Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Tag: Data

Image of the Month

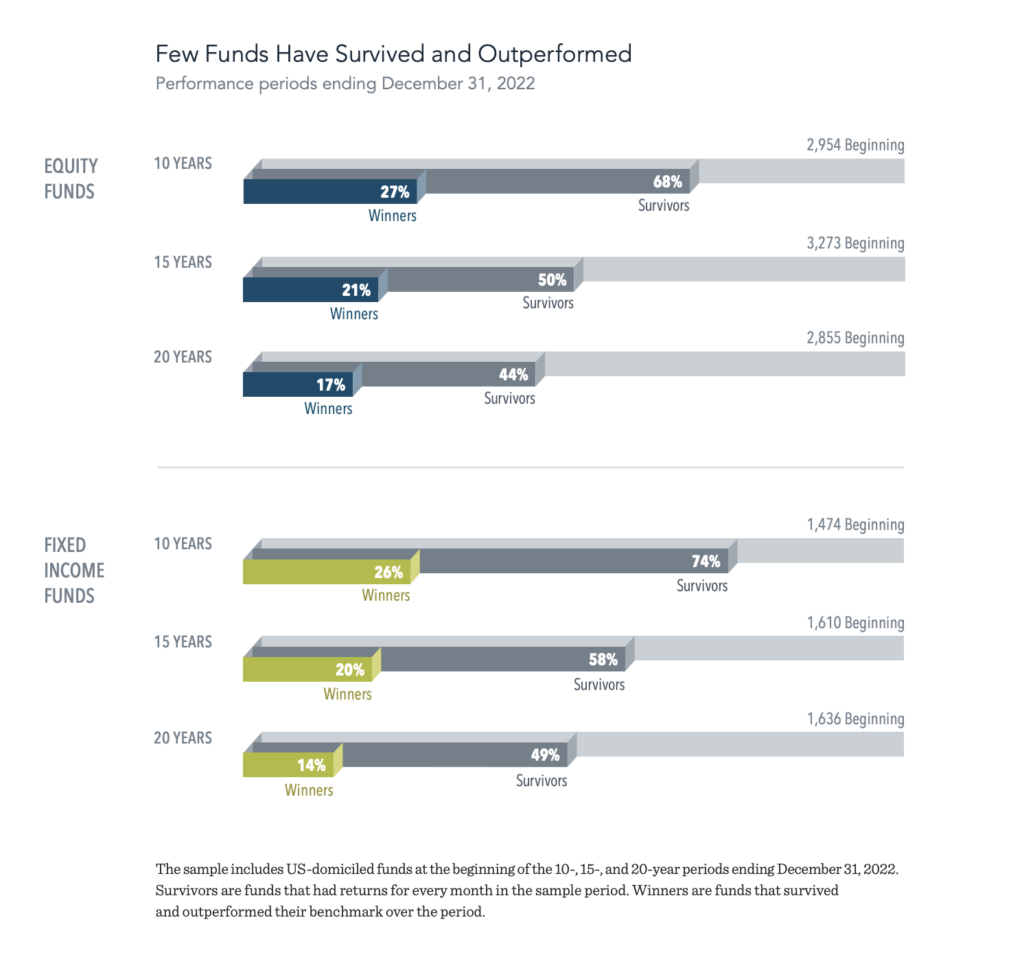

Each year, Dimensional analyzes investment returns from a large sample of US-domiciled funds (over 4,000). This year’s study updates results through 2022 and includes returns from mutual funds and exchange-traded funds (ETFs) domiciled in the US. The evidence shows that a majority of fund managers in the sample failed to deliver benchmark-beating returns after costs. We believe that the results of this research provide a strong case for relying on market prices when making investment decisions.

Market Volatility

The first few weeks of 2016 were the worst start for the S&P 500 in history. So what should you do? The attached article serves as a reminder that negative returns in January (or any single month) are not meaningful because the subsequent 11-month returns have been positive 59% of the time, with an average return of 7%.

The first few weeks of 2016 were the worst start for the S&P 500 in history. So what should you do? The attached article serves as a reminder that negative returns in January (or any single month) are not meaningful because the subsequent 11-month returns have been positive 59% of the time, with an average return of 7%.

Accept the periods of negative volatility and remain disciplined. As the time period increases, the probability of realizing positive expected returns increases. Let patience lead to prosperity.