Details Are Part of Our Difference

David Booth on How to Choose an Advisor

20 Years. 20 Lessons. Still Taking the Long View.

Making the Short List: Citywire Highlights Our Research-Driven Approach

The Tax Law Changed. Our Approach Hasn’t.

Category: Service

Tax Prep Support, Done Right.

Tax season comes with a lot of moving parts. A missing form, incomplete data, or a late reaction can cost you time and money. Our goal is simple: carry some of that load so you don’t have to.

At Hill Investment Group, we think about taxes all year, because after-tax outcomes matter. Taking the Long View means managing what you keep, not only what you earn.

What we do year-round

Tax awareness is built into the daily work behind your portfolio.

We place tax-heavy investments in the right accounts to reduce avoidable drag.

When the opportunity exists, we harvest losses to offset gains while keeping your strategy intact.

We lean on ETFs where appropriate, which tend to avoid the surprise capital gain distributions that show up in many mutual funds.

When cash flow, withdrawals, or charitable giving are part of your picture, we help coordinate the timing and structure so everything stays aligned with your plan.

What we do during tax season

Tax season should feel orderly. For clients where we manage the full relationship, we coordinate directly with your tax preparer, track form releases and revisions, and prepare a clean packet with the core reports your CPA needs.

No hunting through portals, no guessing which forms matter.

For clients earlier in their journey with us, many of these same principles are at work in how we manage your portfolio, and we’re always happy to point you in the right direction.

The goal, as always, is to make this easier for you.

What you still need to handle yourself

Some items live outside Hill, like W-2’s, old employer retirement plans, accounts held elsewhere, K-1s, and certain custodian forms.

Easy to miss items

- IRA Form 5498: Useful for keeping contribution and cost basis records accurate over time.

- HSA Form 1099-SA: Required if you took money out of an HSA.

- Qualified charitable distributions: Your 1099-R will not label a QCD for your CPA. However, if we facilitated it, we would help send a list to your CPA.

If you want to talk through tax planning as part of your broader plan, reach out to us at service@hillinvestmentgroup.com.

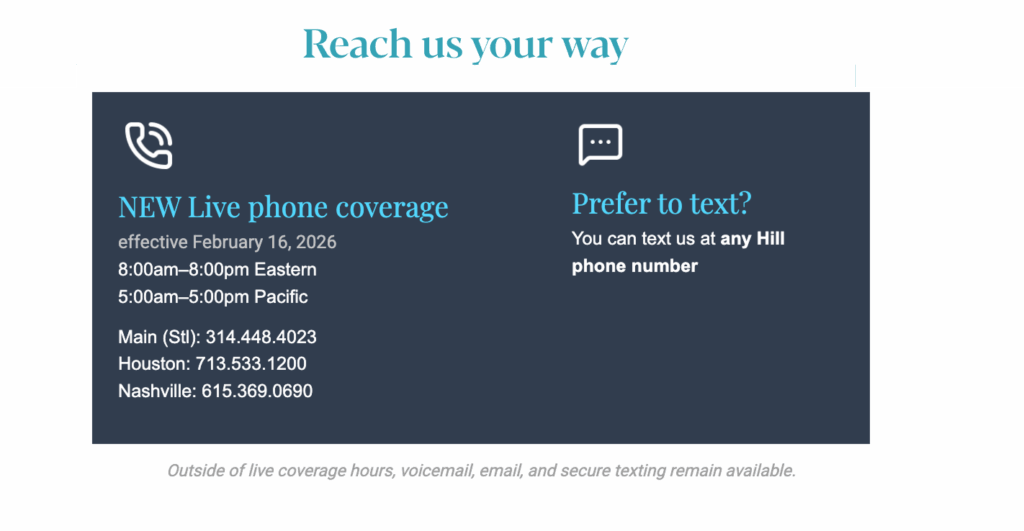

A Real Person, When You Need One

Most of us know the feeling.

You have a question that matters. You call a company. And instead of a person, a menu of prompts, and the hope that someone on the other end will actually care.

We’ve always believed financial advice should feel more human than that.

At Hill Investment Group, our approach to service has been guided by a few simple principles:

- Be fast – Available and respond promptly

- Be friendly — Warm, thoughtful, and welcoming

- Take ownership — If it’s important to you, it’s important to us, and we’ll see it through

As we’ve evolved, we’ve spent a lot of time asking a simple question: How do we grow without losing what makes the experience personal?

One answer is to lean into our people.

Our team now works coast to coast, and we’re using that to better serve you. Historically, our phones have been answered live from 8:30am to 5:30pm Central Time. Beginning February 16th, we’re expanding live phone coverage so you can reach a real person from 8:00am to 8:00pm Eastern (5:00am to 5:00pm Pacific).

The experience won’t change. No phone trees. No prompts. No outsourcing. Just a knowledgeable member of our team who’s ready to help.

Outside of those hours, our existing voicemail, email, and secure texting options will remain in place.

We don’t view this as a feature or an upgrade. It’s simply part of our responsibility to serve you well. When something is on your mind, you shouldn’t have to wait or wonder if anyone is listening.

Thank you for trusting us with what matters to you. We’re committed to showing up with care, consistency, and a very human voice on the other end of the line.

A Thoughtful Moment for Year End Giving

As the year comes to a close, this is a reminder that there are just a few days left to make charitable gifts that count for this year’s taxes. Many of you have already completed your giving. If generosity towards family or charity is still part of your year end plans alongside holiday gifts, there is still time to act with intention.

At Hill Investment Group, we view giving as an extension of a long view, values driven plan. Credible giving means supporting what matters to you while being thoughtful about how and when you give. For those who are eligible, charitable gifts from an IRA can be an especially efficient way to give, particularly when required minimum distributions are already part of the picture. Donor advised funds also allow families to give appreciated assets and avoid capital gains tax.

Tax law changes beginning on January 1, 2026, may reduce the value of charitable deductions for some households. For families who are already planning to give, completing gifts this year can be a thoughtful way to align generosity with 2025’s tax laws.

If year end giving is already part of your plan, now is a natural time to bring it across the finish line. Send us a note at service@HillInvestmentGroup.com if you want help accomplishing your goals for this year.