Details Are Part of Our Difference

David Booth on How to Choose an Advisor

20 Years. 20 Lessons. Still Taking the Long View.

Making the Short List: Citywire Highlights Our Research-Driven Approach

The Tax Law Changed. Our Approach Hasn’t.

Tag: Carl Richards

5 Steps for Dealing With a Scary Market

The New York Times Sketch Guy, Columnist, and Take the Longview podcast guest Carl Richards, is one of the best in the world at connecting money and emotion. His unique ability is boiling down ideas to their essence so that everyone can relate. In a recent piece, he does it again, clearly outlining a 5-step guide to making it through the ups and downs of the financial market. Check it out here.

Podcast Episode: Carl Richards – What Really Matters in Your Life

This podcast episode (42 minutes) is worth listening to for a variety of reasons. Most importantly, Carl Richards is one of the best in the world at connecting money and emotion in ways real people can understand. He is the creator of the Sketch Guy column, appearing weekly in The New York Times since 2010. With over 800 simple sketches, Carl knows how to get us thinking and talking about what really matters in our lives. Through his writing, speaking, and sketches, Carl makes complex financial concepts, easy to understand. His work also serves as the foundation for his two books, The One-Page Financial Plan: A Simple Way to Be Smart About Your Money, and The Behavior Gap: Simple Ways to Stop Doing Dumb Things with Money.

Matt loved taping this episode with Carl from his new home in London and counts Carl as a long-time friend.

Don’t forget to leave a review wherever you subscribe to podcasts! Your support really helps spread the word.

Is Your Advisor Making Simple Things Complex?

Financial simplicity, like many goals, is as desirable as it is elusive.

Or so it seems.

If you took a sample of 100 investors and asked each one about the vital signs of their portfolios – their fees, returns, and allocations – you’d be hard-pressed to find many who could speak confidently and accurately about them.

This isn’t just a guess from left field. In 2016, MarketWatch cited a Prudential Investments retirement preparedness survey that found more than 40% of Americans had no idea how their investments are allocated. We’ve seen similar stats from other surveys published since then.

What’s most disappointing about this apparent collective bewilderment, is that the system seems designed to be this way. We work in an industry where thousands of “advisors” are not only encouraged to sow seeds of confusion, they’ve made millions of dollars doing so.

When a broker pulls an investor out of their comfort zone and into the weeds, the investor becomes vulnerable. Accordingly, advice becomes a sales pitch, and costs become confusing – a pattern we see time and again.

We know investors deserve better, so we’re on a mission to make the complex simple, to make financial conversations comfortable, and ultimately to shed a liberating light into the dark corners where families have been harboring their greatest financial fears for years.

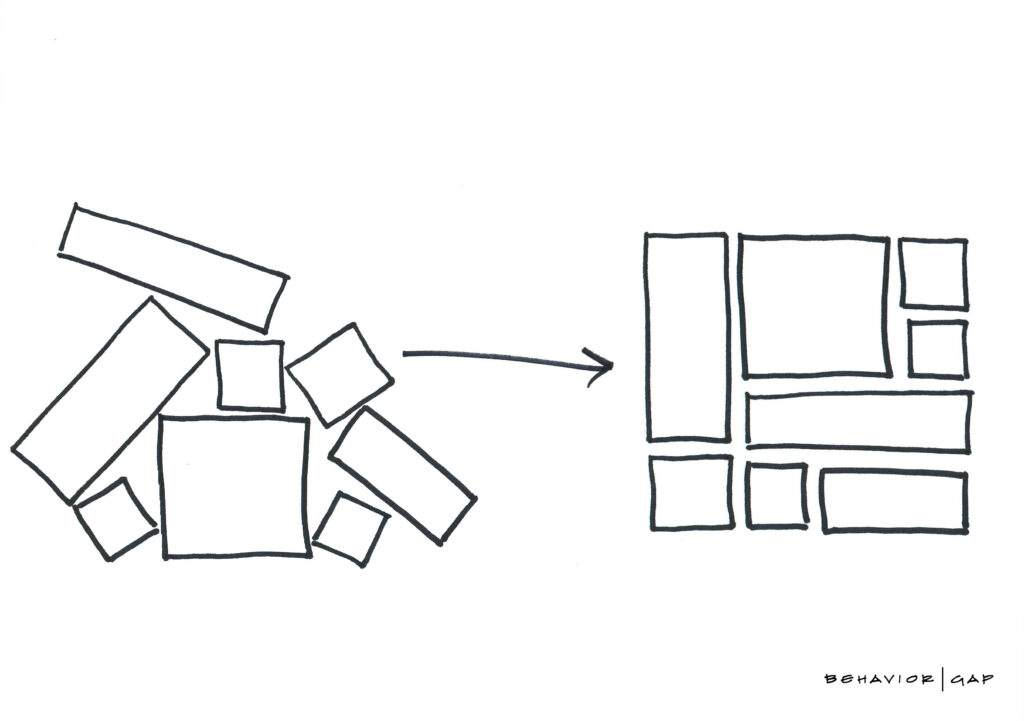

As our friend Carl Richards has embodied in his Behavior Gap sketch above, an advisor’s job isn’t to prove how much they know. It’s about helping investors see the few, elegant, simple changes they can make to their plan, to make a huge impact over the long-term.

There’s nothing more rewarding for us at Hill Investment Group than seeing someone’s reaction when the air finally clears for them, and they realize that simplicity wasn’t as elusive as they once thought.

In the words of pianist and composer Frédéric Chopin, “Simplicity is the final achievement.”