Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Tag: Charles Schwab

Matt Hall on Your Television

Congratulations to our own Matt Hall, who is featured in Schwab’s new national ad campaign!

As mentioned in a post back in July, Matt was selected to participate in a series of ads highlighting the advantages independent advisors bring to our clients. Here is the first in a series airing over the next few weeks and months.

In the 30-second spot, Matt and the other advisors zero in on a few of the crucial promises independent advisors make when we work with our clients. Schwab is essential in our ecosystem for safeguarding our clients’ securities and is the leading custodian working with independent advisory firms.

The independent model is superior to the other options available to investors because of its fiduciary standard for clients. We work for you, and only you, and avoid the conflicts that exist with big banks and brokerage firms.

Thanks, Matt, for representing Hill and the broader advisor community genuinely looking to serve others now and in the longer view!

Independent Difference Campaign

I’m proud to be a part of the independent advisor community. In the most simplistic definition, independence means that our firm does not fall under a major brokerage firm, bank or trust company. We operate independently and work for you, not a corporation. This is a hugely important distinction because our model allows us to operate objectively.

I was recently invited to be a part of a national ad campaign supporting independent advisors around the country, and I was taped saying lines like:

I am a fiduciary, not just some of the time, but all of the time.

As a fiduciary, I promise to put your interest first. Always.

As a fiduciary, I promise to always act in the best interests of you and your family.

We believe these statements at our core and think every investor deserves to be served by someone who works solely for them, as their fiduciary. Reciting these lines came naturally and we’re honored to help support the broader community of advisors.

Stay tuned for more information on the campaign, who it’s associated with, and when it will air!

Details Are Part of Our Difference

As our clients know, we seek to eke out every last basis point of potential return for you. So, while we balance the ideal combination of factors to achieve the highest odds of excess return, we also seek to minimize all costs, expenses, and taxes which eat into an investor’s net return. There are a couple of ways this plays out:

Evaluating Asset Managers

When evaluating asset managers, we scrutinize their trading practices to implement their strategies cost-effectively. If they don’t have reasonable trading procedures, their trading costs will be higher and, ultimately, lower the return of your investment.

Reducing Trading Fees

Just like our fund managers, we want to make sure that we are trading cost-effectively to be good stewards of your hard-earned capital. The most recent step in this effort was transitioning much of our recommended portfolio from mutual funds to ETFs, mainly to eliminate fees for trading mutual funds.

At Hill Investment Group, we are not satisfied with just better; we are always working towards finding the best solution we can find for you. The change from mutual funds to ETFs is a savings win, but we were eager to take it one step further.

Eliminating Hidden Costs

You may not know that ETFs have their own unique hidden trading costs. Like stocks, ETFs trade with a bid-ask spread. That means that, for example, market makers may buy an ETF at $9.99 and sell it to another investor for $10.01. The market maker earns a nice $0.02 profit/share, and the buyer and seller pay the cost.

We wanted to make this better. So, for ETF trades of over a certain size, rather than trade on the exchange with a limited short-term supply, we deal directly with the banks. We get the banks to compete for our business and bid against each other. This can shrink and nearly eliminate the market maker’s profit. This competition and direct access yield better prices than we could otherwise get on the exchange.

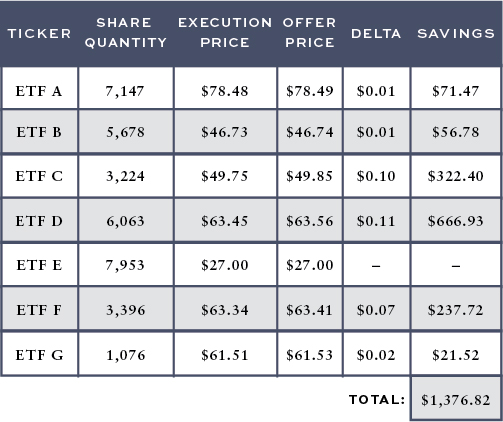

For example, we recently rebalanced one of our clients’ portfolios which resulted in purchases of various ETFs. The table above outlines the ETFs we bought, the price we would have gotten if we went to the market (Offer Price), and the price we executed at (Execution Price).

Conclusion: Details Matter

In just one day, using this trading strategy, we saved this client over $1,300 in trading costs. This one example is just one of many ways we fight for every basis point —the details matter and are part of the HIG difference.

Past results are not indicative of future results, or all client results. There are no implied guarantees or assurances that your target returns or cost savings will be the same as the example shown. Future returns or cost savings may differ significantly from the past due to many different factors. Investments involve risk and the possibility of loss of principal. The values and performance numbers represented in this report do not reflect management fees. The values used in this report were obtained from third-party sources believed to be reliable. Savings numbers were calculated by HIG using the data provided.