Details Are Part of Our Difference

David Booth on How to Choose an Advisor

20 Years. 20 Lessons. Still Taking the Long View.

Making the Short List: Citywire Highlights Our Research-Driven Approach

The Tax Law Changed. Our Approach Hasn’t.

Tag: Financial planning

The Parable of the Wizard & the Prophet: What It Teaches Us About Money

There’s a well-known idea in the world of big-picture thinking, first introduced by historian Charles Mann, that people tend to fall into one of two camps when it comes to solving problems: wizards and prophets.

The wizard believes in the power of innovation. They chase breakthroughs, trusting that human ingenuity can overcome nearly any obstacle. In their view, the solution is out there. We just haven’t invented it yet.

The prophet, on the other hand, champions restraint. Prophets remind us of our limits, calling for thoughtful stewardship and humility. They believe real progress comes not from racing ahead, but from pausing to reflect, simplify, and align with deeper values.

This tension between wizard and prophet shows up in everything from climate change to technology, and even how we think about investing.

The Wizard

In investing, wizard energy often shows up as the lure of the new:

- A product promising market-beating potential

- A hot stock expected to soar

- An app that promises to automate everything overnight

The wizard pursues complexity and fast results. And in moderation, this mindset has its place. Without it, we wouldn’t have low-cost index funds, digital account access, or the academic breakthroughs that helped shape evidence-based investing.

But unchecked, wizardry can lead to chasing fads, mistaking novelty for progress, and believing the next big thing is always just a click away.

The Prophet

Prophets bring a different mindset to investing. They emphasize what’s within our control: saving consistently, diversifying broadly, and sticking to a long-term plan. They ask deeper questions like: How can I align my money with my values? And what will make this last?

This approach can feel quieter, but over time, it offers clarity, resilience, and connection to what matters most.

Better Together

At Hill, we aim to balance both perspectives. Like the wizard, we embrace smart innovation, leveraging tools and research when they align with long-term evidence. And like the prophet, we build portfolios and plans around timeless principles: patience, discipline, and long-view thinking.

Financial progress isn’t about choosing sides. It’s about responsible stewardship and intentional alignment so that your money supports a life of meaning and purpose.

20 Years. 20 Lessons. Still Taking the Long View.

What 20 Years Have Taught Us

Twenty years ago, we launched Hill Investment Group with a simple idea and a bit of idealism. We called our firm the Island of Idealism: a place where evidence mattered more than ego, long-term thinking trumped short-term noise, and clients could breathe a little easier knowing they had a guide they could trust.

That idealism is still with us. But over two decades, it’s been sharpened by experience. We’ve helped clients weather storms, tune out the headlines, and stay committed to plans built for decades, not days.

In the spirit of reflection, I reached out to my co-founder, Rick Hill, to help compile this list. Rick is now retired, but his thinking (and our friendship) continues to shape our work and HIG culture.

Here are 20 lessons we’ve learned in 20 years. Some are personal. Some are practical. All of them are built to last.

20 Lessons in 20 Years

1. Evidence beats emotion.

2. You don’t need to predict the future to build wealth. You need a process.

3. Costs, taxes, and behavior matter more than market forecasts.

4. Markets reward discipline, not cleverness.

5. Diversification is the only free lunch. Eat it every day.

6. A sound allocation only works if you stick with it. Education builds confidence, and confidence fuels discipline.

7. Our most successful clients are curious and engaged. They’re fun to work with, understand the philosophy, and like to delegate.

8. Listening is more powerful than convincing.

9. Trust is earned through credibility, reliability, and intimacy, not promised through performance.

10. Simplicity makes people feel smart. Complexity makes them feel confused. We care deeply about simplicity.

11. People want progress, not perfection.

12. Culture matters and should be tended like a garden.

13. High standards are contagious. So is apathy.

14. You don’t need to be big to be mighty.

15. The right people are worth the wait.

16. Saying no creates space for what matters.

17. Don’t check your portfolio when the world feels upside down. Check your plan.

18. The Stockdale Paradox applies to investing: Confront the facts, believe in the outcome. Untether from the short term.

19. Market volatility is normal. History proves it. You get paid for tolerating the bumpy ride.

20. Take the long view. It’s the only one that works.

Whether you’ve been with us since the early days or just recently joined the journey, thank you for trusting us. We’re proud of what we’ve built, and we’re even more excited about what’s ahead.

Still client-focused. Still evolving. Still taking the long view.

For your further exploration

- Hear the origin story: Matt & Rick on the “Island of Idealism”

- Read about it in Odds On: The Making of an Evidence-Based Investor

- ️Explore the Stockdale Paradox in this podcast episode

More Long View, More Long Term Success

Tune Out the Noise. Stay the Course.

We’re more plugged in than ever. The average person now spends nearly four hours on their smartphone daily, and over half of Americans get their news from social media. That’s a lot of headlines, and most of them short, urgent, and emotionally charged.

While access to information has never been greater, trying to beat the market by reacting to it is one of the surest ways to undermine your financial progress.

This constant stream of information can rattle even disciplined investors. Markets dip on geopolitical tensions. Another AI company announces a breakthrough. Interest rates nudge higher. The instinct is to react, shift allocations, “de-risk,” or step out of the market altogether.

But history shows that these short-term decisions often hurt long-term results.

Explore the Research

Independent research backs this up. Morningstar’s Mind the Gap study, most recently updated in 2023, compares the returns of investment funds to the returns earned by the investors in those funds. The results reveal a persistent gap: investors tend to underperform their own investments by 1.0% to 1.7% annually. Why? Because they often buy high, sell low, and attempt to time the market, frequently in response to short-term news.*

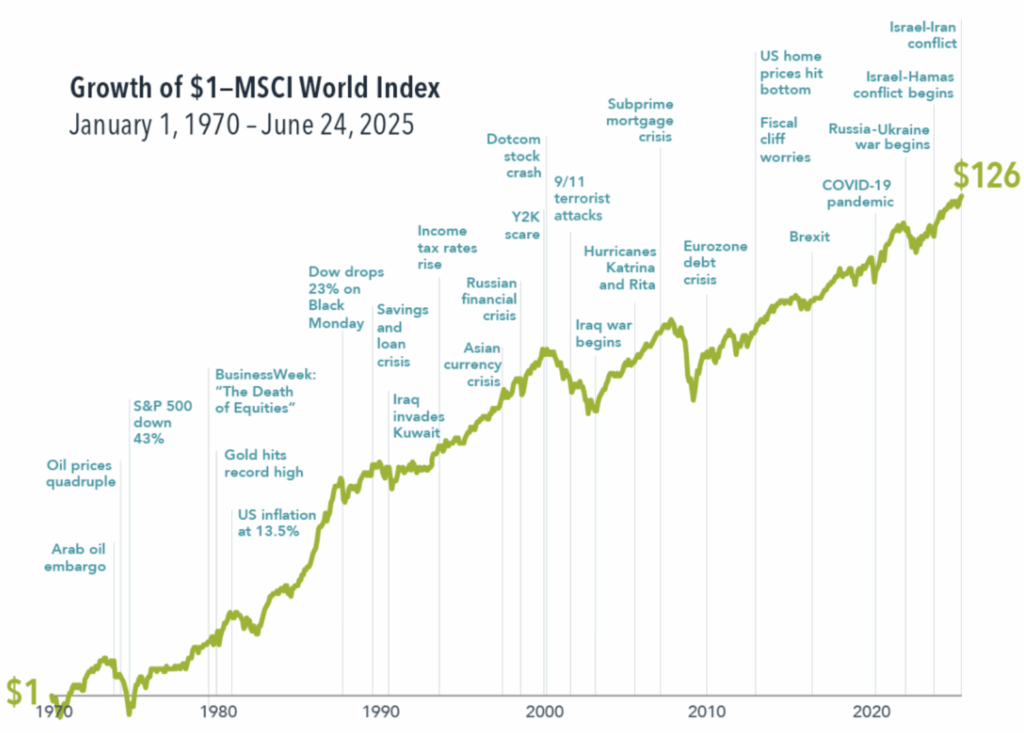

Consider this hypothetical example: Over the last 50 years (1974–2023), while markets faced double-digit inflation, multiple financial crises, and a global pandemic, long-term investors who stayed disciplined were rewarded. A $1 investment in the MSCI World Index would have grown to approximately $126.** Now imagine an investor who underperformed that index by just 1% annually; they would have ended up with a portfolio roughly 40% smaller.

What We Focus On

At Hill Investment Group, we work to tune out short-term noise, not because we’re ignoring reality, but because we believe markets are constantly processing new information. The headlines you’re reading? The market read them about five seconds ago. By the time most investors can react, they’re already behind.

Taking the Long View means focusing on what can actually be controlled: strategic asset allocation, disciplined rebalancing, thoughtful tax management, and investor behavior. That’s where meaningful long-term impact happens.

When headlines get loud, remember this: staying invested is not a passive decision. It’s an active commitment to your plan. That’s what we help our clients do every day.

That’s The Long View.

* Morningstar (2023): Mind the Gap Study – U.S. Edition

** Dimensional Fund Advisors (2025): Geopolitical Jitters