Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Tag: client services

It’s Not Too Late For These 5 Tax Moves!

With 2020 coming to an end, we thought it would be a good time to remind everyone of a few tax planning strategies that can be easily overlooked:

- Maximize your 401(K) or other employer plan contributions – Saving funds on a pre-tax basis in a retirement account allows them to grow tax-deferred until they are withdrawn in retirement.

- Contribute to your Health Savings Account (HSA) – An HSA is an often overlooked savings vehicle that allows individuals covered by high-deductible health insurance plans to save money on a pre-tax basis. The funds then grow tax-deferred and if used for medical expenses can be withdrawn tax-free. These are sometimes called the triple tax advantages of an HSA.

- Get going on 529 contributions – If you have children (or grandchildren, nieces, nephews, or anyone that may attend school in the future), a 529 may be the right savings vehicle for you. The tax deductibility of these contributions depends on your state of residence, and any contributions grow tax-free so long as they are used for qualified education expenses.

- Contribute to a cause you care about – If you don’t have a charitable organization that you want to support directly in 2020, you can open a Donor Advised Fund to make the charitable contribution this year, allowing you to gift to your favorite charitable organization later. You receive the tax deduction in the year of contribution to the Donor Fund, and this also allows your funds to stay invested, and potentially grow, so that you can give away greater amounts in the future.

- Think about financial gifts to individuals – While gifts to individuals are not tax deductible, they are a great way to lower your overall estate and reduce the amount that is potentially subject to estate taxes in the future. Cumulative gifts to an individual up to $15,000 [$30,000 for a married couple filing jointly in 2020] are under the annual gift exclusion and do not require a gift tax return to be filed. If you give more than $15,000 to one person, you may have to file a gift tax return and would encourage you to consult with your tax professional.

For some individuals it makes sense to accelerate their tax deductions in 2020, and for others it may make sense to delay their deductions until 2021. One of the things we do at Hill Investment Group is work with our clients’ clients’ CPAs and estate attorneys to ensure they are maximizing not only their portfolio with us, but their complete financial picture. Feel free to give us a call to discuss.

Get the Whole Family Involved

One question we hear often is, how do I teach my kids about money?

We’ve shared our conversation with Marilyn Wechter about subtle ways to set our kids up for success with money and talked about how not to be a snowplow parent, but what about the nuts-and-bolts? How can we teach our kids the basics of saving, the power of compound interest, and how capital markets work? In other words, how do we make finance fun?

Recently, John and I had a crash course in teaching a trio of teenagers. We thought we’d share some valuable takeaways you can incorporate into your own “money talk” with your kids.

The meeting’s highlight was “Roll with the Market”, a dice game that aimed to replicate the stock market. We also introduced them to our version of Finance 101: budgeting, savings, goals, credit cards, and Rick Hill’s favorite Rule of 72.

In “Roll with the Market”, the kids decided if their money was “in” or “out” through 10 rounds of dice rolls. The game gave the kids a taste of what it’s like to be invested in the stock market, simulating a rising or falling market’s emotional effects and changes to their investments. To our surprise and satisfaction, the three kids stayed in the market all 10 rounds, never once deciding to sit out (equivalent to going to all cash). Even at this young age, they were able to intuitively understand and take the long view!

Here are a couple of tips for keeping children engaged as they learn:

- Use cold hard cash – Once we threw some cash on the table and got them involved in helping manage it, they were hooked.

- Gameify the essential topics – Making the lesson a game reframed their idea of money from obscure to practical and made it fun! They were also able to practice and absorb the lessons without just listening to us drone on.

- Make it relevant – We believe the real power of wealth lies in creating freedom and options to lead the life you choose. By asking a couple of pointed questions, we were able to help them understand that money can power their dreams, even now. The key was showing them money matters today – not just in the future. Each member of the family was totally engaged, asking great questions, participating in thoughtful conversation.

If the idea expressed here sounds good to you, let us take “the money talk” off your hands. Contact us about scheduling a family meeting. You never know what small spark will set off your child’s long-term success with money.

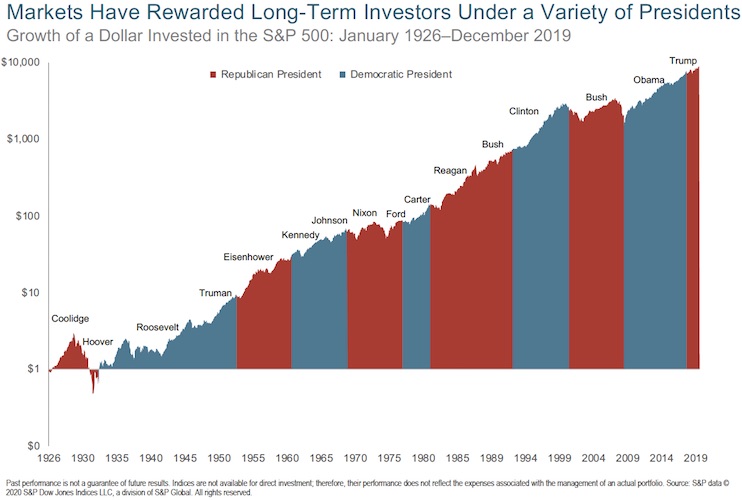

Does Your Money Care Who Wins the Election?

We send our clients exclusive quarterly communications. To give you an idea, here is the graph we provided in our recent letter. The key question asks if your money cares who wins the election. Want to know more? Schedule a quick call with me to discuss and find out what other perks our clients receive.