Details Are Part of Our Difference

David Booth on How to Choose an Advisor

20 Years. 20 Lessons. Still Taking the Long View.

Making the Short List: Citywire Highlights Our Research-Driven Approach

The Tax Law Changed. Our Approach Hasn’t.

Category: A piece we love

A Forbes Piece We Love

John Jennings, podcast guest and Chief Strategist and President at The St. Louis Trust Company, recently wrote about why it’s almost impossible to beat the market in his latest piece for Forbes. He details why the skewed pattern of market returns stack the odds against regular investors. Read it here.

#1 New Release in Investing Books

The next book about money we plan to read is The Psychology of Money – Timeless lessons on wealth, greed, and happiness. It is scheduled to be released on September 8th and is getting the buzziest reviews we have heard about any finance book in 2020. It’s authored by Morgan Housel, who readers of this email will recognize. Housel uses 19 short stories to explore the way people make financial decisions. “Important decisions are often made at the dinner table, where personal history, your own unique view of the world, ego, pride, marketing, and odd incentives are scrambled together.”

“It’s one of the best and most original finance books in years.”

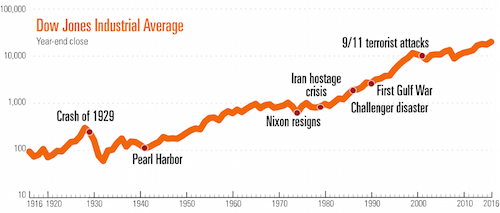

Immitation is Flattery

“Bad news and ill omens can make the market appear riskier than many investors would prefer,” wrote Vanguard in their recently published lessons on their website. “But if you take the long view, things might not seem so bad.” We love that Vanguard, the second-largest mutual fund company on the planet, used our trademarked phrase. Obviously, we agree.