Details Are Part of Our Difference

David Booth on How to Choose an Advisor

20 Years. 20 Lessons. Still Taking the Long View.

Making the Short List: Citywire Highlights Our Research-Driven Approach

The Tax Law Changed. Our Approach Hasn’t.

Tag: Evidence-Based Investing

We Work for You

This is an ad we’d be proud to run in the Wall Street Journal, or anywhere, for that matter, because it’s the truth.

However, we’re only seeking to help a handful of new, special families each year…not tens of thousands. So, rather than charge higher fees to our clients to pay for expensive ads, we’ve been blessed with your help in achieving over 20 years of highly successful, selective growth through your heartfelt and warm introductions to family, friends, and those you care about who’ve become part of the Hill Family. Thank you!

As you celebrate along with us, if there’s someone special you’d like to help and think might be a good fit, please reach out to me.

Not ready for that? We’d be happy to send them a copy of Odds On so they can learn more about our “Take the Long View” philosophy, evidence-based investing, and values.

Hill Investment Group is an SEC-registered investment adviser. This material is provided for informational purposes only and should not be construed as investment advice or a solicitation to engage our services. Past growth or success should not be interpreted as a guarantee of future results. References to client introductions, relationships, or experiences are not intended to imply that any client or prospective client will achieve similar outcomes. All investing involves risk, including the potential loss of principal. For additional information, please refer to our Form ADV, available upon request.

The Parable of the Wizard & the Prophet: What It Teaches Us About Money

There’s a well-known idea in the world of big-picture thinking, first introduced by historian Charles Mann, that people tend to fall into one of two camps when it comes to solving problems: wizards and prophets.

The wizard believes in the power of innovation. They chase breakthroughs, trusting that human ingenuity can overcome nearly any obstacle. In their view, the solution is out there. We just haven’t invented it yet.

The prophet, on the other hand, champions restraint. Prophets remind us of our limits, calling for thoughtful stewardship and humility. They believe real progress comes not from racing ahead, but from pausing to reflect, simplify, and align with deeper values.

This tension between wizard and prophet shows up in everything from climate change to technology, and even how we think about investing.

The Wizard

In investing, wizard energy often shows up as the lure of the new:

- A product promising market-beating potential

- A hot stock expected to soar

- An app that promises to automate everything overnight

The wizard pursues complexity and fast results. And in moderation, this mindset has its place. Without it, we wouldn’t have low-cost index funds, digital account access, or the academic breakthroughs that helped shape evidence-based investing.

But unchecked, wizardry can lead to chasing fads, mistaking novelty for progress, and believing the next big thing is always just a click away.

The Prophet

Prophets bring a different mindset to investing. They emphasize what’s within our control: saving consistently, diversifying broadly, and sticking to a long-term plan. They ask deeper questions like: How can I align my money with my values? And what will make this last?

This approach can feel quieter, but over time, it offers clarity, resilience, and connection to what matters most.

Better Together

At Hill, we aim to balance both perspectives. Like the wizard, we embrace smart innovation, leveraging tools and research when they align with long-term evidence. And like the prophet, we build portfolios and plans around timeless principles: patience, discipline, and long-view thinking.

Financial progress isn’t about choosing sides. It’s about responsible stewardship and intentional alignment so that your money supports a life of meaning and purpose.

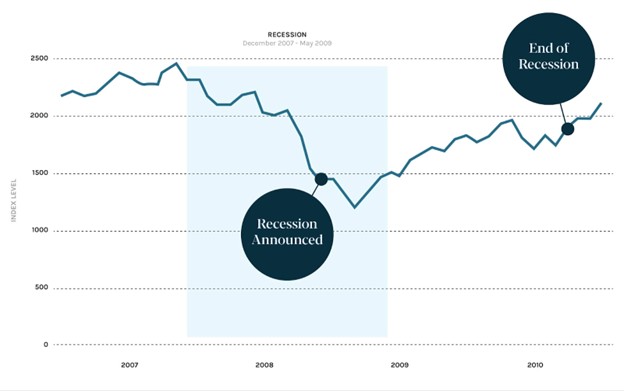

Markets Don’t Wait for Official Announcements

Over the last several months, “tariffs” have made frequent headlines. They’re on. They’re off. They’re up. They’re down. Understandably, many investors are asking: How will this affect my portfolio?

Here’s the short answer: the market doesn’t wait for official announcements—good or bad. Every second global financial markets are open, prices are adjusting in real time to reflect all known information, whether that information is accurate, speculative, or incomplete.

This is why reacting to headlines or trying to time the market based on “breaking news” often proves unproductive. The news is already priced in.

At Hill, we help clients build portfolios rooted in long-term planning, academic research, and thoughtful consideration of risk. These portfolios are designed with the understanding that market fluctuations and unexpected headlines are part of the journey.

Rather than react to each new cycle of uncertainty, we focus on your plan, your risk tolerance, and the full breadth of evidence available. This approach is intended to help clients remain invested and confident, even in the face of short-term volatility.

The included graphic from Dimensional illustrates how markets respond to news events. It highlights a consistent truth: while headlines can move markets temporarily, disciplined, diversified investors who stay the course are often better positioned over the long term.

If you have questions about how your portfolio is structured to weather market headlines—or want to revisit your plan—we’d be happy to talk.