Details Are Part of Our Difference

David Booth on How to Choose an Advisor

20 Years. 20 Lessons. Still Taking the Long View.

Making the Short List: Citywire Highlights Our Research-Driven Approach

The Tax Law Changed. Our Approach Hasn’t.

The Lure of Private Equity

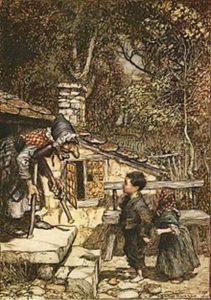

One of the most memorable fairytales of my childhood was the story of Hansel and Gretel. In this tale, an evil witch lures two children to her house made of gingerbread with the promise of candy and sweets, only to try and eat the unsuspecting kids. This story was namely memorable due to the nightmares that it caused me, but I never forgot the lesson that if something sounds too good to be true, it probably is. Investing in Private Equity (PE) reminds me of this story. Private Equity managers lure investors in with the promise of exclusive access to uncorrelated returns and higher performance reserved only for the ultra-rich. One only needs to dive a little deeper to realize that many of these claims aren’t what they appear to be. Lack of pricing, misleading return numbers, high fees, and illiquidity make this asset class less than desirable.

|

Lack of Price Transparency | PE investments are only priced once a quarter. These prices do not come from actual trades between willing market participants, but rather from PE managers claiming what they think they could sell a business for. Only posting prices once a quarter, and not having transparency on where those prices came from, makes the returns of PE appear smoother and less risky than they truly are. |

|

Internal Rate of Return (IRR) | PE managers often advertise their stellar returns via IRR numbers. For example, firms like Apollo and KKR have since inception IRR returns of 25-35% a year! Who wouldn’t want to invest in a firm that has returned 30% a year for decades? Unfortunately, this IRR number is not comparable to the time-weighted returns you see from public markets. Early success on low asset values can skew the IRR number to look higher than the return most investors experienced. Based on the amount of assets Apollo and KKR have managed over the last few decades they would have 2.5x more assets than they currently do if they had 30% year-over-year returns since inception (not including any additional inflows from new clients). Using more comparable return calculations you find that PE returns are very similar to those of public markets. |

|

High Fees | All-in, PE fees are ~6-7%/year. This is made up of mostly a management fee and a performance fee. Management fees are usually around 2%, but some of the more successful managers charge even more. Performance fees are usually around 20%, charged on top of the ~2% management fee. As a point of comparison, the public equity funds we use in our models today charge between 0.17-0.39% management fees (8x cheaper), and no performance fees. Ultimately the economic rents of skilled PE managers accrue to the managers themselves, not the investors. PE is often referred to as the “Billionaire Factory” – for managers, not investors. From 2005 to 2020, 19 new billionaires came out of Private Equity alone. |

|

Illiquidity | PE also has the nasty feature of illiquidity. Once you decide to invest, your money might be tied up for 5-10 years, meaning you can’t get it out if you need it. This lack of flexibility is a large drawback to this style of investing. You may be willing to make this sacrifice for the prospect of higher returns. But as already discussed, because of the high fees there is little evidence that PE can reliably provide higher returns. |

This information is educational and does not intend to make an offer for the sale of any specific securities, investments, or strategies. Investments involve risk and, past performance is not indicative of future performance. Consult with a qualified financial adviser before implementing any investment strategy.

David Booth on How to Choose an Advisor

There are roughly 200,000 advisors in the US. How does an investor choose one?

David Booth, the founder of Dimensional Fund Advisors, says, “trust the advisor who trusts the market.”

The One Minute Audio Clip You Need to Hear

Howard Marks is a very successful writer, speaker, thinker, and money manager. He is Co-Chair of Oaktree; you can read his impressive bio here.

We think you need to hear this clip because it is one of the better examples of all time, in our humble opinion, illustrating why taking the long view is likely the winning approach.

There is no need to swing for the fences to be a successful investor. It’s actually the opposite.

Enjoy this classic clip from Howard Marks’ interview with Barry Ritholtz on Bloomberg’s Masters In Business from 2019.

*If you want the full interview, you can find it here.