Details Are Part of Our Difference

David Booth on How to Choose an Advisor

20 Years. 20 Lessons. Still Taking the Long View.

Making the Short List: Citywire Highlights Our Research-Driven Approach

The Tax Law Changed. Our Approach Hasn’t.

Category: People

Culture & Perspective: Why Culture Matters

The Hill perspective is well known. It is our motto and our compass: Take the Long View. Many of our clients and friends of the firm also know our culture. We strive to be warm, caring, thoughtful, serious about our work, and human enough to enjoy it together.

The Hill perspective is well known. It is our motto and our compass: Take the Long View. Many of our clients and friends of the firm also know our culture. We strive to be warm, caring, thoughtful, serious about our work, and human enough to enjoy it together.

As we grow, an important question stays front and center: how do we continue to deepen both our culture and our perspective at the same time, especially as our team is spread across the country?

Occasionally, we’re given a rare gift: the chance to be together in one place. Last month, nearly our entire nationwide team happened to be in St. Louis at the same time. Recognizing how uncommon that is, we chose to be intentional with the moment and invest it in something meaningful.

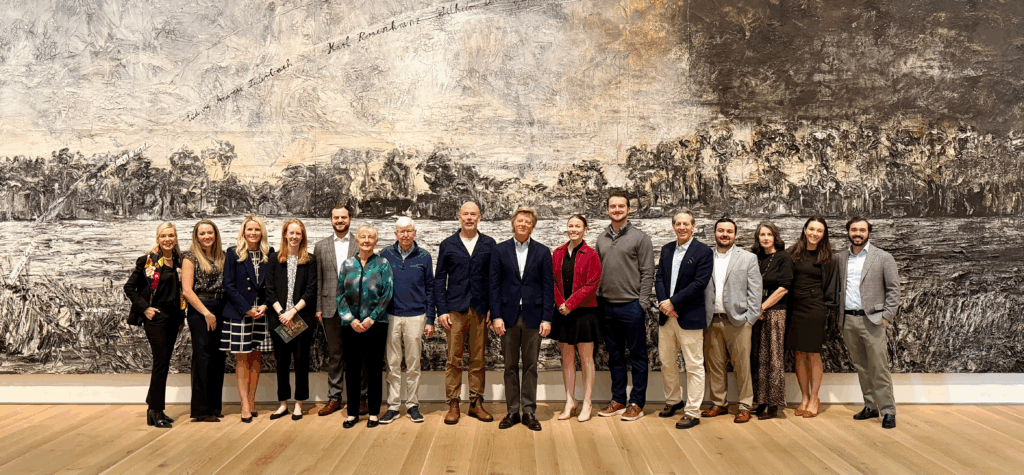

When author, artist, and former financial advisor Carl Richards was in town for our event, we extended the experience by taking the team to a once-in-a-lifetime exhibition by German artist Anselm Kiefer at the Saint Louis Art Museum. The visit was arranged by my wife, Jeana, who serves in a volunteer leadership role at the museum. Notably, Jeana and Rex Sinquefield, co-founder of Dimensional Fund Advisors, were among the significant underwriters supporting the exhibition.

Together, we spent time immersed in the work of one of the most important living contemporary artists. Kiefer, who recently turned 80, is known for confronting history, destruction, and renewal on a monumental scale. His work takes the long view. From loss comes rebirth. From devastation, renewal. The physical scale of his art reinforces the message. Some things simply cannot be understood without stepping back and taking them in fully.

It is hard not to see the parallel.

Life is not smooth. Markets are not either. Both move in cycles that include setbacks, uncertainty, and moments that test conviction. Yet over time, periods of decline have been followed by recovery. Often the most meaningful progress comes from staying engaged rather than stepping away when things feel uncomfortable.

Clients often tell us that one of the most valuable things we do is help them stay on the ride. Not because there are guarantees. There are not. But because perspective matters. When you zoom out and look across decades rather than days, the long-term story of investing has been one of resilience and growth.

That perspective is deeply embedded in our culture. It shapes how we invest, how we advise, and how we support clients through both calm and turbulent moments.

Hill Investment Group is only 20 years old, but we are grounded in values and relationships that allow us to do our work with care, humility, and conviction. When we have moments to come together as a team, we try to use them intentionally to reinforce who we are and how we think.

We’re grateful to share this journey with you, and we look forward to continuing the ride together.

Happy Holidays.

Reminder, The Rick Hill Award Nominations Still Open

When Rick Hill officially retired in 2023, our team wanted to continue celebrating his incredible legacy with the Rick Hill Award. As you may recall from an earlier post, I am the proud first recipient.

This annual award, paired with financial recognition, is presented to the team member who best exemplifies living our firm’s values (see below for the list) throughout the prior year. We’ve been paying close attention to those moments in 2025 when teammates have gone above and beyond, and we want to include our clients in the “voting” process.

So, please consider taking the time to nominate someone you believe deserves this honor! If you’ve had a meaningful interaction with a team member that reflects Rick’s and our firm’s values, please email Matt Hall directly. Please include the individual’s name and one or two examples of why you are nominating this person. We value your insight and are grateful for your help in recognizing the teammates who make our firm extraordinary.

The nomination window closes soon, so don’t wait!

We’ll share the news about this year’s winner right here in the February 2026 issue! If you need a refresher on the Hill Investment Group Values, revisit this article, otherwise nominate someone below.

The Rick Hill Award Nominations are Open

When Rick Hill officially retired in 2023, our team set out to celebrate his incredible legacy with the Rick Hill Award. As you may recall from an earlier post, I was honored to be the first recipient.

When Rick Hill officially retired in 2023, our team set out to celebrate his incredible legacy with the Rick Hill Award. As you may recall from an earlier post, I was honored to be the first recipient.

This annual award recognizes the team member who best embodies our firm’s values throughout the year. In 2025, we’ve been watching for the quiet, consistent moments when teammates go above and beyond, and we’d love your help in identifying those who deserve this honor.

If you’ve had a meaningful interaction with a member of our team that reflects Rick’s spirit and our firm’s values, please email Matt Hall directly. Just share their name and a brief example of why you’re nominating them. Your insight helps us recognize the teammates who make our firm extraordinary.

Nominations close January 31, 2026.

We’ll share this year’s winner in the February 2026 issue.

Corporate values are often empty statements on walls or stickers on laptops. Ours aren’t. We try to live them quietly and consistently, not plaster them everywhere. Below are the six values that guide our work every day.

EVIDENCE-BASED INVESTING EVANGELISTS

We don’t choose gunslingers and gurus to manage the real wealth of clients or our own. We favor evidence-based investment approaches that are designed to be disciplined, diversified, and repeatable over time.

MAKING FRIENDS IS OUR BUSINESS

Inspired by the old Anheuser-Busch mantra, relationships are at the heart of what we do. Sometimes, friends become clients, and often, clients develop genuine connections with our team. “There will be neither frustration nor failure where there is friendship.”

CHEERS AND THE FOUR SEASONS

Hill Investment Group is a place where we truly know our clients. We know what they like to drink and the preferences that make them who they are. We see clients and serve them in a manner befitting a familiar yet high-end experience. We value hospitality, reliability, and excellence.

PATIENCE AND DISCIPLINE

The rewards of the long view are only possible when we help our clients stay focused on what truly matters.

CANDOR

We value the truth (no spin) and commit to sharing it with one another and our clients, especially when it’s hard.

FUN GOES WITH BUSINESS

We take our work seriously and have fun in the process! We celebrate our wins and recognize life and work milestones at every chance.