Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

The Rick Hill Award – Nominations Still Open

With Rick Hill officially retiring last year, we’re thrilled to continue celebrating his incredible legacy with the Rick Hill Award. As you may recall from a post Buddy shared in early 2024, we announced this special recognition at our 2023 holiday party to honor Rick’s values and actions, which have been at the heart of our firm’s success (and our friendship) since day one.

This annual award, paired with financial recognition, will be presented to the team member who best exemplifies living our firm’s values throughout the prior year. We’ve been paying close attention to those moments in 2024 when teammates have gone above and beyond, and we’re excited to share the winner with our team at our company celebration on February 8th. We’ll tell you about the winner our February email.

There’s still time to nominate someone you believe deserves this honor! If you’ve had a meaningful interaction with a team member that reflects Rick’s and our firm’s values, please email Matt Hall directly at matt@hillinvestmentgroup.com. The nomination window closes on January 31st, so don’t wait!

We value your insight and are grateful for your help in recognizing the teammates who make our firm extraordinary.

The Futility of Market Predictions: Why Evidence-Based Investing Wins

Why Predictions Fail: Insights from the Experts

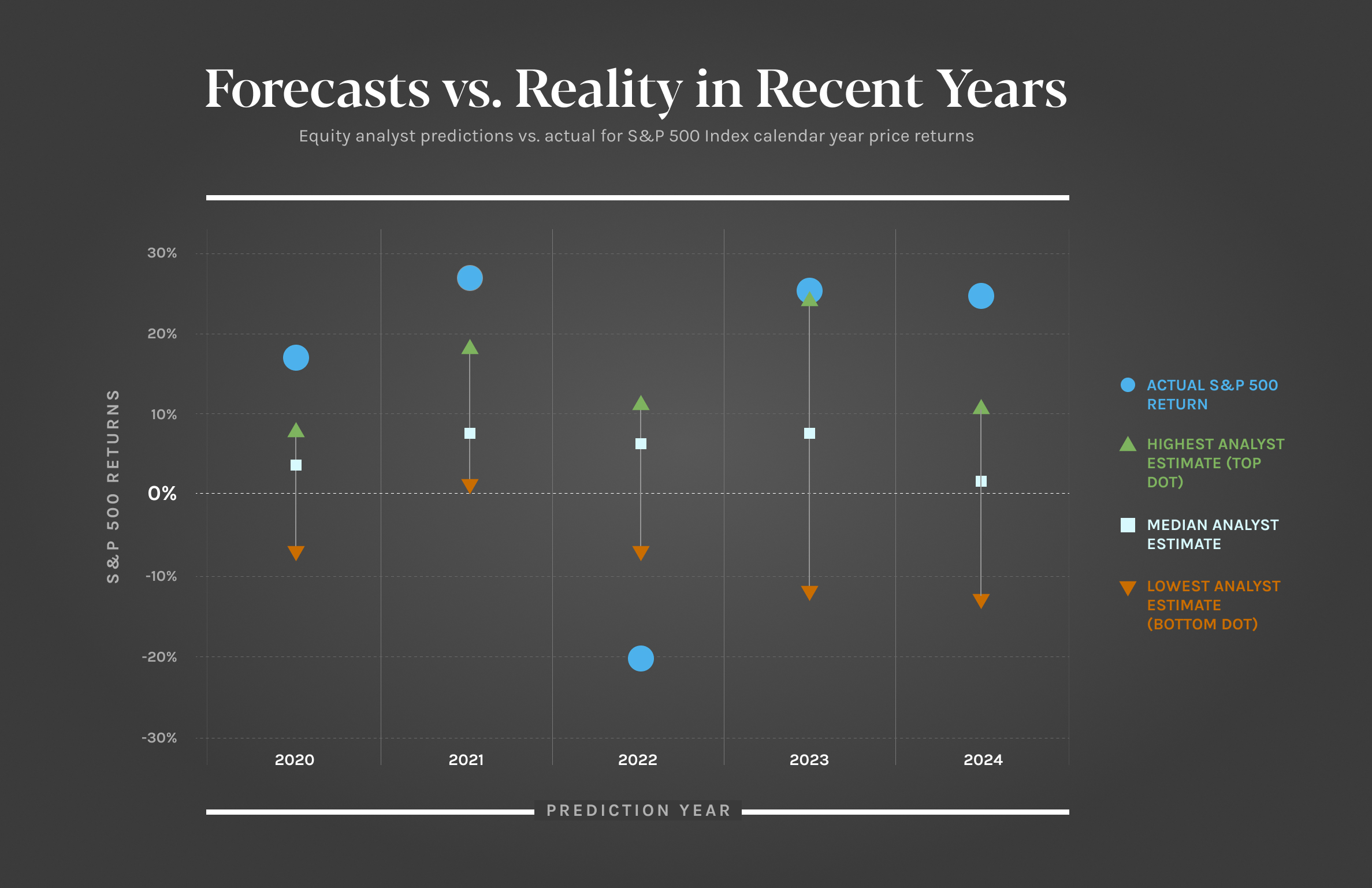

As the new year approaches, financial analysts, equity experts, and market commentators are quick to release their predictions for the year ahead. However, a closer look at their track record reveals a consistent truth: these predictions are almost always wrong. Our analysis of S&P 500 return estimates since 2020 underscores this point—actual annual returns have repeatedly fallen outside the range of the highest, median, and lowest forecasts. Even the most confident experts frequently miss the mark.

The Illusion of Predictability

Equity analysts devote significant time and resources to analyzing economic trends, running complex models, and projecting outcomes. Despite their efforts, their predictions rarely align with reality. Why? Because markets are inherently unpredictable. They are influenced by countless factors—some measurable and others entirely unforeseen. Attempting to predict annual market returns is akin to forecasting next year’s weather: unreliable at best.

Here’s another key insight: while the long-term average return of the S&P 500 is between 8% and 10% annually, the actual return in any given year rarely aligns with this average. Instead, annual returns often deviate significantly, reflecting the market’s inherent volatility.

What Should Investors Focus On?

If accurate market predictions are unattainable, how should investors approach the future? At Hill Investment Group, we take an evidence-based approach. Instead of relying on predictions, we emphasize planning, modeling, and focusing on what we know. Here are our guiding principles:

- Discipline Pays Off: On average, markets increase by approximately 4 basis points (0.04%)* daily. While this incremental growth may seem small, it compounds significantly over time. The key to capturing these gains is staying invested.

- Volatility Equals Opportunity: Market unpredictability isn’t a flaw; it’s an essential feature. The volatility we experience is the price of admission for long-term equity rewards. Rather than fearing market swings, we view them as an integral part of the investment journey.

- Control What You Can: Instead of trying to predict market movements, we focus on what is within our control—creating robust financial plans, building resilient portfolios, and adhering to evidence-based investment strategies.

- Patience Is Crucial: History has shown that markets recover from turbulence and achieve new highs over time. Staying patient and avoiding knee-jerk reactions to short-term fluctuations is essential for long-term success.

The Takeaway

The data is clear: expert predictions are unreliable. This is why we avoid basing our strategies on forecasts and instead focus on enduring principles that withstand market volatility. Here’s what we know:

- While markets are unpredictable, disciplined investors are consistently rewarded over the long term.

- The average return is positive, even though individual annual returns vary widely.

- Long-term success comes from thoughtful planning, patience, and maintaining perspective.

At Hill Investment Group, we embrace the uncertainty of the market and focus on guiding our clients toward their financial goals. By staying committed to an evidence-based philosophy, we help our clients navigate the inevitable ups and downs while positioning them for long-term success.

The next time you hear an expert confidently predict the market’s direction, remember to take it with a grain of salt. Markets may be unpredictable, but with the right strategy and mindset, they remain one of the most powerful tools for building enduring wealth.

*10% on average per year for equity returns divided by 252 trading days per year on average equates to .04%, or 4 basis points, of growth per trading day.