Details Are Part of Our Difference

David Booth on How to Choose an Advisor

20 Years. 20 Lessons. Still Taking the Long View.

Making the Short List: Citywire Highlights Our Research-Driven Approach

The Tax Law Changed. Our Approach Hasn’t.

Can You Imagine Your Future Self?

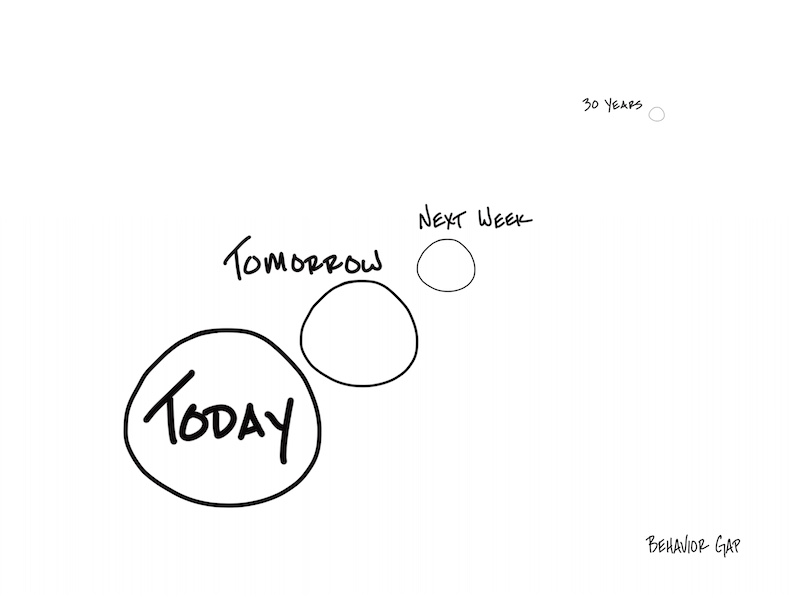

One of the big problems with setting goals is that we’re really bad at imagining our future selves. Remember what you imagined you’d be as an adult when you were a kid? I’m guessing there are some gaps between that dream and your current reality.

In the same way, there will be gaps between your current reality and your future self. And that’s partially because when we talk about goals, we’re often talking about long time frames. Consider retirement, for example. That could be upwards of 20 or 30 years from now. You can’t even imagine yourself at that age, let alone plan for it. That’s your parents, not you!

When we start talking about our distant future self, it’s easy to rationalize the decision to not do anything. Something 30 years down the road sounds an awful lot like something that can be started tomorrow.

In fact, our future self can often feel like some other annoying person constantly stealing heaps of fun from our current self. You may feel like you’re still 30, but if you just celebrated (or mourned) turning 60, it’s time to get real. Our future self will be here faster than we think. So how do we vividly connect with our future self to make better decisions today? Listen to the latest episode of TLV and consider writing a letter to your future self here.

New Video From the Client Service King

We’re continuing our video series highlighting team members, and this month I encourage you to watch John Reagan’s under two-minute piece. John dedicates his professional life to client service. It’s that simple. He is reliable with a capital “R,” and I consider him the backbone of Hill Investment Group. John is a partner in the firm, leads client service, the Financial Planning Committee, and founded our Longview Charitable Initiative (where we give back to our communities). John is someone you want on your side. Clients have told me that they wish they could “find a John Reagan in other parts of their lives.” John works every day to help simplify and add value to the lives of the families we serve. He’s self-described as “slow and steady” in the video, and we love him for it! It’s also a perfect fit with this month’s podcast.

Welcome Charles Kafoglis

We are excited to welcome Charles Kafoglis to our team. Charles is an Associate Advisor based in Houston, TX, dedicated to serving Hill Investment Group’s Hillfolio clients across the country. Charles brings decades of client service experience from his days as a management consultant and educator…an ideal fit for our team. Most recently, he has been working with teens and young adults, with a particular focus on young women, to instill financial literacy skills that are sorely lacking across all levels of our education system. Charles puts his family first, appreciates the value of listening, making a difference, and practical problem-solving. Read about his journey to Hill Investment Group and how his work experience will elevate you and your family’s experience with us here.