Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Tag: financial advice

Why Not Just Invest in Money Market Funds Currently Yielding 5%?

At Hill Investment Group, we pride ourselves on our steadfast commitment to long-term investing principles. Our philosophy centers around ignoring short-term market noise and focusing on sustainable, enduring strategies. Recent interest rate increases have sparked questions among our clients, particularly regarding money market funds and how to approach fixed-income investing in this evolving interest rate environment. If you have questions, we prepared this data with you in mind.

For over a decade, the Federal Reserve has maintained historically low-interest rates since the financial crisis of 2008. However, more recently, we have witnessed an increase in the federal funds rate (the interest rate at which depository institutions [banks and credit unions] lend reserve balances to other depository institutions overnight on an uncollateralized basis), signaling a departure from the exceptionally low-interest rate environment we have grown accustomed to.

What does this higher interest rate environment mean for investors?

As investors, we have a range of choices, from safe assets like short-term government debt to riskier alternatives such as venture capital. Each investment option carries a distinct level of risk, and investors typically opt for riskier assets only if they offer higher expected returns compared to safer ones. For example, if a 1-Year Treasury bill (US Government Debt) provided a 5% return, no rational investor would buy a 1-Year General Electric bond (a risker bet) paying a 4% return. Therefore, to entice investors to buy its bonds, General Electric would need to offer more than a 5% return.

To determine the riskiness of different investments, we can compare them to the least risky option, which is typically short-term US government debt. This is where the Federal Funds Rate comes in. The Federal Funds Rate acts as a benchmark for determining the interest rates of the least risky assets: short-term US government debt. As of May 15th, 2023, the federal funds rate was 5.08%.

This means an investor in a money market fund should expect a ~5% return for this low-risk investment. Other investment options need to offer returns surpassing this baseline to entice investors.

For instance, one of the corporate bond funds we like to invest in, Avantis Core Fixed Income ETF (AVIG), has a yield to maturity or expected return of 4.5%. That doesn’t look alluring compared to a money market yielding 5%. Why would any investor choose to invest in AVIG over a money market fund?

This is where the duration or timeline of the investment comes into play. The Federal Funds Rate is reset eight times a year, potentially causing fluctuating returns for money market accounts. For example, over the last year and a half, the return of money market accounts has increased from 0% to 5%. Over the next year and a half, it could return to 0% or rise even higher. No one knows what the Fed will do in the future, but Investors have expectations and use their expectations to invest in bond markets. Their investment sets market prices. A yield curve depicts the aggregate expectations of all investors for how interest rates will change in the future.

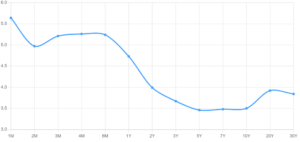

Looking at the current yield curve, investors can gauge the return they should anticipate for different investment durations, i.e. holding periods.

US Treasuries Yield Curve

5/15/2023

While market predictions are often wrong, there is no way of knowing if the market is over or underestimating future rate changes. Numerous financial blogs and media pundits claim they magically “know” where markets are going.

However, this is precisely where the beauty of markets reveals itself. The market aggregates everyone’s opinion on where rates will go, and rather than trying to outguess, we ignore the noise and trust the information embedded in market prices.

This brings us back to answering the question of “where” to invest. Money market funds typically have short durations of around 15 days. Investing in a money market fund, you could expect that 5% return for about 15 days. A month from now, the return could be higher or lower. The yield curve suggests that the market believes rates will decrease as longer-duration bonds have lower yields. For example, AVIG, our corporate bond fund, has a duration of 6 years. Looking at the yield curve, 6-year treasuries have an expected return of 3.5%. Thus, comparing 4.5% to 3.5%, you are being compensated with about 1% extra return for taking credit risk in AVIG compared to treasuries.

Interest rate changes are like rising or receding tides that lift or lower all boats. As interest rates fluctuate, we adhere to a consistent investment strategy. We understand that the risk/return tradeoffs are linked, and we do not attempt to time interest rate movements. This is why we do not recommend shifting your fixed-income investments to money market funds. We simply don’t know how long those relatively high, short-term rates will exist. The price of the funds we buy already incorporates the odds and risks of rates going up, down, or staying flat.

Instead, we focus on your long-term investment objectives and individual risk tolerances. We create a plan that meets your needs regardless of whether interest rates are rising or falling. Ultimately, all expected future interest rate changes are already factored into market prices, and it is not worth trying to outguess them.

That does not mean there are no appropriate use cases to invest in money market funds though. For example, if you are about to buy a home, it may make sense to invest the down payment in a money market fund to earn some interest with low risk.

We are here for you to review the different investment options and find a financial plan that works for your needs, with the goal of putting the odds of financial success in your favor.

Marginal Utility and Diminishing Return

We don’t know when to stop.

At least, I sure don’t.

Sometimes, on the way home from work, I’ll swing by the grocery store, buy a pint of ice cream, and eat it.

That’s right. The whole thing.

Yes, I know. That’s a LOT of ice cream.

I’ve noticed that a very interesting thing happens when I do this:

Bite 1: Best thing in the world, ever.

Bites 2-10: Really good.

Bites 11-15: Good.

Bites 16-20: Meh.

Bites 21+: OK, now I’m sick.

I learned this lesson the first time I ate a pint of ice cream in a single sitting.

And yet, for some reason, I still occasionally repeat the experiment.

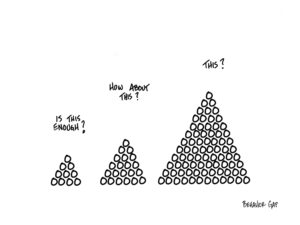

Of course, this phenomenon doesn’t only occur with ice cream. This is a well-documented economic principle called Marginal Utility, and, you guessed it, it applies to money, too.

Beyond a certain point, having more money will not lead to more security, freedom, and happiness.

Because security, freedom, and happiness do not come from more money (at least, not beyond a certain point). They come from knowing when to stop.

What to Ignore in 2020

It’s that time of year—investors are eager for advice and herds of “thought leaders” are competing for your attention to tell you what to do during the new year. Instead of adding to the cacophony of 2020 to-do lists, we’re switching it up by telling you what to ignore.

We’re big fans of the author and celebrated podcast host Tim Ferriss’ Not-To-Do-List, so we decided to put our own twist on his concept.

“Not-to-do lists are often more effective than to-do lists for upgrading performance,” says Ferriss. “The reason is simple: what you don’t do determines what you can do.”

Below are four types of financial information that, at best, waste time and, at worst, create stress and anxiety. It’s our hope that you’ll ignore them so you can stay focused and productive, and live richly.

Any Variation of the Headline: “X Stocks to Buy”

The 4+ billion Google results for “stocks to buy in 2020” aren’t just risky—they’re almost certainly doomed to flop.

“The track record of expert forecasters is as dismal as ever,” says David Epstein, author of Range. “In business, esteemed forecasters routinely are wildly wrong in their predictions of everything from the next stock-market correction to the next housing boom.”

As our co-founder Rick Hill says, “Stop trying to find the needle in the haystack—just buy the haystack,” which is what our clients do.

Stock Market News and Notifications

Just like watching what you eat keeps you fit and healthy, a low information diet can keep you calm and focused, especially when it comes to your personal finances. As important as the latest headlines might seem, it’s important to remember: The media’s job isn’t to keep you informed, it’s to keep you tuned in 24/7/365 so they can sell advertising. We stay tuned in to what matters over the long term, so that you can focus on what matters today. That’s the kind of tradeoff we like.

Your Short-Term Portfolio Performance

It’s nice to have our sleek app that puts your entire investment portfolio in your pocket, but that doesn’t mean you should monitor it incessantly. Redefine how you measure success – we suggest measuring your performance against your goals in terms of decades and generations rather than 24-hour news cycles.

Financial Advice from Anybody Without a Fiduciary Standard

As Matt Hall covered in his book, Odds On, most big-name brokerage firms prize sales quotas and their compensation over client care and education. In any industry, a convergence of greed and incompetence is dangerous. In wealth management, the consequences can be life-shattering for you and your family.

Before considering any financial advice, always ask: Is our relationship a fiduciary? If the answer is anything besides, “Yes, always” or if the written version is accompanied by an asterisk and a bunch of legalese, ignore it.

It’s great to pick up new productive habits, but sometimes the best way to improve your life is by subtracting, not adding. You might surprise yourself with how much you accomplish with the extra breathing room.