Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Honoring Rick Hill’s Legacy

Picking Up Pennies – Volume 7

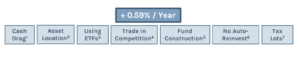

Welcome to the final installment of Picking Up Pennies. Last month, we discussed how understanding the concept of tax lots can optimize an investor’s tax consequences and even create a tax asset via active tax loss harvesting. Over the last six months, we have discussed different strategies we employ to increase returns, reduce costs, and minimize taxes. This final article will summarize the impact of these small decisions on your investment portfolio.

- Volume 1 – Keep Cash Balances Low (Better Chance for Higher Returns)

- Volume 2 – Asset Location (Reduces Taxes)

- Volume 3 – Using ETFs (Reduces Taxes)

- Volume 4 – Trading ETFs in Competition (Reduces Trading Costs)

- Volume 5 – Number of Funds and Not Auto-Reinvesting Dividends (Reduces Trading Costs)

- Volume 6 – Tax Lots and Tax Loss Harvesting (Reduces Taxes)

- Volume 7 – Summary (Total Impact)

Determining the exact impact of each decision is difficult as each strategy will impact every investor differently. For this analysis, we used what we think is a typical investor.

– Allocation is 60% Stocks and 40% Bonds

– Half of the money is in a taxable account, half is in an IRA

– Portfolio turnover is 10%/year

– 25% income tax rate, 15% capital gains tax rate

While the impact of some strategies may be more pronounced than others, it’s important to remember that every penny counts. When you add up all these strategies, you’ll see a significant difference in your investment outcomes. Specifically, about 0.59% per year or 59 basis points in financial industry jargon, which we prefer to avoid. Remember, all else being equal, the higher your tax rate, the more significant your net savings.

As discussed throughout the series, implementing these strategies is more than a one-size-fits-all approach. Each investor and family is unique, and tailoring these strategies to your needs takes time and effort. Our personalized approach is a testament to our commitment to your financial success.

In the first installment, I mentioned that I often ask other money managers how they implement these solutions. Most of the time, the response is, “We are not doing X because… it is too much work, clients don’t know the difference, the benefit is small, etc.” All of these answers are correct except one. It does take a lot of work…clients don’t normally notice the difference…but the benefit is NOT small. When you add all this up, it makes a meaningful difference. As your fiduciary, our obligation is to seek the best solutions we can find for our clients…no matter what.

These benefits are all the small details in your investment implementation. This series does not even include the bigger items that add even more value, like asset allocation, quarterly rebalancing, behavioral coaching, spending strategy, and a low-fee diversified investing strategy. Add it all together and compound these advantages over time, and now you’ve got something to be proud of now and in the long view!

1 Assumes the average investor holds 8% cash across uninvested cash and cash held in funds (5% + 3%). HIG holds 1% cash (0.7% + 0.3%). 60/40 portfolio returns 4% above cash. Impact = 30 bps

2 Assumes 5% bond returns and 10% equity returns. Impact = 20 bps

3 Assumes 3% annual capital gain distributions. Impact = 5 bps

4 Assumes savings of 2 cents per share traded. Impact = 1 bp

5 Assumes 20% additional fund turnover. 0.1% round-trip trading costs. Impact = 2 bps

6 Assumes 4% distributions and 0.1% higher trading costs. Impact = 1 bp

7 Tax benefits would depend on specific market conditions. Impact assumed to be zero for this analysis.

Hill Investment Group Relocates Headquarters to The Plaza in Clayton

We’re thrilled to announce a significant milestone in Hill Investment Group’s journey. As part of our ongoing commitment to providing an exceptional environment for our team and clients, we are moving our headquarters to The Plaza in Clayton, a move that promises to bring new opportunities and a fresh perspective to our operations. This marks an exciting new chapter in our company’s history.

The decision to relocate our main office from 7701 Forsyth (where we have been for 18 years) to The Plaza was fueled by our vision for pursuing excellence and innovation. The Plaza, nestled in the heart of Clayton, not only offers a prime location but also embodies the values of sophistication, professionalism, and forward-thinking that resonate deeply with our own ethos.

This move represents more than just an address change. It symbolizes our unwavering dedication to our clients, as we strive to create an environment that fosters collaboration, creativity, and most importantly, client satisfaction. The Plaza provides state-of-the-art facilities and amenities, ensuring we can continue delivering our valued clients the highest level of service.

With its mix of traditional exterior and modern interior design and prime location, The Plaza offers a vibrant atmosphere that aligns perfectly with our dynamic team and the progressive nature of our industry. This move will enhance our ability to serve our clients effectively while providing an inspiring space for our team to thrive.

At Hill Investment Group, every detail matters. From the investments we recommend to the spaces we inhabit, excellence is not just a goal; it’s our standard. Our new location at The Plaza is a testament to this commitment, reflecting our dedication to providing the best for our clients and setting the stage for continued growth and success.

We are incredibly excited about this new chapter in our journey. We are eager to share this exciting new space with you and look forward to the opportunities it will bring. Stay tuned for updates as we settle into our new home and continue to elevate the standard of financial services in Clayton and beyond.

*The move-out date is 5/22; we will move in one month later. Rest assured, we will be available as usual during the interim, working mainly from the fifth floor of the Plaza building. With clients in 34 states, many of you see us on Zoom, but for those in and around St. Louis, we look forward to showing you the new space this Summer.