperformance to want to bet on whatever feels like the winning horse. Without having someone to hold our hand any of us, including professionals who know better, have a hard time waiting it out. Our take on all of this: While we see many non-client investors run from small stocks, this as an opportunity for our clients to buy what’s on sale and reap the long-term rewards of remaining disciplined.