Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Tag: Carl Richards

The Magic of Incremental Change

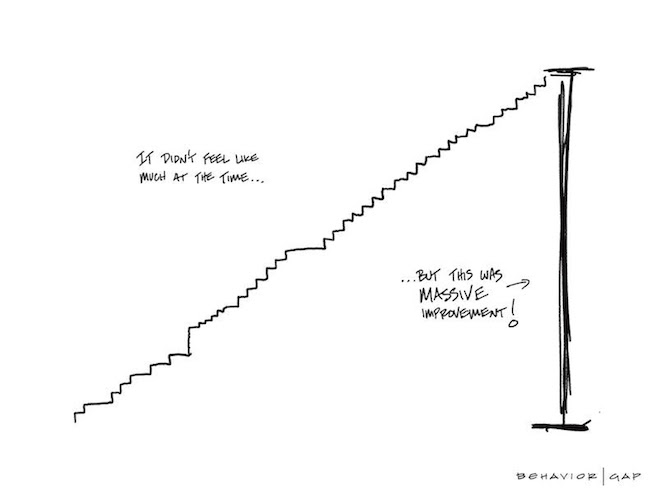

HIG friend, podcast guest, and NYT columnist, Carl Richards, shared the following story about how incremental change adds up if you take the long view. Keep reading for the story behind the sketch.

The Magic of Incremental Change

Back when I lived in Las Vegas, I used to ride road bikes with a semi-competitive group of riders. I remember when I first joined the group, it felt like a big victory if I could just keep up with them for the first 15 minutes. After a while, that became the first half-hour. Then an hour. One day, almost without even noticing it, I was suddenly able to stick with the pack for the entire ride.

It felt sudden at the time, but of course, it wasn’t. And although I was surprised, nobody else was, because they had all seen it before with other riders or experienced it themselves.

This is the sneaky power of incremental change.

Each day, you make a small improvement. Then, that becomes the new normal, and you get used to it. You make a small improvement again, and then that becomes the new normal. This happens over and over, slowly but surely. We barely notice we are getting closer to our goal, and then (again, seemingly “all of a sudden”) we’re there!

I didn’t feel a lot faster because I wasn’t a lot faster… compared to yesterday or even last week. In fact, I was just a little faster than I was last month. But month after month, ride after ride, it all added up. All those little bits of “faster” started to compound on top of one another.

Of course, this doesn’t just apply to riding bikes. I’ve had times in my career where I wondered if I was accomplishing anything. I specifically recall a time when I was working remotely for a large company. I got very little feedback on my work and was largely left alone. I loved the independence, but I also struggled because I had no idea if what I was doing was valued by the people I worked for.

To deal with this struggle, I started reviewing each week and noting what I had done. It felt weird at first because I didn’t want it to be seen as taking credit for things, but as the weeks added up and the list got longer, it felt good. I was doing stuff, and that stuff was making a difference, for sure.

No one else needed to see the list. It still felt good. It helped me to see, in real-time, how incremental changes add up.

If you build a process of reflecting every quarter, month, and year, you’ll never feel like you’re not accomplishing anything again. And while that may spoil some of the surprise of suddenly and unexpectedly arriving at your goal one day, I promise it will be worth it to feel much better along the way.

-Carl Richards

Six Ways to Tell the Difference Between Real and Pretend Investors

The following is a piece former podcast guest and New York Times Columnist, Carl Richards wrote for his newsletter. We enjoyed his humorous take on “pretend” investors.

Pretending to be an investor is dangerous. It’s not like when you were a kid pretending to be a superhero. That’s because kids generally know better than to confuse “make-believe” for reality. It’s pretty rare that a child jumps off the roof because they actually think they can fly.

But when it comes to investing, adults confuse “make-believe” and reality all the time.

Don’t you think it’s time we grow up a little?

Here are six ways to tell the difference between real and pretend investors to help get started.

…

- Pretend investors think that financial pornography is real, and therefore, the news ticker scrolling across the television screen represents actionable information.

Real investors know it might be entertaining, like going to the circus. But they would never make a decision because of it.

- Pretend investors think it makes perfect sense to change their investments based on what they hear in the news: There’s a new president, so act! He doesn’t like the Federal Reserve, so trade! He criticized bankers, so buy bank stocks!

Real investors make changes to their investments based on what happens in their own lives. If their goals change or there is a fundamental change in their financial situation, then they consider making a change in their investments. But they would never make a change based on someone yelling “buy” or “sell” on a Financial Pornography Network.

- Pretend investors think they need to monitor their investments all the time. (The little supercomputer they carry around in their pockets makes it so easy!)

Real investors know it takes a long time for a tree to grow, and it will not help to dig it up to see if the roots are still there. The same rule applies to investments.

- Pretend investors talk about their investments—a lot. They say things like, “I’m long this, or short that.” They use jargon that often does not make sense, though it sounds kind of impressive if you don’t listen too closely. Sometimes they cheer for things like increased consumer spending, higher unemployment, or in some cases, even war.

Real investors understand the difference between the global economy and their personal economy, and choose to focus on the latter.

- Pretend investors worry endlessly about the news in some far-off part of the world and the impact that news will have on their portfolio.

Real investors focus on the things they can control, like saving a bit more next year, keeping their investment costs low, not paying fees unless it’s necessary, and managing their behavior by not buying high and selling low.

- Pretend investors complain endlessly about volatility in the markets, and focus on days.

Real investors are focused on enjoying the benefits of the returns the market generates over decades.

…

Look, if it feels like I’m getting in your face a little, it’s because I am.

But I’m doing it for you!

Jumping off the roof because you think you can fly can have disastrous consequences… it just so happens, so can throwing around your money because you think you know how to invest.

If any of the six items in bold above sound like you… you may want to think about what it means to be a real investor.

Or just jump off that roof, and see what happens.

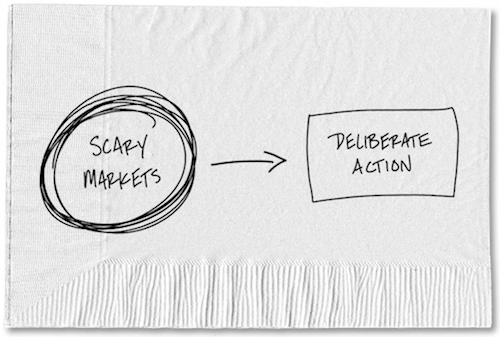

5 Steps for Dealing With a Scary Market

The New York Times Sketch Guy, Columnist, and Take the Longview podcast guest Carl Richards, is one of the best in the world at connecting money and emotion. His unique ability is boiling down ideas to their essence so that everyone can relate. In a recent piece, he does it again, clearly outlining a 5-step guide to making it through the ups and downs of the financial market. Check it out here.