Details Are Part of Our Difference

David Booth on How to Choose an Advisor

20 Years. 20 Lessons. Still Taking the Long View.

Making the Short List: Citywire Highlights Our Research-Driven Approach

The Tax Law Changed. Our Approach Hasn’t.

Category: Timely Topic

SPECIAL HILL EVENT: An Evening with Author Carl Richards

We’re delighted to share that Hill Investment Group will host a very special evening with Carl Richards—internationally recognized author, speaker, and podcaster—on Wednesday, November 12, 2025, at The Racquet Club in St. Louis, which will be one of Carl’s first stops on his national book launch tour for the release of his latest work Your Money: Reimagining Wealth in 101 Simple Sketches.

Many of you know Carl through his Behavior Gap sketches and writing. His simple drawings and powerful insights remind us that clarity often comes from seeing complex ideas made beautifully simple.

This gathering will include cocktails, heavy hors d’oeuvres, and a lively conversation with Carl about his newest work and what it means to “take the long view” in both money and life.

Event Details

The Racquet Club — 476 North Kingshighway, St. Louis, MO 63108

Gathering at 6:00 PM | Program Begins at 6:30 PM | Concludes at 7:45 PM

Attire: Jacket, No Tie. No Denim, Please.

A few seats remain. Please RSVP by November 7, or call us at (314) 448-4023.

Do you want something like this in webinar form or in your city? Email me.

The Longview Advantage ETF: Your Fund, Built for the Long View

We created the Longview Advantage ETF (EBI) to give our clients the best of evidence-based investing at the lowest possible cost. In this update, Matt Hall and Matt Zenz share how it’s working.

TRANSCRIPT

Matt Hall:

Okay, I told you we’re gonna do more videos. We’re doing another video. I’m here with Matt Zenz, CIO of Hill Investment Group, and the architect of our ETF. We thought it might be fun for you and important to just know a little bit more about the Longview Advantage, ETF. And Matt, one of the things that we’re really proud of that we haven’t communicated maybe to our audience is the Longview Advantage.

ETF symbol EBI is getting a lot of attention. What should our clients know about it? What’s the most important thing they should understand?

Matt Zenz:

Yeah, I think there’s kind of two different ways to look at this. The first is, as an evidence-based investor, which we all are, all of our clients are, is that you win because this is designed better. We combined all of the most compelling ideas across the evidence-based community into one fund. And then we’re implementing it without compromise. Because we’re smaller, which we all are, all of our clients are, is that you win because this is designed better. We combined all of the most compelling ideas across the evidence-based community into one fund. And then we’re implementing it without compromise.

Because we’re smaller, because we’re more nimble, we’re able to more effectively go after what the evidence says. You’re able to pick up the pennies, and that means wins means higher returns for you as a client, but then also as a client of Hill Investment Group, you get to win again because you get this strategy at cost. We don’t charge our clients for it. So that means we run it at the lowest possible cost to our end clients. Our clients save about a half a million dollars a year in fees because they’re, because they aren’t paying what they were paying before some of the other managers. And so you get to win both on the structure of the fund and also the cost of the fund.

Matt Hall:

Yeah. Well that’s obviously a home run. And how has it performed since February? Since it launched?

Matt Zenz:

It performed exactly as it was designed, on par with what we would expect based on how we designed the strategy.

We want to emphasize smaller, deeper value, more profitable companies. We’ve been able to do that as a structure, and the performance has been exactly in line with what you would expect for that type of portfolio.

Matt Hall:

Awesome. Well, thanks for sharing that. To all of our clients, thank you for your support. We’ve had unbelievable confidence in the strategy and just wanted to share this update with you. Let us know if you have any other questions.

Markets Don’t Wait for Official Announcements

Over the last several months, “tariffs” have made frequent headlines. They’re on. They’re off. They’re up. They’re down. Understandably, many investors are asking: How will this affect my portfolio?

Here’s the short answer: the market doesn’t wait for official announcements—good or bad. Every second global financial markets are open, prices are adjusting in real time to reflect all known information, whether that information is accurate, speculative, or incomplete.

This is why reacting to headlines or trying to time the market based on “breaking news” often proves unproductive. The news is already priced in.

At Hill, we help clients build portfolios rooted in long-term planning, academic research, and thoughtful consideration of risk. These portfolios are designed with the understanding that market fluctuations and unexpected headlines are part of the journey.

Rather than react to each new cycle of uncertainty, we focus on your plan, your risk tolerance, and the full breadth of evidence available. This approach is intended to help clients remain invested and confident, even in the face of short-term volatility.

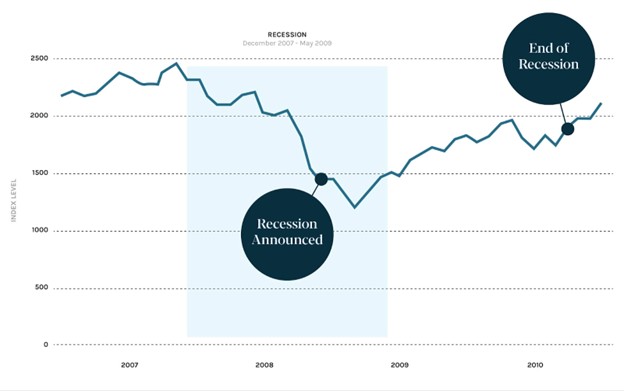

The included graphic from Dimensional illustrates how markets respond to news events. It highlights a consistent truth: while headlines can move markets temporarily, disciplined, diversified investors who stay the course are often better positioned over the long term.

If you have questions about how your portfolio is structured to weather market headlines—or want to revisit your plan—we’d be happy to talk.