Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Tag: Market Decline

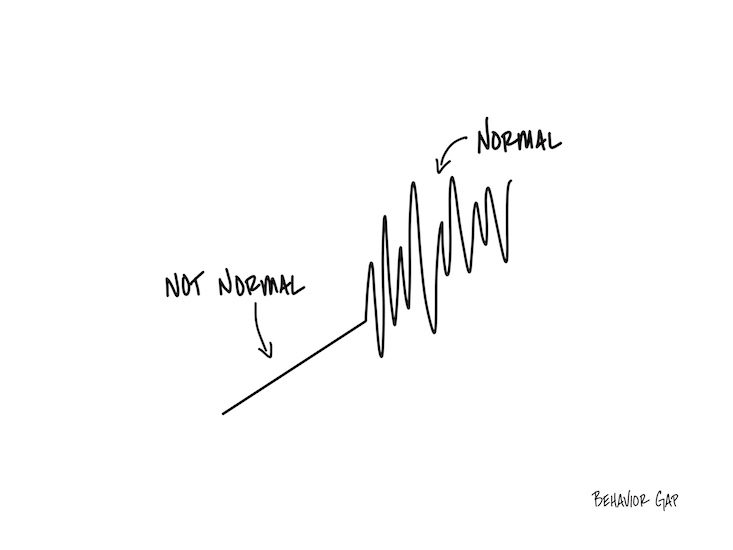

Normal Volatility

Imagine it’s a very still day, and you’re in a boat on the ocean.

There’s no wind.

No swell.

The water is as flat as a mirror.

The calm goes on just long enough for you to start to feel like it’s normal.

When a small wave finally comes… it feels big. When a regular wave comes… it feels huge.

As scary as it might feel, it’s important to remember that waves are normal.

In fact, occasional storms are normal.

And the last thing you want to do when you get into a storm is abandon ship.

My First Market Decline – 1969

I still have vivid memories of my first market decline when I was working as a stockbroker. For the first two years of my career, nearly everything I recommended was going up. I was proud of the value I thought I was providing to my clients and impressed with how smart I was.

By 1969, the Dow Jones Industrial Average was getting close to an all-time high of 1,000. Then it started to decline and just kept going down. It eventually dropped almost 40%.

The situation hit me hard. I felt so bad about the losses my clients were experiencing that I couldn’t sleep and had stomach problems. To make things worse, a lot of my early clients were friends of my parents. When I would go home for a visit, I would call ahead and ask my parents to move their car out of the garage so I could park there and close the door behind me. I didn’t want my parents’ neighbors to know I was home because I couldn’t face questions about why their stocks were doing so poorly. I really didn’t know what to say because I didn’t have an answer. It was during this period that I spent one afternoon hiding out in the movie theater watching a Clint Eastwood triple feature!

Eventually, I went to my manager and asked for advice: What can I do? What should I say? He was surprised by my questions and responded bluntly with, “Keep trading stocks.” That was my job, after all. We were brokers, not financial advisors. We were paid to trade stocks because trading created revenue for our firm whether the stocks went up or down in our clients’ accounts.

Then he added something that turned out to be good advice for me. He said that if the market decline was bothering me that much, I should quit my job and go work in a bank trust department. He was right. I wasn’t interested in selling stocks to help a firm make money whether or not my clients won or lost..I left my brokerage job shortly thereafter.

Obviously, I’ve experienced many more market downturns since that fateful time…because that’s simply what the market does. We just can’t accurately predict when. In fact, there have been 10 times when the market declined more than 20% in the past 50 years—with the two most recent happening in 2007-2009 (down 55%) with the financial crisis and in March 2020 (down 35% in 21 days) with the COVID-19 pandemic.

Lesson Learned: Expect that the market will decline and ignore it when it does.

History shows that market declines are inevitable—higher equity returns wouldn’t be possible without the risk of occasional downturns. Also, market declines are temporary. When you remember these two facts, you’re less likely to let your emotions get in the way of your long-term investing strategy. After all, a loss isn’t a loss until you sell your position.

Of course, ignoring market downturns is easier said than done. I admit that I still feel anxious during these periods, and I know that many investors experience the same sleeplessness and pit-in-the-stomach sensations I felt back in 1969. Today, though, I’m not afraid to face my clients when the markets are bad.

Instead, I like to initiate calls during these rough periods just to ask how they’re feeling and to give them better advice than I could have 50 years ago. Instead of recommending new stock trades, I tell them to do nothing – except the occasional rebalance. This downturn, like others before it, will pass.

Also, I’ve learned, and communicated to all that will listen…especially our clients…to focus on what you can control. The market is not controllable. Your investing philosophy, asset allocation, and personal spending and savings are in your control. Focus your attention, energy, and actions there. And leave the rest to us.