Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Tag: Carl Richards

Marginal Utility and Diminishing Return

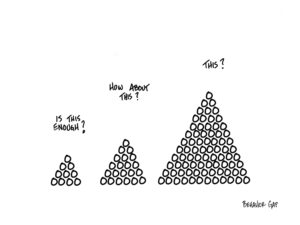

We don’t know when to stop.

At least, I sure don’t.

Sometimes, on the way home from work, I’ll swing by the grocery store, buy a pint of ice cream, and eat it.

That’s right. The whole thing.

Yes, I know. That’s a LOT of ice cream.

I’ve noticed that a very interesting thing happens when I do this:

Bite 1: Best thing in the world, ever.

Bites 2-10: Really good.

Bites 11-15: Good.

Bites 16-20: Meh.

Bites 21+: OK, now I’m sick.

I learned this lesson the first time I ate a pint of ice cream in a single sitting.

And yet, for some reason, I still occasionally repeat the experiment.

Of course, this phenomenon doesn’t only occur with ice cream. This is a well-documented economic principle called Marginal Utility, and, you guessed it, it applies to money, too.

Beyond a certain point, having more money will not lead to more security, freedom, and happiness.

Because security, freedom, and happiness do not come from more money (at least, not beyond a certain point). They come from knowing when to stop.

Image of the Month

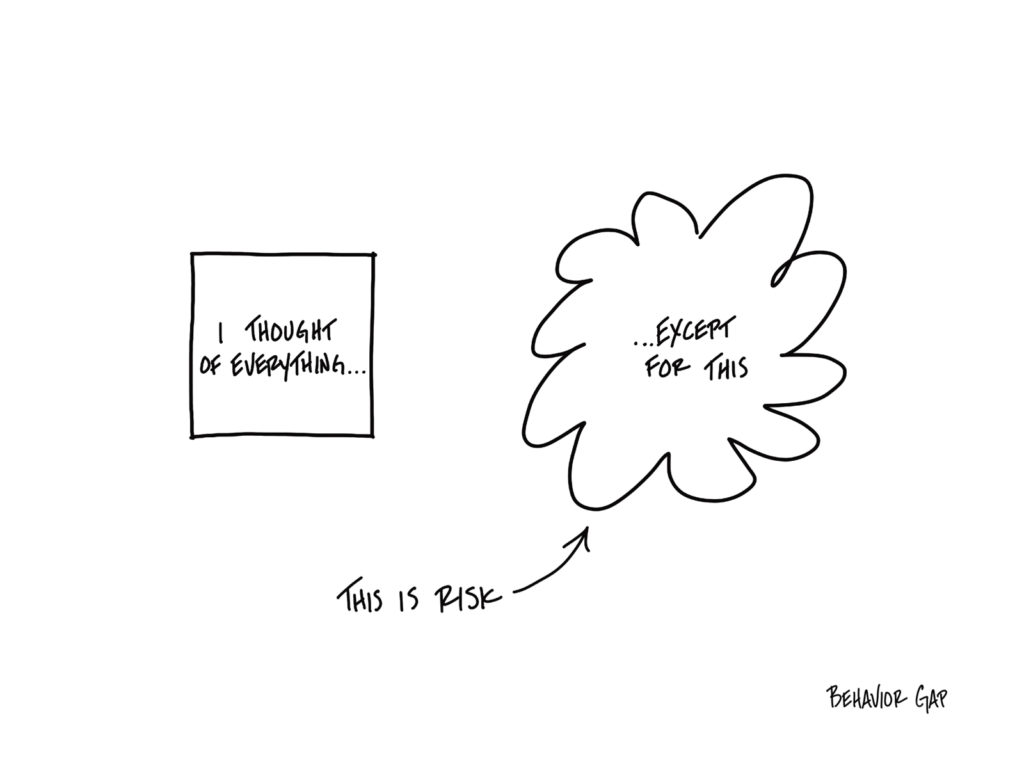

Risk is What’s Left Over

We are really good at managing risk by looking backward and preparing ourselves to handle a situation we’ve already seen. But we’re not very good at managing risk by looking forward and preparing ourselves for something we can’t even imagine.

The problem is, “something we can’t even imagine” is precisely what we need to be prepared for. Because risk is what’s left over after you think you’ve thought of everything.

It’s not the car you see coming that will kill you… it’s the one you don’t.

Bummer, right?

Let me be clear: This doesn’t mean you should cover yourself in bubble wrap and lock yourself in your house.

The point is simply to foster general resilience. You know—like an emergency fund.

And guess what, emergencies will happen. When they do, general resilience provides a margin of safety.

That’s what will protect you from the thing you never saw coming… not trying to predict the future and certainly not bubble wrap.