Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Tag: 401(k)

The Big Picture: Integrating all of your Assets at Hill

Integrating Your 401(k) into your Financial Plan

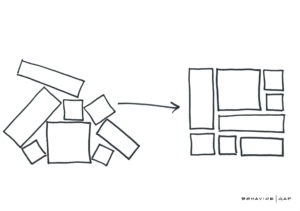

To have the best and most accurate picture of your financial situation, you must look at every asset (and liability). Did you know that you can integrate your 401(k), 403(b), 457, HSA, and variable annuity accounts into your overall plan? And get help managing the investments directly?

We have a new state-of-the-art system that allows for safe and compliant HIG advisor access to all of your accounts – taking the hassle, fiduciary responsibility, and management risk off your plate.

What does this mean for me?

- HIG taking fiduciary responsibility – upon setup, HIG takes on immediate responsibility for managing these assets.

- Combatting volatility with timely trading and rebalancing – ensuring your allocation is in line with your plan, no matter what’s happening in the markets.

- Investing in the right funds for you – full review of the cost and quality of available funds immediately upon setup, repeated quarterly.

- Tax efficiency through asset location – maximizing the value of these vehicles as an important part of your portfolio.

- Cost – the cost for this service is determined according to your regular fee schedule. See more details here.

Why it matters

These accounts shouldn’t be an orphaned part of your financial picture. Let us coach you more effectively and get the peace of mind knowing ALL of your assets are taken care of, no matter what.

Ready to set up your access to this service?

Schedule a call with me here. Setup takes no more than 15 minutes.

InBev Anheuser-Busch: One Step Forward, Two Steps Back?

While nostalgia can be an effective way to market beer, in my opinion, it’s no way to manage a brewery’s 401(k) plan. At least not if it hearkens back to a time when it was routine for plan sponsors to load up a 401(k) plan with high-cost investment selections and expect participants to sort it out for themselves.

While nostalgia can be an effective way to market beer, in my opinion, it’s no way to manage a brewery’s 401(k) plan. At least not if it hearkens back to a time when it was routine for plan sponsors to load up a 401(k) plan with high-cost investment selections and expect participants to sort it out for themselves.

This is what I fear has happened when InBev Anheuser-Busch (A-B) proudly announced nine additions to its 401(k) plan investment current lineup of low-cost, passively managed index funds. Much to my disappointment, the additions represent a confusing mix of mostly active funds.

When I was assistant treasurer at A-B in the mid-80s, I was proud to help the company become one of the first in the nation to replace all active funds with index funds in both its 401(k) plan lineup and pension plan investments. Our early leadership has since become common practice, buttressed by the empirical evidence on how to advance retirement plan participants’ successful outcomes.

There is a glimmer of hope in the mix. Dimensional Fund Advisors appears to be among the firms A-B announced in its new “active management” lineup. While Dimensional offers a different strategy from traditional indexing – something we refer to as “evidence-based investing” – it’s not traditionally active either. Dimensional is itself a leading advocate of avoiding largely fruitless attempts to beat the market through stock-picking or market-timing.

Even with this positive exception, I feel the new lineup still represents an unfortunate shift, sacrificing better choices on the altar of more choices.

Maybe I’m being nostalgic, but the A-B I knew, knew better.